Interest Rate Swaps 101 – Understanding the Basics and How They Work

Sid and Sunil are comic book aficionados. Sid has a majority collection of Archie’s, while Sunil has a collection of Tinkle and Tintin books. One day, they decide to engage in a swap. Sunil gets the opportunity to read Sid’s Archie collections, while Sid can enjoy reading Sunil’s Tinkle comics. It’s a mutually beneficial arrangement as both individuals get to experience something new without incurring any additional costs. Instead of purchasing new comic books, they choose to temporarily exchange items. Similarly, in the world of financial derivatives, a swap is an Over-The-Counter (OTC) product that entails an agreement between two parties to exchange specific components, such as interest payments, commodities or currencies, for a predetermined duration.

What is Interest Rate Swap?

Interest Rate Swaps (IRS) are financial derivative instruments commonly used by investment banks and financial institutions to manage their exposure to interest rate fluctuations. An interest rate swap involves the exchange of cash flows between two parties based on a specified notional amount, with each cash flow reflecting a different type of interest rate. The purpose of an IRS is to help participants manage their interest rate risk and potentially reduce borrowing costs.

How Interest Rate Swap Works?

In an interest rate swap, two parties agree to exchange interest payments over a predetermined period. The payments are based on a fixed interest rate and a floating interest rate. The fixed rate remains constant throughout the term of the swap, while the floating rate is linked to a reference rate, such as the Mumbai Interbank Offered Rate (MIBOR). The party paying the fixed interest rate believes that interest rates will rise, while the party paying the floating interest rate believes that rates will fall or remain stable. By entering into the swap, both parties can potentially benefit from their respective interest rate outlooks. It is important to note that in a swap, the notional amount is not exchanged; rather, only the respective interest rates are exchanged.

Interest Rate Swap Example

Let’s consider a simple example to illustrate how an interest rate swap works:

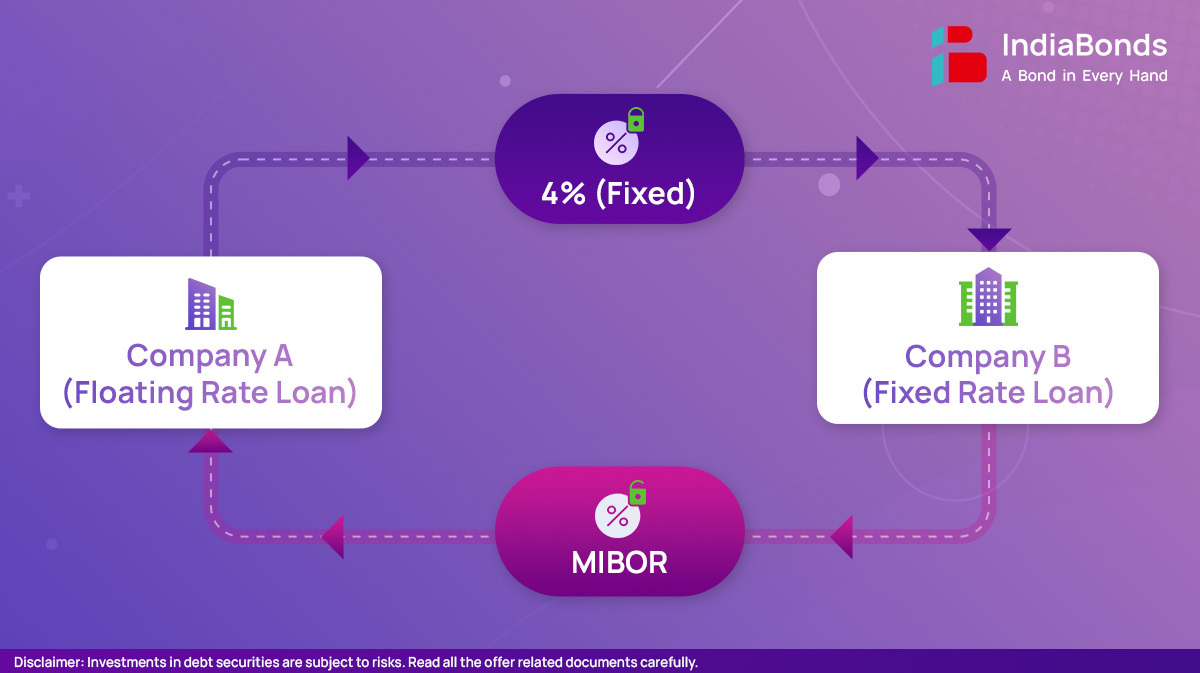

Company A has a variable-rate loan, while Company B has a fixed-rate loan. They participate in an interest rate swap contract.

Company A, expecting interest rates to rise, agrees to pay a fixed interest rate of 4% on ₹10 lacs to Company B. In return, Company B, anticipating a decline in interest rates, agrees to pay a floating interest rate based on MIBOR on the same notional amount. The swap duration is five years.

