What is a Bond IPO – Debt Public Issue

Introduction

Economic growth for a country is led by public investment done by the government and private investment done by companies. This requires money (or capital) from other people; as owners themselves may not have all the resources to invest in growth. Traditionally in India, banks have been the primary source of capital for firms. As the economy modernizes and banks face lending constraints, financial markets become an important provider of capital in India. Companies raise this capital through bonds (debt) and equity issuances from the markets as this gives them greater ability to grow and expand.

What is an IPO?

The meaning of an IPO is Initial Public Offering. It literally means issuing securities of the company for the first time to the public for investment. This is the stage where a company, which had been held privately by a handful of promoters/investors, is now raising money from the public in general. The term IPO has become popular due to the equity market as it has been in practice there for many decades. Hence, when a company raises money for the first time from the public in the form of bonds – it’s called a Debt or Bond IPO.

However, in debt markets, companies raise capital via public issuance of bonds quite frequently, sometimes even more than once a year. Market participants in general call every public bond issuance as an Initial Public Offering, or an ‘IPO’, which is technically incorrect since the word IPO only stands for raising initial capital or for the very first time. Subsequent issues are termed ‘Public Issues of Bonds’. For this article we will use the term ‘Debt Public Issue’ and ‘Bond IPO’ interchangeably.

Why do companies do Bond IPO?

Companies raise debt from investors either in the form of Bond IPO (public issue) or via debt private placements. These private placements are mostly for large institutional investors only and usually out of reach of individual investors who may not have access to the timing/details of such issuances. Also, there are restrictions placed on a company by Security and Exchange Board of India (regulator) on:

- Number of private placements in a year

- High minimum investment amount. Hence the private placement market becomes a ‘big boys only’ investment option.

Initial Public Offering is done by companies to target individuals and raise capital from them. India has a very high savings rate of 28.35% in 2020 as per the World Bank (%age of GDP). IPO for Bonds aim to transfer this share of savings into productive investments for growth by tapping various sources of funds which may not be easily accessible otherwise. Companies find this form of retail investments to be beneficial as this provides a long term and additional pool of capital for them.

