Why Your Parents Chose Fixed Deposits and Why You Don’t Have To

The 1900s – Inception

100 years ago, people mostly kept their money in a pot buried in the ground or under their mattress, sleeping peacefully knowing that their cash was safe. The evolution of modern banking started in the 1900s and lots of Central Banks were formed around the world in the wake or after the World Wars. We had the US Federal Reserve being formed in 1913, the Reserve Bank of India in 1935 and German Bundesbank as late as 1957.

After 1947, post-independent India saw an evolution in the banking system with people starting to trust the banks and began depositing their cash savings into banks as a measure of safekeeping. It was definitely better than keeping all that paper currency stored around the house. Soon, banks started competing for that cash deposit and offered different products or higher interest rates to attract new customers. This is where the term Fixed Deposit was born and it was a big hit because the masses didn’t know any better.

The 2000s – Information, Financial Literacy and Choices

Fast forward to present age and a huge proportion of home savings in India are still in Fixed Deposits. This is likely due to legacy perceptions or old habits, where investors think they have no other options. However, this is rapidly changing now due to the following:

- Multiple Investment Options: Individual investors have a wide variety of investment choices across Bonds, equities, mutual funds, commodities, cryptocurrency etc which was not the case even 20 years ago. Hence FDs can perhaps be a ‘lazy choice’.

- Financial Literacy: People are more aware and educated on financial matters due to the plethora of information available on the web. Increased internet and mobile penetration in India has provided a boost to knowledge transfer and for most people learning is just a click away.

- Ease of Investing: Technology has clearly transformed financial markets and brought the ease of investing to your doorstep. No more long calls to your broker or advisor when you can invest from the comfort of your own living room. This has happened widely for equities already and now IndiaBonds has enabled this for corporate bonds too.

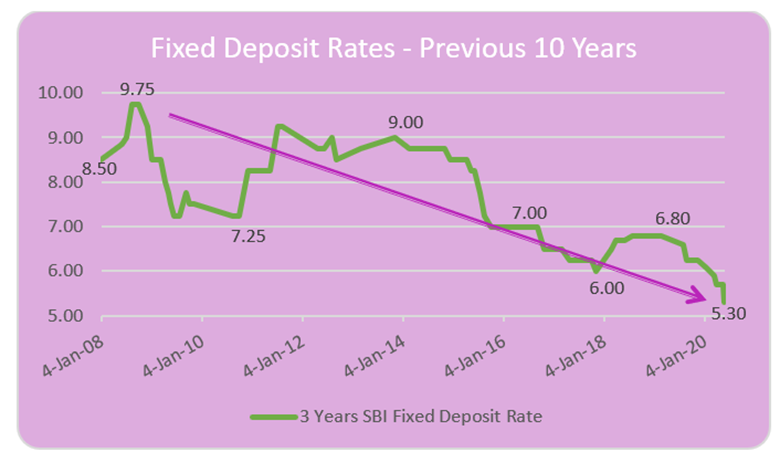

- Collapsing Global Interest Rates: It is a fact that in western economies, individual investments in FDs are a very small percentage of savings which is due to the three points above as well as collapsing interest rates. This is also the case for India where we show how FD rates at SBI have moved in past 10 years below –

The 2000s – Information, Financial Literacy and Choices

We think Bonds offer much more than FDs. Here is the comparison between them as both are deemed to be fixed income products:

- Rate Differential – Investors will be surprised to learn that bonds issued by banks and institutions usually offer higher interest rates than what they offer on their own FDs!

- Lock-in and Liquidity – FDs have a term or tenor lock-in. If you need the liquidity suddenly, there is usually a penalty for breaking the FD which eats away at your returns. Bonds, on the other hand, are something you can just sell in the market (on IndiaBonds as well) straight away at anytime.

- Flexibility – Bond investors can express their view on future interest rates. For example, if you think rates are going higher, you can sell your bond and wait to reinvest in higher rates. Alternatively, if your bonds rally, you can sell and book your profits. With FDs you are stuck for it’s full term.

- Choices – FDs are issued by banks and some private financial institutions; but bonds are issued by a much larger group of financial institutions and companies. One can choose and compare thoroughly based on Credit Ratings of different issuers when investing in bonds.

Learn more about the differences between bonds and fixed deposits in the below video.

Conclusion – It’s the 2020s

Your parents did choose FDs for investments due to the various reasons explained above or simply because the only financial institution they knew was their local bank branch! You clearly do not have to do that. There is an abundance of financial knowledge, choices and technology available at your fingertips to achieve higher returns for yourselves. IndiaBonds is here to deliver those investment options to you. Change is here – Change is now. It’s time to embrace it and take charge of your financial returns and prosperity!

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.