Initially, with MIBOR at 3%, Company A pays ₹40,000 annually (4% of ₹10 lacs) to Company B, while Company B pays ₹30,000 annually (3% MIBOR of ₹10 lacs) to Company A. Eventually, Company A offsets a payment obligation of ₹10,000 to Company B. If MIBOR increases to 5%, Company A will still pay ₹40,000 to Company B, but Company B will now pay ₹50,000 to Company A, compensating for the higher interest rates on Company A’s loan. This effectively converts Company A’s variable-rate loan into a fixed-rate loan. This swap represents speculative activity, typically undertaken by participants such as hedgers, speculators, and arbitrageurs.

In another scenario, Mr. Sahni, a high net worth individual, invests Rs 1 crore in floating rate bonds with a coupon of MIBOR +2%. Anticipating a decrease in interest rates, he seeks to protect his interest income. To achieve this, Mr. Sahni enters into a 3-year swap agreement. Under the agreement, Mr. Sahni makes annual payments based on MIBOR +2% and receives a fixed rate of 7% each year. The counterparty in the swap expects interest rates to rise. This allows Mr. Sahni to effectively convert his floating rate bond into a fixed rate bond, safeguarding against potential interest rate fluctuations.

| Year | Pay (MIBOR +2%) | Receive (7% fixed) | Net |

| 1 | 4+2 = 6 | 7 | +1 |

| 2 | 2+2 = 4 | 7 | +3 |

| 3 | 3+2 = 5 | 7 | +2 |

| Total | 15 | 21 | 6% |

By engaging in a swap and implementing a hedging strategy, Mr. Sahni has effectively attained a 6% boost in his returns.

Types of Interest Rates Swaps

There are various types of interest rate swaps, including:

Fixed-to-Floating Swap: In this type of swap, one party pays a fixed interest rate, while the other party pays a floating interest rate.

Floating-to-Fixed Swap: This swap is the opposite of the fixed-to-floating swap, with one party paying a floating interest rate and the other paying a fixed interest rate.

Basis Swap: In a basis swap, the parties exchange two different floating interest rates, often based on different reference rates or indices.

Uses of Interest Rate Swaps

Interest rate swaps serve several purposes for businesses and investors. Some common uses include:

Hedging Interest Rate Risk: Companies can use interest rate swaps to manage their exposure to fluctuating interest rates. By swapping fixed and floating rates, they can mitigate the impact of interest rate changes on their financial obligations.

Changing Loan Terms: Swapping fixed-rate loans for floating-rate loans, or vice versa, allows borrowers to modify the terms of their debt to align with their financial objectives.

Speculation: Investors can enter into interest rate swaps to take positions on the direction of interest rates, aiming to profit from their expectations.

Risks in Interest Rate Swaps

While interest rate swaps offer various benefits, they also carry some risks:

Counterparty Risk: If one of the swap parties defaults on its payment obligations, the other party may face financial losses.

Basis Risk: If the floating interest rate used in the swap is linked to a different reference rate than the actual interest rate affecting the party’s financial obligations, basis risk arises.

Market Risk: Changes in interest rates can affect the valuation of interest rate swaps. If rates move in an unexpected direction, the market value of the swap may change, resulting in gains or losses.

Conclusion

Interest rate swaps are powerful financial tools used to manage interest rate risk and optimize borrowing costs. By exchanging cash flows based on fixed and floating interest rates, participants can modify their exposure to changing rates. It’s important to understand the risks associated with interest rate swaps and carefully assess the suitability of these instruments for individual financial objectives.

As of June 30, 2023, LIBOR has been phased out and replaced by the Secured Overnight Financing Rate (SOFR).

FAQs

Q: Are interest rate swaps regulated?

A: In the Indian context, the Reserve Bank of India (RBI) is entrusted with the responsibility of regulating all interest rates, currency, and credit derivatives, including over-the-counter (OTC) derivatives.

Q: Can interest rate swaps be cancelled or terminated early?

A: Yes, parties can agree to terminate an interest rate swap before its original maturity date, subject to the terms and conditions outlined in the swap agreement.

Q: Why don’t retail investors participate in the swap market?

A: Retail investors typically do not participate in the swap market due to several reasons:

- The swap market is complex and requires a deep understanding of financial markets.

- Retail investors lack access and infrastructure to participate directly in the swap market.

- Engaging in swap transactions may involve significant costs for individual investors.

- Regulatory restrictions and compliance requirements create barriers for retail investors.

Q: What is MIBOR?

A: MIBOR stands for the Mumbai Interbank Offered Rate. It is the benchmark interest rate used in the Indian financial market.

- MIBOR represents the average interest rate at which banks in Mumbai offer to lend funds to each other on an uncollateralized basis.

- Calculated daily by the National Stock Exchange of India (NSE) based on submissions from participating banks.

- MIBOR is used in floating-rate loans, interest rate swaps and other derivative products.

- Influenced by factors such as the Reserve Bank of India’s monetary policy, market liquidity and supply and demand of funds.

- Provides a measure of short-term interest rates and determines the cost of funds for banks and financial institutions.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.