What is a Bond / Debenture?

A Bond is simply a loan given to the issuer (borrower) by the bondholder (lender) whereby terms of interest payment and the redemption date/s are pre-determined. When you purchase a bond, you are lending money to any entity known as issuer. The legal document registering this loan is called a bond and the issuer pays interest to you on the amount of money you lend and on expiry of the tenure shall pay back the Principal amount.

While Bonds are securities that are mostly issued by the government, bonds issued by companies are often called Debentures.

What are Characteristics of Bonds?

- Face Value: The basic denomination of a bond or face value provided to the bond holder. For example, Rs 1000 per bond.

- Principal Amount: Total amount invested by the bondholder in a bond issue is the principal amount. For example, you invest Rs 10,000 and you get total 10 bonds with face value worth of Rs 1000 each.

- Coupon Rate: The coupon is the interest rate that the issuer pays to the bond holder. It refers to the periodic interest payments that are made by the bond issuer to the bond holder and is expressed as a percentage of the face value just like your Bank FD payments. For example 7.5% can be coupon rate of a bond.

- Maturity Date: This is the date that the issuer has to repay the entire borrowed amount to the bondholder.

- Price: The price of a bond can be higher or lower than the face value depending on prevailing interest rates in the markets as well as change in credit quality of issuer at the time of investment.

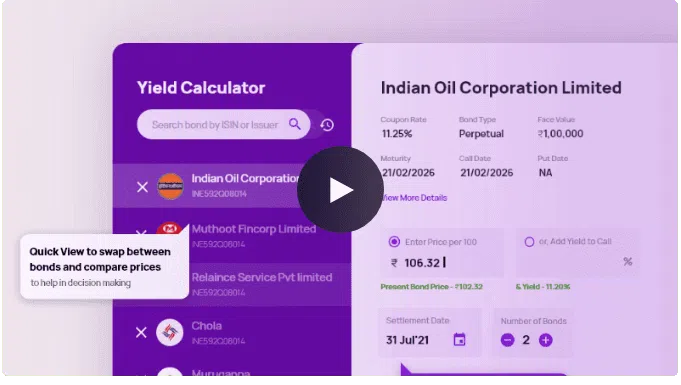

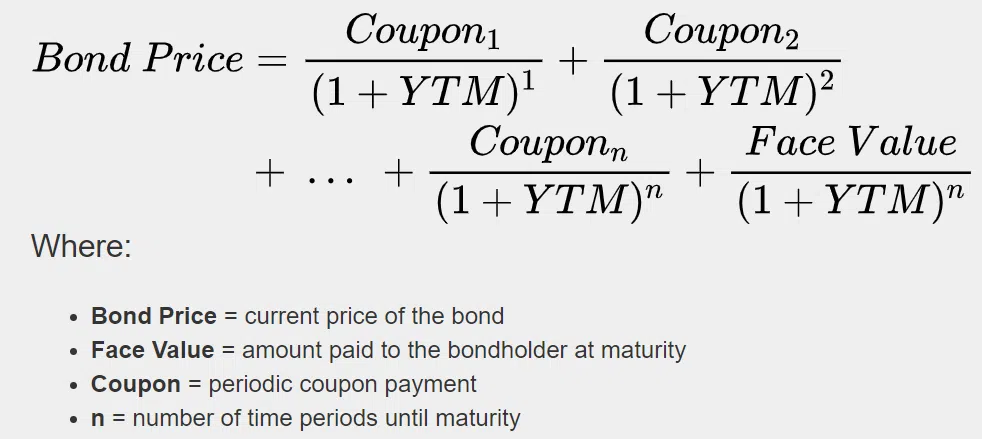

- Yield to Maturity (YTM): This is the total return expressed as a percentage that investor will earn on a bond if held from investment date until maturity date. This is not necessarily same as coupon rate and it is dependent on the price at which investor had / will purchase the bond.

Types of Bonds

There are various types of bonds available in the market:

- Fixed Rate Bonds: Has a coupon or interest rate fixed till maturity of a bond. In this category there are two types:

(A) Taxable Bonds: Interest income is taxable as per the tax bracket of bond holder.

(B) Tax Free Bonds: Interest income is tax free in the hands of bond holder.

- Floating Rate Bonds: Also, known as floaters where the interest rate is linked to reference rate such as MIBOR (Mumbai Interbank Offered Rate) or RBI repo rate etc.

- Zero-Coupon Bonds: It does not pay periodic interest or coupon rate during its life but is effectively rolled up to maturity and bond holder receives full principal amount plus a lumpsum balloon payment as interest on the redemption date.

- Convertible Bonds: This bond lets a bondholder exchange a bond into a number of shares of the issuer's common stock.

- Inflation-indexed Bonds: Inflation-indexed bonds are bonds in which the principal amount and the interest payments are linked and indexed to inflation.

- Perpetual Bonds: These bonds are also often called perpetuities or 'Perps'. They have no defined final maturity. They usually have Call / Put Option Dates or dates at which the issuer may repay the bondholder in full.

Why invest in bonds?

- To maintain diversified investment portfolio

- To earn higher interest and returns then Fixed Deposits

- To achieve your future financial goals depending on individual future income needs.

- Bonds provide regular predictable income stream and also help in capital preservation.

Find Bonds: Where and How?

There is a wide variety of individual bonds to choose from in creating a portfolio that matches your investment needs and expectations. Individual can purchase bonds in two ways:

- Primary Market: If you are interested in purchasing a bond when it is first issued, you should look for various bonds being issued by corporates currently or are likely to issue bonds in near future. These can be via public IPO (like equity) or subscribing to private placements.

- Secondary Market: Bonds are bought and sold by brokers and institutions in secondary market and mostly through over-the-counter (OTC) which are to be reported and settled by both the parties DIRECTLY with the Clearing Corporation, although some corporate bonds are also listed on BSE and NSE.

Sources to find information on bonds: -

a) Primary Market – Lead Managers, Newspaper advertisement, Financial Advisors etc.

b) Secondary Market – Debt Brokers, Stock exchange, Online Financial Market portals etc.

Factors affecting bond prices

- Level of interest rates: Existing Bonds prices go up when interest rates go down and vice versa.

- Credit quality of issuers: Financial conditions of the issuer determine extra yield trader or investors demand for holding issuer’s bonds. Weaker companies pay more interest than stronger companies.

