October’23 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from October 4 -6, 2023.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% consequently the standing deposit facility is unchanged at 6.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

- These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation surged by 2.6% points to 7.4% in July due to spike in vegetable prices, before moderating somewhat in August to 6.8%. Fuel inflation edged up to 4.3% in August. Core inflation (i.e., CPI excluding food and fuel) softened to 4.9% during July-August 2023.

The MPC expects CPI outlook to be shaped by several factors such as:

- Vegetable price correction and the recent reduction in LPG prices.

- The future trajectory will be conditioned by a number of factors like lower area sown under pulses, dip in reservoir levels, El Niño conditions and volatile global energy and food prices.

- According to the Reserve Bank’s enterprise surveys, manufacturing firms expect higher input cost pressures but marginally lower growth in selling prices in Q3 compared to the previous quarter. Services and infrastructure firms expect a moderation in growth of input costs and selling prices.

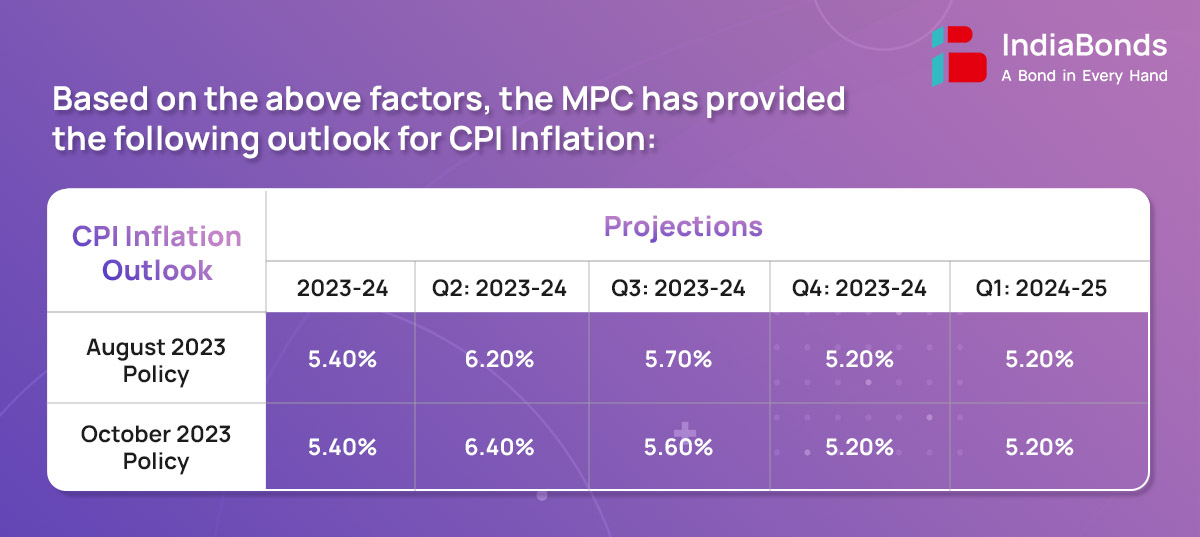

- Taking into account these factors, CPI inflation is projected at 5.4% for 2023-24, with Q2 at 6.4%, Q3 at 5.6% and Q4 at 5.2%, with risks evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2%.

2. Growth

South-west monsoon rainfall recovered during September ended 6% below the long period average. The acreage under Kharif crops was 0.2% higher than a year ago. The index of industrial production rose by 5.7% in July core industries output expanded by 12.1% in August. Purchasing managers ‘indices (PMIs) and other high frequency indicators of the services sector exhibited healthy expansion in August-September. On the demand front, urban consumption is buoyant while rural demand is showing signs of revival. Investment activity is benefitting from public sector capex. Strong growth is seen in steel consumption, cement production as well as in imports and production of capital goods. Merchandise exports and non-oil non-gold import remained in contraction in August, although the pace of decline eased. Services exports improved in August.

The MPC expects real GDP to be based on the following factors:

- Domestic demand conditions are expected to benefit from the sustained buoyancy in services; revival in rural demand, consumer and business optimism, the government’s thrust on capex, and healthy balance sheets of banks and corporates.

- Headwinds from global factors like geopolitical tensions, volatile financial markets and energy prices, and climate shocks pose risks to the growth outlook.

