What are RBI Floating Rate Saving Bonds?

Introduction

The Government borrows funds from the public to finance its various economic and developmental activities. This borrowing takes the form of bonds. The Government issues bonds to the public at a guaranteed interest rate. When the public invests in these bonds, they lend money to the government and earn guaranteed investment returns.

There are different types of bonds for different financial needs of the government. The bonds are safe to invest in since the government backs them. Moreover, you can add a debt component to your portfolio by investing in government bonds. This debt component lends stability to the portfolio, especially in volatile markets.

The government usually issues bonds through the Central Bank, the Reserve Bank of India (RBI). As such, the bonds are also called RBI bonds. Let’s understand what are RBI floating rate savings bonds and how you can invest in them.

RBI floating rate savings bonds meaning?

RBI Savings Bonds, are investment instruments that offer guaranteed returns on your investment. The bonds are called Floating Rate Savings Bonds (2020) (taxable) since they were introduced on 1st July 2020.

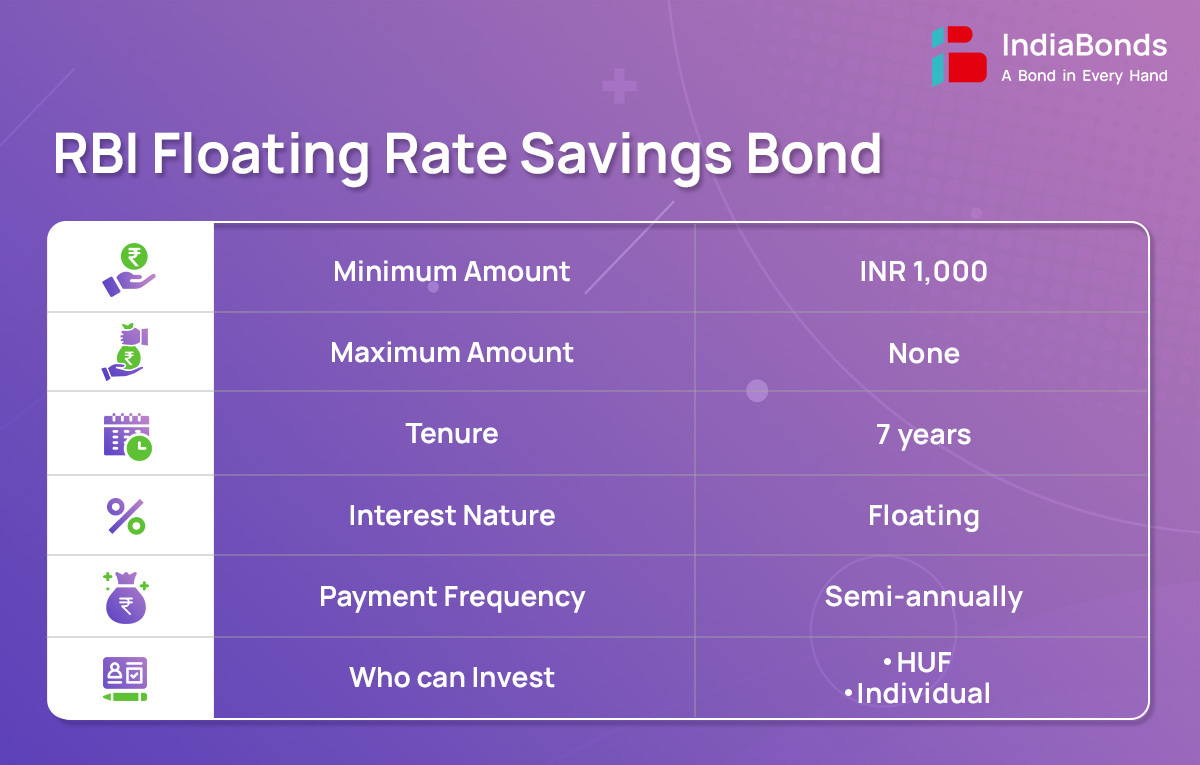

You can invest in these RBI bonds with a minimum amount of Rs. 1000 and Rs. 1000 multiples after that. There is no ceiling on the maximum investment amount. You can invest any amount as per your needs without any upper limit. The deposit tenure is 7 years.

The RBI Bond interest rate is floating in nature and is reviewed after every six months in January and July. The interest is linked to the interest rate of the National Savings Certificate (NSC) with a spread of 35 basis points on the NSC interest rate. The interest income is payable semi-annually.

The RBI floating rate bond interest rate from 1st July 2020 to 31st December 2020 was fixed at 7.15% per annum. From 1st January 2023, the interest rate on these RBI Floating Rate Savings Bonds has been hiked to 7.35% per annum.

The RBI floating rate bonds offer cumulative and non-cumulative deposit options. Under the cumulative scheme, the interest earned is added to the deposited amount and paid in a lump sum on maturity. Under the non-cumulative option, you will get the interest income regularly throughout the deposit term.

Advantages of Investing in RBI Floating Rate Savings Bonds 2025

The RBI Floating Rate Savings Bonds 2025 offer several advantages:

- Floating Interest Rate: Interest rates adjust with market changes, ensuring better returns compared to fixed instruments.