- Liquidity of bond: Like equity shares, you can buy and sell bonds. Usually higher credit quality bonds have more liquidity or tradability than the lower credit ones with government bonds offering the highest amount of liquidity.

| Bond Category |

Credit Quality |

Liquidity |

Examples |

| Government |

Highest |

Highest |

Govt bonds, T-bills |

| Public Sector Enterprise |

High Grade |

Medium |

IRFC, REC, PFC, NTPC, NHAI etc |

| Private Sector Companies |

High to Low |

Varies |

HDFC Ltd, Tata Capital ltd, Shriram Transport Finance Co. Ltd etc |

- Bond Maturity: Longer maturity bonds will trade at higher yields compared to short term bonds as they have longer time horizon that presents more uncertainty on interest rates.

| Maturity |

Yield |

Price Volatility |

| Short |

Lower |

Lower |

| Long |

Higher |

Higher |

- Demand/Supply: Bonds are no different from any other asset with regards to supply and demand. During times of financial crisis, investors prefer government bonds, public sector companies’ bonds for safety. When growth picks up in the economy, investors generally prefer to invest in high yielding corporate bonds with appropriate credit ratings.

What are the Key Bond Investment parameters?

There are number of key variables that comprise the risk profile of bond. Few variables we have already understood earlier are price, interest rate, yield, maturity. Other important parameters are redemption features, embedded options, assessing risk and credit ratings and tax status. Let’s understand each one of these parameters or variables:

Redemption Features:

While the maturity date indicates how long a bond will be outstanding for, many bonds are structured in such a way so that an issuer or investor can opt for early maturity date. The same are discussed below:

- Call Provision: Bonds may have a redemption – or call – provision that allows or requires the issuer to redeem the bonds at a specified price and date before maturity. For example, bonds are often called back by the Issuer (if the call provision were stated at the time of Bond Issue in the information memorandum) when interest rates have dropped significantly from the time the bond was issued. Before you buy a bond, always ask if there is a call provision and, if there is, be sure to consider the yield to call as well as the yield to maturity and then take informed decision. Since a call provision offers protection to the issuer, callable bonds usually offer a higher annual return than non-callable bonds to compensate the investor for the risk that the investor might have to reinvest the proceeds of a called bond at a lower interest rate.

- Put Provision: A bond may have a put provision, which gives an investor the option to sell the bond to the issuer at a specified price and date prior to maturity. Typically, investors exercise a put provision when they need cash or when interest rates for new issues have risen so that they may then reinvest the proceeds at a higher interest rate. Since a put provision offers protection to the investor, bonds with such features usually offer a lower annual return than comparable bonds without a put to compensate the issuer.

- Conversion: Some corporate bonds, known as convertible bonds, contain an option to convert the bond into Equity Shares instead of receiving a cash payment. Convertible bonds contain provisions on how and when the option to convert can be exercised. Convertibles offer a lower coupon rate because they have the stability of a bond while offering the potential upside of a stock.

- Principal Payments and Average Life: Certain bonds are priced and traded on the basis of their average life rather than their stated maturity. This is the case when an issuer wants to repay the principal amount in instalments over a period of time to match expected future cashflow on income. For example, if a bond has five year maturity, but pays the principal in equal one-third instalments in years 3,4,5 – then the average life of the bond is 4 years.

What are the Risks of Investing in Bonds?

All investments offer a balance between risk and potential returns. The risk is the chance that you will lose some or all money that you have invested. Bonds as an investment avenue can be a great tool to generate income and are widely considered to be a safe investment, when compared to stocks. However, you as an investor should identify some potential risks for holding corporate and government bonds. Following are the list of risks involved with investment in bonds.

- Interest Rate Risk: When interest rate rises, bonds prices fall and vice-a-versa. This happens because when interest rates are on decline, investors try to capture or lock in the highest interest rates and will tend to buy more existing bonds that pay higher interest rate. The increase in demand translates into an increase in bond price. On the flip side, if the prevailing interest rate were on the rise, investors would naturally get rid of bond that pays lower interest rates. This would force bond prices down.

- Reinvestment Risk: when interest rates are declining, investors have to reinvest their interest income and any return of principal, whether scheduled or unscheduled, at lower prevailing rates.

- Inflation Risk: Inflation reduces the purchasing power of a bond investor’s future interest payments and principal, collectively known as cash flows. Inflation also leads to higher interest rates, which in turn leads to lower bond prices. Inflation-indexed bonds are structured to remove this inflation risk.

- Credit/ Default Risk: The possibility that a bond issuer will be unable to make interest or principal payment when they are due is default risk. If these payments are not made according to agreements in the bond documentation, the issuer can default. This risk is in minimal in government bonds.

- Liquidity risk: The risk that investors may have difficulty finding a buyer when they want to sell and may be forced to sell at a significant discount to market value. Liquidity risk is greater for thinly traded bonds as lower-rated bonds or bonds that were part of a small issue size.

Bonds do generate an income stream for investors and depending on the issues, they may also help mitigate overall portfolio risk. However, it is important for you as investors to keep in mind the above-mentioned risks before you try your hand in the individual bond issues from companies.

What is the Duration and Convexity of a Bond?

Duration: The term duration has a special meaning in the context of bonds. It is a measurement of how long, in years, it takes for the price of the bond to be repaid by its internal cash flows. It is an important measure for you as an investor to consider, as bonds with higher duration carry more risk and have higher price volatility than bond with lower durations. There are two basic types of bonds duration:

- Duration of zero-coupon bonds – Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, you get a large discount on the face value of the bond. On maturity, the bondholder receives the face value of his investment. In simple words, the investor purchasing a zero-coupon bond profits from the difference between the buying price and the face value, contrary to the usual interest income.

Zero Coupon bond is most suitable for people who want to get a lumpsum amount at a specific time or are investing for any future event such as a child’s education or retirement goal. Though Zero-Coupon bond removes the reinvestment risk it also prevents a regular cash flow, so bond investors who are looking for regular cash flows should avoid investing in zero coupon bonds.

