#Essential

What is After Market Order (AMO)?

Imagine it’s late at night, and you’re finally relaxing after a long day. As you browse through financial news, you spot a promising bond opportunity. But the market is closed, and you’re left wondering if you’ll miss out by morning. If this sounds familiar, we have great news for you! IndiaBonds is excited to announce […]

What is Bond Yield?

Introduction Investors prefer having at least one debt-based investment to give their portfolio a hedge against equity market fluctuations. One such investment option, bonds, is considered a relatively safe form of investment. Investors who are slightly risk-averse and are satisfied by getting lower returns usually prefer bonds to those who prefer high returns with unknown […]

What is Clean Price and Dirty Price in Bonds?

Mr. Grover recently purchased a bond from a company. The bond promises to pay him a fixed amount of interest every six months, with payments due on the 30th of June and the 31st of December. He enjoys these regular payments and he’s also aware that he can sell the bond to another investor at […]

What is G-Sec and State Guaranteed Bond?

Generally, in a developing economy, the expenditure of the central government surpasses its earnings, resulting in an outflow of funds that exceeds the inflow, which is known as a fiscal deficit. To address this deficit, the central government can resort to two measures: printing notes or issuing government securities (borrowing money). However, consistently printing notes […]

What Is a Green Bond & How Does It Work?

The concern for the environment is growing and the government and corporates are taking active steps to reduce the activities that have a hazardous impact on the environment. Apart from that, active steps are being taken to create and develop projects that are more environmentally friendly or create a positive environmental impact. This is where […]

What is Sovereign Gold Bond scheme?

Sovereign Gold Bonds (SGBs) – Introduction Imagine a world where your investments are not only secure but also backed by the lustrous assurance of gold. This isn’t a fantasy; it’s a reality offered by Sovereign Gold Bonds (SGBs). A flashback to 50 years ago reveals a global economy where currency notes were as good as […]

What is the difference between debentures and shares?

Introduction Imagine being the owner of a thriving ice-cream company. Your brand has become a sensation, captivating the hearts of numerous customers who simply can’t get enough. However, a competitor has emerged in your niche, necessitating an increase in marketing expenses. Additionally, it’s time to upgrade your mixing machine and freezers, and there’s a surging […]

What Is The Role Of A Debenture Trustee In Bond Issuances?

Non-Convertible Debentures (NCDs) or simply ‘Debentures’ are long-term debt instruments issued by companies to raise funds from the public or institutions. These are also commonly referred to as ‘Bonds’. A debenture trustee is an independent third party appointed by the company to safeguard the interests of debenture holders. Debenture trustees play a critical role in […]

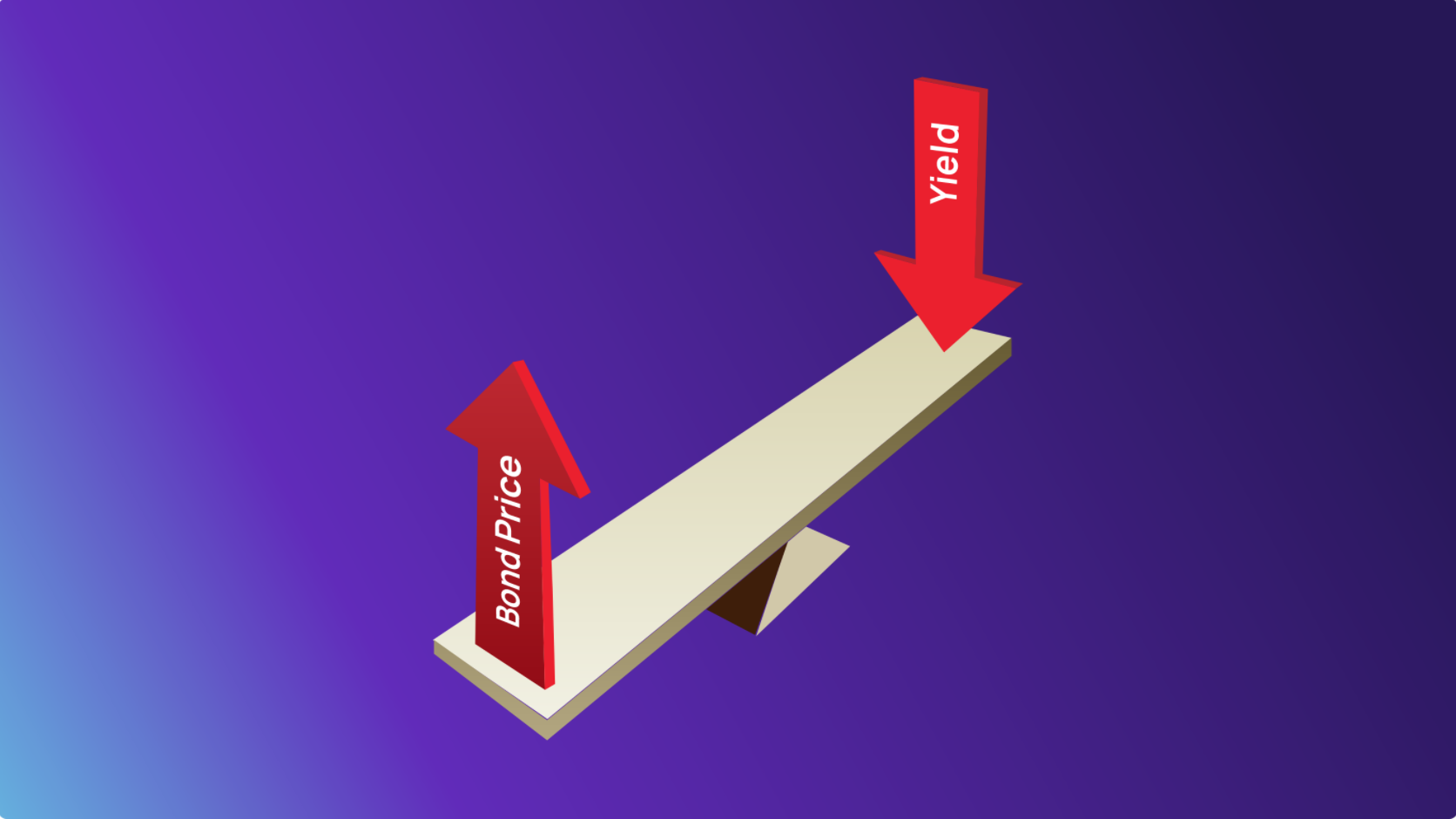

Why Bond Prices and Yields move in Opposite Directions?

Introduction For a retail investor exploring the financial markets, a nuanced understanding of the mechanisms that drive asset prices is essential. This is particularly true for bonds, an asset class known for its complexity and subtlety. In this article, we explore why bond prices and yields move in opposite directions—a fundamental concept that is crucial […]