The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from April 3-5, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

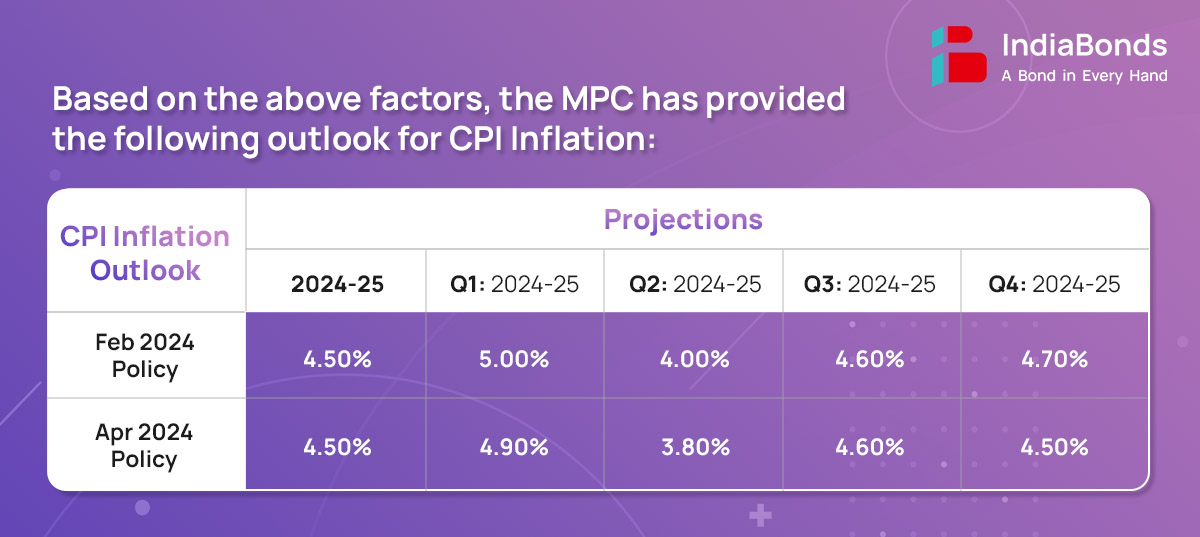

Headline inflation softened to 5.1% during January-February 2024, from 5.7% in December. After correcting in January, food inflation edged up to 7.8% in February primarily driven by vegetables, eggs, meat and fish. Fuel prices remained in deflation for the sixth consecutive month in February. CPI core (CPI excluding food and fuel) disinflation took it down to 3.4% in February – this was one of the lowest in the current CPI series, with both goods and services components registering a fall in inflation.

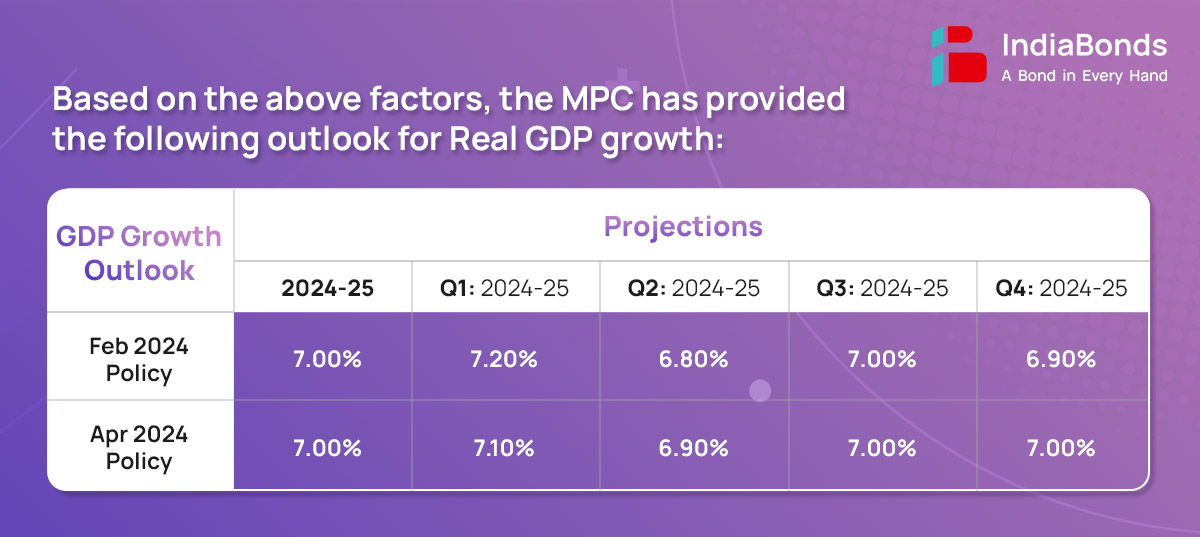

The domestic economy is experiencing strong momentum. As per the second advance estimates (SAE), real gross domestic product (GDP) expanded at 7.6% in 2023-24 on the back of buoyant domestic demand. Real GDP increased by 8.4% in Q3, with strong investment activity and a lower drag from net external demand. On the supply side, gross value added recorded a growth of 6.9% in 2023-24, driven by manufacturing and construction activity.

The global economy exhibits resilience and is likely to maintain its steady growth in 2024. Inflation is treading down, supported by favorable base effects though stubborn services prices are keeping it elevated relative to targets. As the central banks navigate the last mile of disinflation, financial markets are responding to changing perceptions on the timing and pace of monetary policy trajectories. Equity markets are rallying, while sovereign bond yields and the US dollar are exhibiting bidirectional movements. Gold prices have surged on safe haven demand.

RBI has decided to permit eligible foreign investors in the International Financial Services Centre (IFSC) to invest in Sovereign Green Bonds (SGrBs). A scheme for investment and trading in SGrBs by eligible foreign investors in IFSC will be notified separately in consultation with the Government and the IFSC Authority.

RBI has decided to introduce a mobile application of the Retail Direct portal. The move is expected to further improve ease of access and the app will enable investors to buy and sell instruments on the go, at their convenience. The app will be available for use shortly.

RBI has proposed certain modifications to the LCR framework to facilitate better management of liquidity risk by banks. The modifications are made after taking into account the increased ability of depositors to quickly withdraw or transfer deposits during times of stress, using digital banking channels. A draft circular in this regard shall be issued shortly for comments from all stakeholders.

Currently, Small Finance Banks (SFBs) are allowed to use Interest Rate Futures (IFR) for proprietary hedging purposes. Now, these institutions are permitted to deal in permissible rupee interest derivative products according to the Rupee Interest Rate Derivatives (Reserve Bank) Directions, 2019. A circular regarding this matter shall be issued shortly.

The facility of cash deposit is presently available only through use of debit cards. Given the popularity and acceptance of UPI, as also the benefits seen from the availability of UPI for card-less cash withdrawal at ATMs, it is now proposed to facilitate cash deposit facility through use of UPI. Operational instructions will be issued shortly.

To provide more flexibility to PPI holders, RBI has proposed to permit linking of PPIs through third-party UPI applications. This will enable the PPI holders to make UPI payments like bank account holders. Instructions in this regard will be issued shortly.

RBI has proposed to make CBDC-Retail accessible to a broader segment of users in a sustained manner, by enabling non-bank payment system operators to offer CBDC wallets. This is expected to enhance access and expand choices available to users apart from testing the resiliency of the CBDC platform to handle multi-channel transactions.

The next meeting of the MPC is scheduled during June 5 to 7, 2024.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.