- Duration of a vanilla/straight bonds - A straight bond is a bond that pays interest at regular intervals, and at maturity pays back the principal that was originally invested. The standard features of a straight bond include regular interest payment, face value, purchase price, and a fixed maturity date. Suppose an investor invests in a 5-year duration bond having a 10% annual coupon rate with the face value of Rs. 1,00,000/-, then the investor will earn interest of Rs 10,000/- on the predefined interest payment date for 5 years and at maturity date the principal mount will be repaid.

Advantage of a straight/vanilla bond is that it has easy valuation matrix, straightforward cash flow and high liquidity therefore suitable for investors who are looking for regular income and also capital preservation.

Convexity: Convexity of a Bond is a measure that shows the relationship between bond price and Bond yield, i.e., the change in the duration of the bond due to a change in the rate of interest, which helps a risk management tool to measure and manage the portfolio’s exposure to interest rate risk and risk of loss of expectation

If we were to graph the relationship between price and yield for a bond, the result would not be a straight line, but a curve or convex line, as shown in below diagram. The degree to which the line is curved shows how much a bond’s price changes as the result of change in yield.

Convexity is used as a risk management tool and helps to measure and manage the amount of market risk to which a portfolio of bonds is exposed. The main thing for you to remember about convexity is that it shows how much a bond's yield changes in response to changes in price. A bond with greater convexity is less affected by interest rates than a bond with less convexity. Also, bonds with greater convexity will have a higher price than bonds with a lower convexity, regardless of whether interest rates rise or fall.

Taxation in Bonds

You as an investor need to understand tax implications for any asset class you choose to invest as any income through various asset classes can attract various kinds of taxes. In bonds too, there are certain tax considerations you need to check before investing. In bonds, there are two types of income that you earn:

- Interest Income:

When you invest in bonds/NCDs, you get interest income till the time the bond matures. Interest Income from bonds and tax treatment on the same is exactly similar to any other interest income such as interest earned through FDs. In other words, income interest from bonds or NCDs (non-convertible debentures) will be subjected to tax at applicable slab rates and TDS will be applicable.

-

Capital Gains:

If you decide as a bond holder to sell the listed bonds/NCDs on the stock exchange, capital gains tax may also arise. If bonds are sold within a period of 12 months from the date of allotment, short term capital gain / loss which shall depend on your purchase / sell price. If you decide to sell bonds after a period of 12 months, that will result into long term capital gain or loss.

While short term capital gains on sale of bonds/NCDs would be taxed at applicable slab rates, long term capital gains on sale of bond/NCD (a listed security) are taxed at concessional rate of 10% without claiming the benefit of indexation as mentioned under Section 112 of Income Tax Act.

The Surcharge and Health and Education Cess on the above-mentioned tax will be applicable based on the respective income slab of the investor.

Regulatory Framework

-

The issue and trading of fixed income securities are regulated by different regulatory bodies in India.

- Government securities and issues by Banks, Financial Institutions which are regulated by the Reserve Bank of India (RBI).

- Debt securities issued by Corporates are regulated by Securities and Exchange Board of India (SEBI).

The Reserve Bank of India

The Reserve Bank of India (RBI) was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934.The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937. Though originally privately owned, since nationalisation in 1949, the Reserve Bank is fully owned by the Government of India.

The Preamble of the Reserve Bank of India describes the basic functions of the Reserve Bank as:

"to regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage; to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth."

The Main Functions of Reserve Bank of India are stated here-in below

Monetary Authority:

- Formulates, implements and monitors the monetary policy.

- Objective: maintaining price stability while keeping in mind the objective of growth.

Regulator and supervisor of the financial system:

- Prescribes broad parameters of banking operations within which the country's banking and financial system functions.

- Objective: maintain public confidence in the system, protect depositors' interest and provide cost-effective banking services to the public.

Manager of Foreign Exchange

- Manages the Foreign Exchange Management Act, 1999.

- Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India.

Issuer of currency:

- Issues and exchanges or destroys currency and coins not fit for circulation.

- Objective: to give the public adequate quantity of supplies of currency notes and coins and in good quality.

Developmental role

- Performs a wide range of promotional functions to support national objectives.

Regulator and Supervisor of Payment and Settlement Systems:

- Introduces and upgrades safe and efficient modes of payment systems in the country to meet the requirements of the public at large.

- Objective: maintain public confidence in payment and settlement system

Related Functions

- Banker to the Government: performs merchant banking function for the central and the state governments; also acts as their banker.

- Banker to banks: maintains banking accounts of all scheduled banks.

Securities and Exchange Board of India

The Securities and Exchange Board of India (SEBI) was established on April 12, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act,1992.

The Preamble of the Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as "...to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto"

The main Functions of SEBI are stated here-in below:

- regulating the business in stock exchanges and any other securities markets;

- registering and regulating the working of stock brokers, sub-brokers, share transfer agents, bankers to an issue, trustees of trust deeds, registrars to an issue, merchant bankers, underwriters, portfolio managers, investment advisers and such other intermediaries who may be associated with securities markets in any manner;

- registering and regulating the working of the depositories, participants, custodians of securities, foreign institutional investors, credit rating agencies and such other intermediaries as the Board may, by notification, specify in this behalf;

- registering and regulating the working of venture capital funds and collective investment schemes, including mutual funds;

- promoting and regulating self-regulatory organisations;

- prohibiting fraudulent and unfair trade practices relating to securities markets;

- promoting investors‘ education and training of intermediaries of securities markets;

- prohibiting insider trading in securities;

- regulating substantial acquisition of shares and take over of companies;

- calling for information from, undertaking inspection, conducting inquiries and audits of the stock exchanges, mutual funds, other persons associated with the securities market, intermediaries and self-regulatory organisations in the securities market

FIMMDA

The Fixed Income Money Market and Derivatives Association (FIMMDA) is an association of Scheduled Commercial Banks, Public Financial Institutions, Primary Dealers and Insurance Companies. Voluntary market body for the bond, money and derivatives markets with members representing all major institutional segments of the market.

Clearing Corporation

SEBI has laid down the framework of trading / reporting trades in Corporate Bonds on exchanges and the same must be settled through the Clearing Corporation of the Stock Exchanges (ICCL [BSE] & NCL [NSE]). Thus, helping in mitigating the counter party risk and improving the transparency in trading of Corporate Bonds.