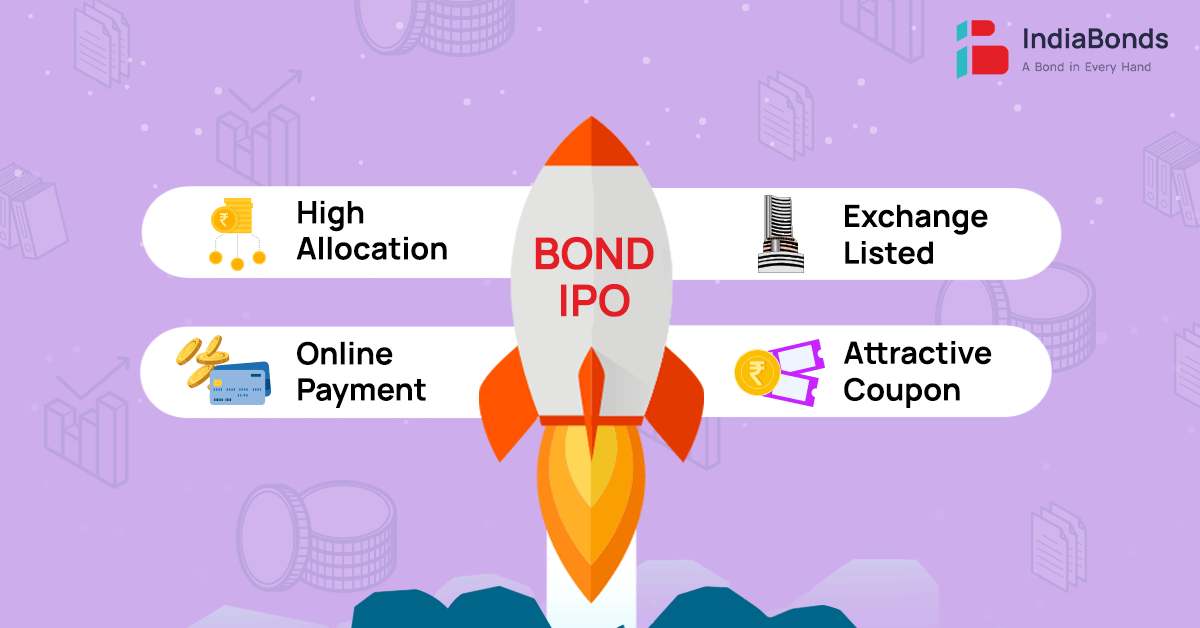

Benefits of Bond IPO for investors

Debt Public Issues are done to attract individual investors who can derive a lot of additional benefits by subscribing to these. A few key advantages are:

Low Minimum Investment: The biggest benefit of investing in Bond IPOs is that you can invest in bonds as low as Rs.10,000! This is truly a product for individuals and helps them to channel their savings, from meagre returns providing Fixed Deposits, to higher and stable returns from bonds.

Higher Interest Rates: Companies mostly offer higher interest rates to individuals than institutional investors in Bond IPOs. Hence, individual investors tend to benefit more.

Additional Disclosures: A Bond IPO in India is regulated by SEBI who requires companies to follow a detailed process of issuance as well as provide a lot more details as disclosures. This provides investors with detailed information regarding the issuer than in private placements.

Higher Allocation: A Bond IPO has a pre-allocated amount of bonds to individuals in the retail and HNI segments. In case the issue is a whopping success, investors are assured of a higher (if not full) allocation of the amount they want to invest.

Transparent Pricing: As a company raises large amounts of capital via public issue, the pricing is transparent for individual investors. They don’t have to conduct multiple checks through sources since the IPO has a uniform price.

Exchange Listing: Bonds in India are required by law to be listed on exchanges. This helps investors get access to regular performance updates from the company as per listing rules and arms them with better monitoring of their portfolio.

Secondary Market Liquidity: As the number of investors large for public issues, the bonds tend to have a much higher liquidity in the secondary market. This helps individuals to invest in bonds exit their investments easily and quickly versus other illiquid complex debt products.

Ease of Application: Subscribing to bonds in India is easy with an online process. Gone are the days of detailed paperwork. You can set alerts for forthcoming Bond IPOs and buy bonds online at IndiaBonds. All you need to do is add your personal details and requirements in a prefilled form.

Watch the video to learn more about Bond IPOs.

Payment Process and Allotment of Bond IPO

This is fairly straightforward for individual investors and can be done online depending on the size of your investments:

UPI – For application amounts up to INR 5 lacs, payments can be made via UPI. This stands for Unified Payments Interface (UPI) and is an instant payment system developed by the National Payments Corporation of India (NPCI), an RBI regulated entity. UPI allows you to instantly transfer money between any two parties’ bank accounts.

ASBA – For application amounts more than INR 5 lacs, payments can be made via ASBA which stands for Application Supported by Blocked Amount. This is an authorization to block the application money in their bank account for subscribing to a new bond issue.

Allotment of bonds or in a public issue is mostly done based on categories mentioned below. Here only 3 and 4 are relevant for individual investors:

- Institutional Investors – example are banks, mutual funds, insurance companies etc

- Non-institutional Investors – example company treasuries, trusts etc

- High-Networth Individuals (HNIs) – for applications higher than INR 10 lacs.

- Retail Investors – for applications up to INR 10 lacs by individuals or HUF

Unlike equity IPOs, allotments are done on a first come first serve basis. So it’s essential to subscribe in a Bond IPO at launch itself! Allotment in case of oversubscription is done by the Registrar on proportionate basis where retail category is given priority.

To conclude, a Debt Public Issue or Bond IPO is a very convenient and beneficial way for individuals to invest in the bond market. Topping it all off, it’s now even easier to monitor and buy bonds via the convenience of IndiaBonds platform. For those who cannot wait for the next Public Issue – do not worry! Here’s a wide range of secondary bond offerings on our bond market at IndiaBonds.com

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.