- Government Backing: Issued by RBI, these bonds carry sovereign guarantee, making them one of the safest investments.

- Regular Income: Interest is paid every six months, providing a steady income stream.

- Taxation: Interest earned is taxable, but the risk-free nature and regular payouts make them attractive for conservative investors.

Eligibility

You can invest in the RBI Savings Bonds if you are:

- an individual, or

- a Hindu Undivided Family (HUF)

Individuals can open an account individually or jointly with two or more members. They can also open an account jointly on one or survivor basis.

These bonds also double up as RBI bonds for senior citizens. Even minors can invest in these bonds. However, in such cases, the guardians will have to invest the amount on behalf of the minor.

Non-Resident Indians, however, cannot invest in RBI savings bonds.

Documentation

To invest in the RBI Savings Bond, you will have to submit the following documents:

- Application form in the form of a Bond Ledger Account.

- A self-attested copy of your PAN Card.

- A self-attested copy of a valid address proof like a passport, Aadhaar card, rent agreement, property deed, etc.

- Cancelled cheque of your bank account wherein you want to receive the maturity amount and interest payments.

- In the case of a HUF or any other institution, a self-attested PAN Card copy of the institution will be needed.

- In the case of minors, a self-attested PAN Card copy of the guardian will be needed.

Issue price

The RBI Savings Bonds are issued at par, i.e., at their original face value, without any premium. The face value per unit of the bond is Rs. 1000. You can invest in one or multiple units of the bond per your needs.

RBI bonds are issued in a dematerialised format. So, you will need a valid Demat account to invest in the bond.

Features

The salient features of RBI bonds are as follows:

- If you are an individual holder of the bond, you can make a nomination.

- You cannot transfer the bond to another individual or entity.

- You cannot buy or sell bonds on the stock exchange or the secondary market.

- You cannot use the bond as collateral to avail of loans from banks and financial institutions.

- Since the interest is compounded half-yearly, you can earn a good return on your investment.

Benefits of Floating Rate Savings Bonds

- Inflation Protection: As rates are linked to market conditions, the investment adjusts to inflation.

- Stable Returns: Semi-annual interest payouts ensure a consistent flow of income.

- Sovereign Security: Zero default risk due to government guarantee.

- Liquidity for Seniors: Senior citizens can avail early exit options based on age criteria.

Why Should You Invest in RBI Floating Rate Savings Bonds?

Investing in RBI Floating Rate Savings Bonds 2025 is ideal for those seeking safe, government-backed investments with better returns than traditional savings schemes. They offer protection against fluctuating interest rates and ensure regular, inflation-linked income. With the RBI floating rate savings bonds interest rate being periodically adjusted, investors benefit during rising interest rate cycles. This makes them a reliable addition to conservative portfolios focused on wealth preservation.

How to invest in RBI Floating Rate Savings Bonds?

You can invest in RBI Bonds through the designated branches of banks authorised by the RBI to issue these bonds. The Stock Holding Corporation of India Limited (SHCIL) also allows you to invest in RBI Savings Bonds.

To invest, you must fill out the application form and submit it with all the required documents. You will also have to pay the deposit amount through cash or cheque at the designated branch so your deposit can be opened easily.

Online investment is allowed only if you invest through an authorised distributor.

Conclusion

RBI floating rate savings bonds are a medium-term saving avenue wherein you can invest for 7 years and earn guaranteed returns on your investment. However, the interest income that you earn from the bonds will be taxed in your hands at your income tax slab rates.

Being backed by the government, the bonds are secured and do not carry any credit risk, i.e., the risk of default. So, if you are looking for a fixed-income investment avenue RBI Bonds investment can be a suitable choice. You can visit IndiaBonds and explore a range of bonds that can help you earn fixed, regular and higher income. Choose and invest in suitable bonds online with minimal hassle.

FAQs

Can I earn a tax benefit on the amount invested in the RBI Saving Bond?

No, the amount invested in the RBI Saving Bond has no tax benefit. It forms a part of your taxable income.

Is cash investment allowed?

Yes, you can invest in cash. However, in that case, the maximum cash investment accepted will be limited to Rs. 20,000. If you want to invest more, you can invest through cheques, demand drafts or any other electronic mode.

Can I surrender the bond before 6 years?

No, you cannot surrender the bond before the tenure of 7 years is completed. However, if you are 60 years or older, you can make a premature withdrawal after the lock-in period. The lock-in period is as follows –

- If you are aged between 60 and 70 years – 6 years

- If you are aged between 70 and 80 years – 5 years

- If you are aged 80 years and above – 4 years

Is the RBI Floating Rate Bond a Good Investment?

Yes, the RBI Floating Rate Savings Bonds are considered a good investment for conservative investors seeking stable income and low risk. Their sovereign guarantee and floating rates aligned with market trends provide protection against inflation and falling interest rates.

What is the Interest Rate of RBI Floater Bonds?

The RBI floating rate savings bonds interest rate is reset every six months and is pegged to the National Savings Certificate (NSC) rate plus 35 basis points. As of the latest reset, the bonds offer competitive returns compared to fixed deposit rates.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.