NSE Clearing Limited (NSE Clearing) (formerly known as National Securities Clearing Corporation Limited, NSCCL), a wholly owned subsidiary of NSE is responsible for clearing and settlement of all trades executed / reported on NSE, collateral management and risk management functions for various segments of NSE.

Indian Clearing Corporation Limited ("ICCL") was incorporated in 2007 as a wholly owned subsidiary of BSE Ltd. ("BSE"). ICCL carries out the functions of clearing, settlement, collateral management and risk management for various segments of BSE.

Role of Rating Agencies

Rating agencies assess the credit risk of specific debt securities and the borrowing entities. In the bond market, a rating agency provides an independent evaluation of the creditworthiness of debt securities issued by governments and corporates.

Credit ratings of borrowers are based on the due diligence conducted by the rating agencies. The objective of a rating agencies is to evaluate the financial situation of the borrower and their capacity to service/repay their financial obligations.

Credit rating acts as a catalyst for channelizing investments in debt instruments by enabling individual and institutional investors in making informed investment decisions.

Following are the list of ratings for long term securities.

| Rating |

Description |

| AAA |

Instruments with this rating are considered to have the highest degree of safety regarding timely servicing of financial obligations. Such instruments carry lowest credit risk. |

| AA |

Instruments with this rating are considered to have high degree of safety regarding timely servicing of financial obligations. Such instruments carry very low credit risk. |

| A |

Instruments with this rating are considered to have adequate degree of safety regarding timely servicing of financial obligations. Such instruments carry low credit risk. |

| BBB |

Instruments with this rating are considered to have moderate degree of safety regarding timely servicing of financial obligations. Such instruments carry moderate credit risk. |

| BB |

Instruments with this rating are considered to have moderate risk of default regarding timely servicing of financial obligations. |

| B |

Instruments with this rating are considered to have high risk of default regarding timely servicing of financial obligations. |

| C |

Instruments with this rating are considered to have very high risk of default regarding timely servicing of financial obligations. |

| D |

Instruments with this rating are in default or are expected to be in default soon. |

Rating Agency may apply '+' (plus) or '-' (minus) signs for ratings from ‘AA' to 'C' to reflect comparative standing within the category.

A rating outlook indicates the direction in which a rating may move over a medium-term horizon of one to two years. A rating outlook can be 'Positive', 'Stable', or 'Negative'. A 'Positive' or 'Negative' rating outlook is not necessarily a precursor of a rating change.

Role of Debenture Trustee

A debenture trustee is an entity that holds the property of Bond/Debenture Issuer Company for the benefit of the debenture holders. They are SEBI regulated entities designed for better investor protection and reducing the events of defaults by financial institutions issuing Bond/Debentures.

A debenture trustee is a single point of contact who can act as a link between the issuer company and debenture holder for the smooth functioning of the process and protecting the interest of the debenture holders.

A debenture trustee keeps a track of issuer company actions to ensure that all the conditions mentioned in the offer are adhered to and debenture holder obligations are met. In case of default by the issuer company, the debenture trustee takes possession of the collateral/mortgaged assets in favour of debenture trustee for benefit of the debenture holders and paying their dues.

Registration Process

1. KYC Compliance

- 1. Requirement: All users must comply with KYC norms set by SEBI, Stock Exchanges, Clearing Corporation, or other authorities (e.g., KRA, CKYC).

- 2. Online KYC Process:

- 1. Initiate KYC via the "KYC" link on the IndiaBonds homepage.

- 2. After KYC submission, the operations team verifies the documents.

- 3. In case of any issues, the team will contact the user to resolve discrepancies.

- 4. Once approved, KYC details are updated on the Exchange, allowing the user to invest or sell bonds.

2. Demat & Bank Account Registration

- 1. Existing Accounts: Users can use their current bank and demat accounts to invest.

- 2. New Demat Accounts: IndiaBonds will assist in opening demat accounts for users who don't have one.

- 3. Registration Limits: Users can register up to 5 bank and demat accounts with the Clearing Corporation, selecting one as the default.

- 4. Pay-In & Pay-Out: Users must select a bank and demat account for pay-in (funds/securities) and pay-out obligations.

What is the process for Investment & Settlement of Bonds?

The Steps to be followed are stated below:

1. Steps for Investment :

- 1. Select/Search Bonds:

- a. Based on your investment objective, choose the bond to buy or sell.

- b. Review bond details, enter the quantity, and confirm bank and demat account information.

- c. Confirm the order and proceed with the online payment via the payment gateway.

- 2. Transaction Reporting: Once confirmed, the transaction is reported to the RFQ Platform of the Exchanges.

- 3. Pay-In and Pay-Out : Transfer of funds (buyer) and/or securities (seller) is done directly with Clearing Corporations. Upon receiving the pay-in of funds and securities from both parties, the Clearing Corporation releases the pay-out to the respective counterparty's bank or demat account.

2. Payment and Transaction Cancellation:

- 1. The payment gateway transfers funds to the Clearing Corporation on or before the stipulated time on settlement date.

- 2. If a counterparty fails to meet pay-in obligations, the Clearing Corporation returns funds/securities in the source account, and the transaction is cancelled.

- 3. Cancellation penalties may apply as per Stock Exchange policy.

3. Key Notes:

- 1. Minimum Investment: Minimum Investment starts with ₹10,000 onwards.

- 2. RFQ Platform: Orders for securities are reported and executed on the RFQ Platform of the Stock Exchange, as per regulatory guidelines.

Fixed Deposits vs Bonds

Fixed Deposits and Bonds are both fixed income instruments, which offer interest income to investors.

What are Fixed Deposits? A fixed deposit (FD) is a financial instrument provided by banks, NBFCs and companies which provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

What are Fixed Deposits? A fixed deposit (FD) is a financial instrument provided by banks, NBFCs and companies which provides investors with a higher rate of interest than a regular savings account, until the given maturity date.