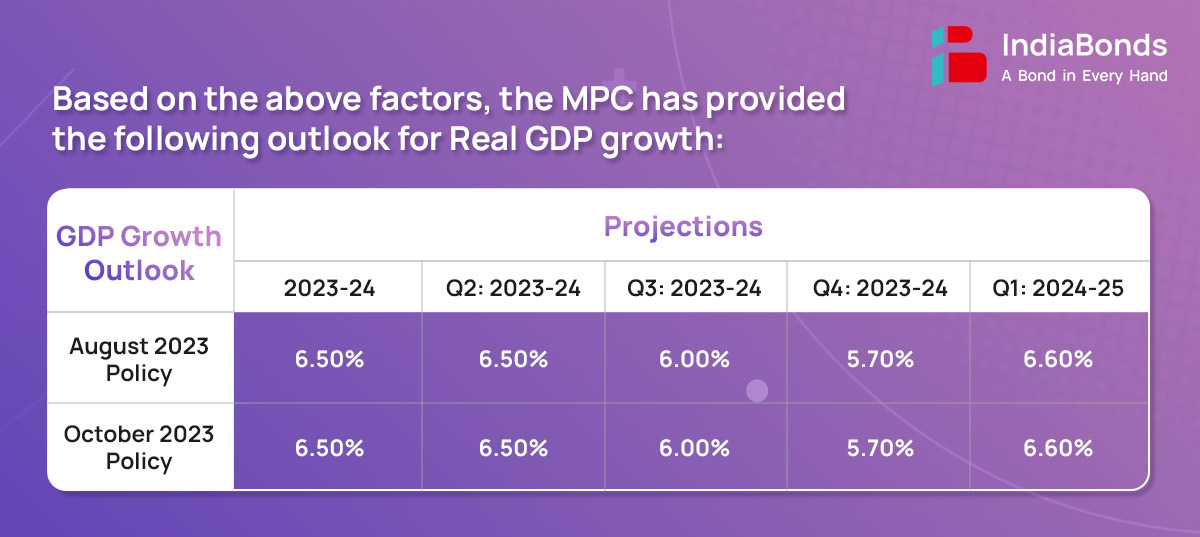

- Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5%, with Q2 at 6.5%, Q3 at 6.0%, and Q4 at 5.7%, with risks evenly balanced. Real GDP growth for Q1:2024-25 is projected at 6.6%.

3. Liquidity

- To ensure that liquidity conditions evolve in sync with the monetary policy stance, the Reserve Bank – as a temporary measure – had imposed an incremental cash reserve ratio (I-CRR) of 10% which impounded about Rs.1.1 lakh crore from the banking system. The I-CRR was reviewed on September 8 and is being discontinued in a phased manner, ending October 7, 2023.

- Despite such hardening at the short-end of the term structure, the average term spread in the G-sec market (10-year minus 91-day Treasury Bills) remained at around 40bps in August-September suggesting stable financial conditions.

- In recent months, banks have preferred to place funds under the overnight SDF instead of offering them in the main 14-day variable rate reverse repo (VRRR) operations. It is imperative that banks assess their actual liquidity requirements over the reserve maintenance cycle and bid accordingly in the auctions under main 14-day VRRR operations.

- Going forward, while remaining nimble, RBI may have to consider OMO-sales (Open Market Operation sales) to manage liquidity, consistent with the stance of monetary policy. The timing and quantum of such operations will depend on the evolving liquidity conditions.

4. Global Economy

The global economy is slowing under the impact of tight financial conditions, protracted geopolitical tensions and increasing geo-economics fragmentation. Global trade is contracting. Headline inflation is easing but rules above the target in major economies. While major central banks are signaling a peaking of their rate hike cycle, there are indications that the tight monetary policy stance could persist for longer than anticipated earlier. Sovereign bond yields have firmed up, the US dollar has appreciated, and global equity markets have corrected.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Review of Regulatory framework for Financial Benchmark Administrators

RBI has revised the extant regulations issued in June 2019 and put in place a comprehensive, risk-based framework for administration of financial benchmarks. The revised directions will provide greater assurance about the accuracy and integrity of financial benchmarks.

2. Review of Regulatory Framework for Infrastructure Debt Fund – NBFCs (IDFNBFCs)

The key changes in the revised framework are: (i) withdrawal of the requirement to have a sponsor for the IDFs; (ii) allowing IDFs to finance toll-operate transfer (ToT) projects as direct lenders; (iii) permitting IDFs to raise funds through ECBs; and (iv) making tri-partite agreements optional for PPP projects.

3. Gold Loan – Bullet Repayment Scheme – UCB

UCBs have been permitted an extended glide path for achievement of PSL targets, beyond March 2023. With a view to incentivizing UCBs that have met the prescribed PSL targets as on March 31, 2023, RBI has decided to increase the monetary ceiling of gold loans that can be granted under the bullet repayment scheme from Rs. 2.00 lakh to Rs. 4.00 lakh for such UCBs who have met the overall PSL target and sub targets as on March 31, 2023.

4. Framework for recognition of SROs for Regulated Entities (REs) of Reserve Bank

RBI has decided to issue an omnibus framework for recognizing SROs for various Regulated Entities (REs) of the Reserve Bank. The omnibus SRO framework shall prescribe the broad objectives, functions, eligibility criteria, governance standards, etc., which will be common for all SROs, irrespective of the sector.

5. Payments Infrastructure Development Fund – Extension of Scheme

RBI has proposed to extend the PIDF Scheme by a further period of two years, i.e., upto December 31, 2025. Also, it is proposed to include beneficiaries of PM Vishwakarma Scheme in all centers under the PIDF Scheme. This decision to expand the targeted beneficiaries under the PIDF scheme will provide fillip to the Reserve Bank’s efforts towards promoting digital transactions at the grassroots level.

6. Introducing new channels for Card-on-File Tokenization

RBI introduced Card-on-File Tokenization (CoFT) in September 2021 and began implementation from October 1, 2022. RBI has now proposed to introduce CoF token creation facilities directly at the issuer bank level.

7. Master Direction on Internal Ombudsman mechanism in Regulated Entities

RBI has decided to harmonies internal Ombudsman framework and issue a consolidated Master Direction. The Master Direction shall bring uniformity in matters like timeline for escalation of complaints to IOs, exclusions, temporary absence of the Internal.

The next meeting of the MPC is scheduled during 6th – 8th Dec’23.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.