It is always advisable to check the features of both these instruments in order to fetch good returns.

| Features |

Bonds/ Non-Convertible Debentures |

Fixed Deposits |

| Safety |

Most bonds are secured in nature as its backed by assets |

For Bank FDs are insured up to Rs 5 lakh (capital & interest) per depositor, other than Bank FDs are unsecured in nature |

| Liquidity |

Can be liquidated anytime as bonds are tradable on exchanges |

Can be withdrawn pre-maturely, however, liquidity at reduced interest rates or penalty charges |

| Returns |

Offers fixed returns and chance of taking advantage of interest rate cycle to maximize returns |

Returns are fixed. Cannot be traded hence you cannot take advantage of interest rate changes in the economy |

| Credit Rating |

It is mandatory for issuers to get the instrument rated by at least one credit rating agency |

Mandatory for NBFCs but not for others. Bank FDs are not rated |

| Taxation |

As per the tax slab of the individual other than tax free bonds |

As per the tax slab of the individual |

| TDS (Tax Deducted at Source) |

Pursuant to the provisions of Section 193 of the Income Tax Act, 1961, as amended, effective from 1st April 2023, TDS will be deducted at the rate of 10% (or such other rates as may be notified from time to time) on any interest payable on any security issued by a company other than securities issued by the Central Government or a State Government. |

TDS is applicable if interest exceeds above the prescribed limit |

| Interest Payout Frequency |

Monthly/Quarterly/Annually/Cumulative |

Monthly/Quarterly/Annually/Cumulative |

Debt/Bond funds vs Bonds

What are Bond or Debt Funds? Bond funds are mutual funds that invest in bonds. Put another way, one bond fund can be considered a basket of dozens or hundreds of underlying bonds (holdings) within one bond portfolio. Most bond funds are comprised of a certain type of bond, such as corporate or government, and further defined by time period to maturity, such as short-term (less than 3 years), intermediate-term (3 to 10 years) and long-term (10 years or more).

| Features |

Bonds/ Non-Convertible Debentures |

Debt/Bond Funds |

| Price |

The price of the bond may fluctuate while investor holds the bond. |

Bond funds are not valued by a price but a net asset value (NAV) of the underlying holdings in the bond portfolio. |

| Principal Amount Risk |

Bond holder receives principal amount invested at a time of bond maturity. Hence, there is no loss of principal amount |

As bond funds consider NAV and not the price, investor can lose some of their principal amount if NAV falls. |

| Returns/ Interest Rates |

Returns are fixed and hence can be useful for investor to determine exact returns at maturity of the bond. |

Returns vary depending on market conditions and interest rate scenario in the economy. |

| Credit Risk |

Invest in higher credit quality securities with better returns. |

Depends on credit quality of underlying securities in which the fund invests. |

| Liquidity |

Most listed bonds are liquid and tradable on exchange. |

Investors can generally redeem fund units at any time, at the current market value (or NAV) of the fund. Some funds may carry a redemption fee/exit load. |

Equity vs Bonds

Stocks and bonds are the two main classes of assets investors use in their portfolios. Stocks offer an ownership stake in a company, while bonds are akin to loans made to a company (a corporate bond) or any other organization. In general, stocks are considered riskier and more volatile than bonds. However, there are many different kinds of stocks and bonds, with varying levels of volatility, risk and return.

| Features |

Bonds |

Equity |

| Safety |

Investment in bonds are generally safer as you don’t hold a risk of losing principal amount |

Equity investment is riskier investment as there can be chances of losing principal amount |

| Predictable Returns |

It has fixed and predictable returns in form of interest payments at periodic intervals unless the issuer defaults |

Returns are subject to market price of the shares |

| Market Risk |

In bond investment interest income is fixed at the time of purchase and remains same till term of maturity. Hence, market risk is negligible. |

Stocks are more volatile and market prices affect the returns drastically. Market risk is much higher. |

| Bankruptcy |

Bond holders are the first in line to get their amount invested as they are lenders and generally bonds are backed by assets. |

Shareholders are last in line during bankruptcy and you may lose the entire investment. |

| Interest Rate Risk |

Bonds are subject to interest rate risk and changes in interest rate can lead to lower investment return |

Interest rate risk does not impact equity investment to larger extent |

Investment Strategy – Part I

Investment Objectives - “It’s very difficult to get somewhere if you have no idea where you are going!”

As in most endeavors, setting goals is an important part of creating an investment portfolio. You need to have investment objectives, while you create a portfolio. Also, investment objective should not only be identified, but prioritized as some goals may conflict with each other. Following are some of the investment objectives that you may consider:

Current Income: It stands to reason that anyone considering the creation of a bond portfolio would have current income high on their list of objectives, if not the primary goal. The maximization of current income becomes a risk/reward decision as higher yielding bonds present greater risk.

Capital Appreciation: Capital appreciation is when an investment or portfolio increases in value. Many people do not think about bonds when it comes to capital appreciation, but the reality is that bonds do fluctuate in value, and can be used to meet this investment objective, though they should probably not be the only asset class in the portfolio. Longer maturity and discount bonds provide the most price movement when interest rates change, but this also increases the portfolio’s price risk.

Capital Preservation: Capital preservation is when a portfolio’s principal maintains its value. Investors that are seeking the preservation of capital are looking to minimize price risk. Investors looking for capital preservation would usually want to purchase bonds with shorter maturity with high credit ratings.

Tax Minimization: This is usually considered a secondary objective, but investors seeking to minimize taxes may want to consider tax-free bonds.

Broadly, we can categorize Investment goals in two categories:

a) Cash Flow Goals – Want to earn Rs 50,000/- per month through investments

b) Capital Appreciation Goals – Want to have Rs 2 crore portfolio in next 10 years.

Investment objectives of current income and tax minimization will fall in the category of cash flow goals, while capital appreciation and preservation will be in capital appreciation goals. To conclude, you need to know what you want to achieve, so that you know which category (cash flow goals & capital appreciation goals) is suitable, and what is the reasonable returns to expect.

Portfolio Management Styles

Once you have finalized goals and objectives, you should consider knowing different strategies that you can start investing in bonds as per your goals and needs. There are various techniques you and your investment advisor can use to help you match your investment goals with your risk tolerance.

Passive Portfolio Management

Passive portfolio management is essentially a buy-and-hold approach. Passive portfolio management provides the least amount of risk, but also the lowest potential returns. Passive portfolio management is also known as indexing, because it involves choosing an index that you wish to match the return of, and recreating it in the portfolio. Matching an index by replicating every security in it is not practical, as many indexes contain hundreds or thousands of securities. Professional portfolio managers will index by creating a portfolio of securities that match various characteristics of the index such as coupon, maturity, duration, and credit rating. The duration component is probably the most important determinant of portfolio performance, followed closely by the credit rating.

Enhanced Indexing

Enhanced indexing is a hybrid of passive and active portfolio management. The objective is to outperform the targeted index, but it also presents the risk of underperforming the index. One strategy involves deviating from the characteristics of the portfolio. For example, a manager may create a portfolio with a slightly longer average duration or lower average credit rating. Another strategy involves creating an indexed portfolio with most of the assets, and actively managing a smaller portion of the assets.

Asset-Liability Management

Asset-liability management (ALM) is a portfolio management strategy that involves matching the cash flows of the portfolio assets with liabilities. In other words, the portfolio is constructed so the interest payments and maturities of the bonds in the portfolio are matched against the future payment obligations. While this is popular with large institutional investors, such as insurance companies, it is less common with retail investors. However, it can be an effective strategy for investors who are retired or are approaching retirement. The advantage is that it lowers the price risk because the investor is less likely to have to sell an investment at a loss.

Active Portfolio Management

Active portfolio managers are attempting to outperform the benchmark. This is often very difficult to achieve, especially considering the higher transaction fees that result from increased trade activity. It is the strategy that presents the highest potential return, but the risk is also higher. Active managers do not believe in the efficient market hypothesis, or they believe that markets are not significantly efficient. Most retail investors do not prefer managing bond portfolio actively as it involves transaction fees and has higher risk.

Investment Strategy – Part II

Investment Strategies

Once you have finalized goals and objectives, you should consider knowing different strategies that you can start investing in bonds as per your goals and needs. There are various techniques you and your investment advisor can use to help you match your investment goals with your risk tolerance.

Diversification

Diversification is the allocation of assets to several categories in order to spread, and therefore possibly mitigate, risk. Regardless of your investment objectives, diversification is an important consideration in building any portfolio. Diversification can be achieved in any number of ways, including by:

Ladders: A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at equally spaced intervals. When you buy bonds with a range of maturities, a technique called laddering; you are reducing your portfolio’s sensitivity to interest rate risk. If, for example, you invested only in short-term bonds, which are the least sensitive to changing interest rates, you would have a high degree of stability but low returns. Conversely, investing only in long-term bonds may result in greater returns, but prices will be more volatile, exposing you to potential losses. Assuming a normal yield curve, laddering allows returns that would be higher than if you bought only short-term issues, but with less risk than if you bought only long-term issues. In addition, you would be better protected against interest rate changes than with bonds of one maturity. For example, you might invest equal amounts in bonds maturing in 2, 4, 6, 8 and 10 years. In two years, when the first bonds mature, you would reinvest the money in a 10-year maturity, maintaining the ladder.

Barbells: Barbells are a bond investment strategy similar to laddering, except that purchases are concentrated in the short-term and long-term maturities. The barbell strategy is used to take advantage of the best aspects of short-term and long-term bonds. In this strategy bond investor invests in long- and short-duration bonds but does not invest in intermediate-duration bonds. Longer dated bonds typically offer higher interest yields, while short-term bonds provide more flexibility.

The short-term bonds give an investor the liquidity to adjust potential investments every few months or years. If interest rates start to rise, the shorter maturities allow an investor to reinvest principal in bonds that will realize higher returns than if that money was tied up in a long-term bond.

The long-term bonds give an investor a steady flow of higher-yield income over the term of the bond. However, by not having all your capital in long-term bonds, this limits the downside effects if interest rates were to rise in that bond period.

Bullets: If you know as an investor that you will need a certain amount of capital at a given point in time in the future, then a bullet investment strategy might be the best way to go. This strategy suggests that an investor stagger purchase dates on bonds that all mature at the same time i.e., purchasing several bonds with the similar maturity date

By staggering the purchase of bonds, investors can more efficiently seek out securities that have more attractive interest rates. And since all of the bonds have the same maturity date, investors are able to receive a potentially more attractive inflow. However, because the investor is staggering the purchase of the bonds, it can lead to a risk that interest rates will fall over the bond purchasing period.

Market Timing Strategies

Market timing involves attempts to correctly anticipate changes in interest rates. Bond traders and investors can use several methods to try to forecast interest rates and structure trades to profit from their forecasts. Forecasting just about anything, be it weather, corporate earnings, or financial markets, forecasting changes in interest rates is as much an art as a science. It is impossible to forecast with extreme accuracy, but professional bond traders employ various techniques to try to stack the odds in their favor. Because the Reserve Bank of India changes interest rates to implement monetary policy in order to pursue its stated goal of “price stability and sustainable economic growth,” predicting what the RBI is going to do can help forecast interest rates. “RBI watching” is something that virtually all bond investors do to help them determine the future course of interest rates.

Relative Value Strategies

Relative value (RV) strategies attempt to take advantage of temporary price anomalies between different bonds. In other words, the spread between the two bonds is exceedingly large, and the manager expects the spread to return to normal. The anomaly may be in a credit spread, a yield spread, or a maturity spread.

Aggressive managers will usually go long the cheap security and short the expensive bond. These trades are usually made market neutral by weighting the long and short position by the price sensitivity of each bond. An investor can also take advantage of relative value anomalies by swapping out of an expensive security in their portfolio into a cheap.

What are Government Securities?

A government security is a tradable instrument issued by the Central Government or by the State Governments and is acknowledged as Government’s debt obligation. Government securities carry practically no risk of default and are called risk-free gilt-edged instruments. These securities are short-term (treasury bills with original maturity of less than one-year) or long-term securities (Government bonds or other dated securities issued by State Governments with original maturity of one-year or more).

Government of India also issues other instruments such as Savings Bonds, National Saving Certificates, oil bonds, Food Corporation of Indiabonds, fertilizer bonds, power bonds, etc. These bonds and securities are, usually not fully tradable and are, therefore, not eligible to be SLR securities.

Types of Government Securities

Treasury Bills (T-bills): Treasury bills are money market and short-term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 day, 182 day and 364 day. Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity.

The Reserve Bank of India conducts auctions usually every Wednesday to issue T-bills. Payments for the T-bills purchased are made on the following Friday.

Dated Government Securities: These are long term securities and carry a fixed or floating coupon rate which is paid on the face value, payable at fixed time periods (usually half-yearly). The tenor of dated securities can be up to 30 years. Government security contains the following features - coupon, name of the issuer, maturity and face value. For example, 5.79% GS 2030 would mean:

Coupon: 5.79% paid on face value

Name of Issuer: Government of India

Date of Issue : May 11, 2020

Maturity : May 11, 2030

Coupon Payment Dates : Half-yearly ( 11th May and 11th November) every year

The coupon payment date if falls on Sunday or a holiday, then the coupon is paid on the next working date for dated Government Securities, however, if the redemption or maturity date falls on Sunday or a holiday, then the redemption proceeds are paid on the previous working day. The types of government securities issued are fixed rate bonds, floating rate bonds, zero-coupon bonds, special securities (food bonds, oil bonds, fertilizer bonds, etc).

State Development Loan (SDLs): State Government also raises loans from the market known as SDL. These dated securities are issued through an auction similar to Central Government Securities and pay interest at half-yearly intervals, while principal is repaid on the maturity date. Securities issued by Central Government and SDL qualify for SLR and also eligible as a collateral for borrowing through market repo and borrowing by eligible entities from RBI’s daily Liquidity Adjustment Facility (LAF).

Issuance of Government Securities

Primary issuance of government securities is conducted through auction method on electronic platform called NDS platform. The members of this electronic platform consist of commercial banks, scheduled urban co-operative banks, primary dealers, insurance companies and provident funds. These members maintain funds account (current account) and securities account (SGL) with RBI and can place their bids in the auction through NDS electronic platform.

The RBI, in consultation with Government of India issues an indicative half-yearly auction calendar that contains information about the borrowing amount, security tenor and likely period during which auctions will be held. RBI also issues a notification and press release a week prior to the auction with exact security details on its website www.rbi.org.in.

There are two types of auction method used by the RBI to issue government securities:

Yield Based Auction: A yield based auction is generally conducted when a new Government security is issued. Investors bid in yield terms up to two decimal places (for example, 8.19%, 8.20%, etc.). Bids are arranged in ascending order and the cut-off yield is arrived at the yield corresponding to the notified amount of the auction. The cut-off yield is taken as the coupon rate for the security. Successful bidders are those who have bid at or below the cut-off yield. Bids which are higher than the cut-off yield are rejected.

Price Based Auction: A price based auction is conducted when Government of India re-issues securities issued earlier. Bidders quote in terms of price per Rs.100 of face value of the security (e.g., Rs.102.00, Rs.101.00, Rs.100.00, Rs.99.00, etc., per Rs.100/-). Bids are arranged in descending order and the successful bidders are those who have bid at or above the cut-off price. Bids which are below the cut-off price are rejected.

Economics and Bond Market

Economics is a social science that studies how individuals, governments and companies make choices on allocating scarce resources to satisfy their unlimited wants. The concept of choice is the core to economics and how economic agents such as companies and individuals make choices in the face of the constraints that drive economic theory. Economists assume that every economic agent always acts in self-interest to seek maximization of their own well being. Let’s consider few economic laws and principles that affect bond markets.

Law of Supply and Demand

The law of supply and demand is interaction between supply of a resource (in our case bonds) and demand for that resource. The law defines the effect that the availability of a product and the desire (demand) for that product has on price. Generally, if there is a low supply and a high demand, the price will be high. In contrast, the greater the supply and the lower the demand, the lower the price will be. Equilibrium is achieved when price of supply meets the price point of demand for a product. In bond market, the law of supply and demand can contribute to explain a bond’s price and its interest rate at any given time. It becomes the base to any economic understanding.

Bond’s supply and demand determine the interest rate in the bond market, and a bond becomes a tradable commodity. Investors such as you, buy bonds while companies and government supply bonds. Consequently, the interaction of supply and demand functions in the bond market determines the price and quantity.

Macroeconomics and interest rates

While an understanding of economics is important to understanding any financial market, it is particularly important when it comes to the bond market. One of the prime determinants of bond prices is the general level of interest rates and the level of interest rates is driven by macroeconomics.

Gross Domestic Product & Consumer Price Index

Experienced bond investors and traders keep a close eye on economic indicators and indexes, such as gross domestic product (GDP), which is the sum of all of a country’s goods and services produced in a year; and the consumer price index (CPI) which measures the overall rate of change in the prices of consumer goods and services.

A faltering economy is not the only concern for bond investors- an economy that is growing too rapidly will lead to excessive demand for goods and services, which will eventually lead to rapidly increasing prices, or price inflation (the law of supply and demand). A declining economy, as evidenced by a declining GDP, and an “overheated” economy, as evidenced by a rapidly increasing GDP, which will eventually lead to significant increases in the CPI, will both have a significant impact on bond prices.

Flight to Quality/Safety Phenomenon

Flight to quality refers to the herd-like behavior of investors to shift out of risky assets during financial downturns or bear markets. For example, an economic decline will have an impact on the financial fortune of the issuers of most bonds, be they corporations or state and local governments, thereby affecting the price of the bonds. Issues of lower credit quality are typically more affected, as they are less able to withstand an environment of lower revenues and earnings. In significant downturns, investors usually sell out of equities and lower quality bonds and purchase much safer instruments; most often are high rated (AAA) Government and PSU bonds of shorter duration. This phenomenon is known as a ‘flight to quality/safety’ and can lead to an increase in the price of certain government bond issues for a period of time.

Inflation

Inflation is often described as the general rise of prices in the economy. However, the increase in prices is merely the effect, called price inflation. Monetary inflation, which is the expansion of credit in the financial markets, is what often drives price inflation. As credit expands, and more money becomes available in the marketplace, the price of goods and services generally rise in response. This is because the inflation increases supply of money in circulation while simultaneously decrease in the value of money as a result.

There are two types of inflation index most widely tracked: Wholesale Price Index (WPI) and Consumer Price Index (CPI). In recent years, RBI has started targeting CPI for setting monetary policy. The CPI is the average change over time of the prices paid by consumers for basket of goods and services. Both CPI and WPI are normally quoted as percentage change over a specified period of time.

Impact of inflation on Bond Market

Interest rates, bond yields (prices) and inflation expectations have a correlation to one another. Movement in short-term interest rates, as dictated by country’s central bank (RBI), will affect different bonds with different terms to maturity differently, depending on the market’s expectations of future levels of inflation.

Inflation is a bond’s worst enemy. Inflation erodes the purchasing power of a bond’s future cash flows. The timing of a bond’s cash flows is important. This includes the bond’s term to maturity. If market participants believe that there is higher inflation on the horizon, interest rates and bond yields will rise and the price will decrease to compensate for the loss of the purchasing power of future cash flows. Those bonds with the longest cash flows will see their yields rise and prices fall the most.

Business Cycle

A concept that is critical to an understanding of financial markets is the business cycle (also known as the economic cycle). The business cycle refers to fluctuations in economic activity, most often as measured by changes in gross domestic product (GDP). These recurring fluctuations are somewhat random and do not follow a predictable pattern.

There are five stages in a business cycle:

a) Expansion b) Peak c) Contraction d) Trough e) Recovery

Expansion stage of the cycle is characterized by rising employment wages and profits that fuels the expansion of supply and demand for goods and services and consumer confidence that encourages spending. Expansion is most often accompanied by the accommodative monetary policies of low interest rates and expanding money supply. Eventually, the expansion leads to inflation as there are too many rupees chasing too few goods. The central bank then adopts more restrictive monetary policy and raises interest rates. As the supply of money contracts and high interest rates discourage consumer and business spending, unemployment increases and economic activity peaks and eventually begin to decline. The central bank (RBI) begins to loosen monetary policy until economic activity reaches a trough and begins to recover.

Fiscal Policy

Fiscal policy is the means by which a government adjusts its spending levels and tax rates to monitor and influence a nation's economy. The government uses fiscal policy to influence aggregate demand. Aggregate demand is the total consumption, government spending and investment that occur within an economy. The government policy attempts to influence the direction of the economy through changes in government spending or taxes. The government uses their spending or tax rates to influence aggregate demand – increasing it during economic slowdown and increasing it when there is excess growth. Simply put, the government has two levers when setting fiscal policy

(a) Government can change the levels of taxation

(b) Government can change the levels of spending

Impact of Fiscal Policy on bond market

Fiscal policy can be used to influence both expansion and contraction of GDP as a measure of economic growth. Let’s check the impact of fiscal policy on economy and bond market mentioned below:

-

Expansionary fiscal policy will lead to an increase in the size of the government’s budget deficit.

- Higher government borrowing will cause markets to fear default and push up interest rates on government debt.

-

A crowding out impact takes place in the bond market. Budget deficit spending forces government to raise funds in the capital markets. Since there is a finite amount of investment available to borrowers, the government reduces the amount of investment funds available to private sector to fund their operations. This will force borrowers to pay higher interest rates to raise capital for their projects; therefore, overall aggregate demand doesn’t increase.

- There will be a direct effect of fiscal policy on government bond prices, which impacts corporate bonds prices as well. Tax shocks have a negative effect on expected government bond and corporate bond returns, while spending shocks have positive effect on bond returns in expansionary fiscal policy.

Monetary Policy

Monetary policy is the use of the supply of money and short-term interest rates to influence economic growth and inflation. Monetary policy consists of the actions of a central bank that determine the size and rate of growth of the money supply, which in turn affects interest rates.

Money is necessary in order to carry out transactions. However inherent to the holding of money is the trade-off between liquidity advantage of holding money and the interest advantage of holding other assets. When the demand of money is stable, monetary policy can help to stabilize an economy. However, when the demand for money is not stable, real and nominal interest rates will change and there will be economic fluctuations. Monetary policy is maintained through actions such as modifying the interest rate, buying or selling of government bonds, and changing the amount of money banks are required to keep in the reserves. Let’s look at various tools of monetary policy:

Cash Reserve Ratio (CRR): CRR is a set percentage of customer net deposits that a bank is required to hold in reserves, or funds that are not allowed be loaned. The required reserve ratio is a tool in monetary policy, given that change in cash reserve ratio directly impact the amount of loanable funds available. The Reserve Bank of India (RBI) uses the CRR to drain out excessive money from the system.

Key Interest rate: RBI uses Reverse Repo Rate and Repo Rate to control interest rate in India. Reverse Repo Rate is the rate at which the RBI borrows money from commercial banks. Banks are always happy to lend money to the RBI since their money is in safe hands with a good interest. An increase in Reverse Repo Rate can prompt to park more fund with the RBI to earn higher returns on idle cash. It is also a tool which can be used by the RBI to drain excess money out the banking system.

Repo Rate is the rate at which the RBI lends money to commercial banks is called Repo Rate. It is an instrument of monetary policy. Whenever banks have any shortage of funds they can borrow from the RBI. A reduction in the Repo Rate helps banks get money at a cheaper rate and vice versa. The Repo Rate in India is similar to the discount rate in the US.

Open Market Operations: An open market operation (OMO) is an instrument of monetary policy which involves buying or selling of government securities from or to the public and banks. The mechanism influences the reserve position of banks, yield on government securities to control the flow of credit and buys government securities to increase credit flow. Open market operation makes bank rate policy effective and maintains stability in government securities market.

Statutory Liquidity Ratio: Every banks has to maintain a certain quantity of liquid assets with themselves at any point of time of their total net time and demand liabilities. These assets have to be kept in non-cash form such as G-secs, gold, approved securities like bonds, etc. The ratio of the liquid assets to time and demand assets is termed as the Statutory Liquidity Ratio.

Impact of Monetary Policy on bond market

Monetary Policy has direct impact on bond market and bond markets takes cues from prevailing interest rates in the economy to determine yields and price of government bonds and corporate bonds.

- When interest rates are low or RBI reduces Repo Rate, bond yields decline as there is increased demand for bonds which results in the rise of bond prices.

- When interest rate is high or RBI increases Repo Rate, bond yields rise and prices fall for bonds.

-

Central banks are aware of their ability to influence bond prices via its monetary policy. During recessions, central bank may lower interest rates to stave off deflationary forces which will lead to increase in bond or asset prices. Increasing bond prices have a mildly stimulating effect on the economy as it lowers borrowing cost for corporations and the government, leading to increased spending in the economy.

-

RBI also uses OMO to control the liquidity in the bond market which also has significant impact on bond prices. When the liquidity (money supply) in the market increases for short-term, RBI can sell government securities through Open Market Operation and hence reduce the liquidity for short-term, which results in fall of the bond prices and bond yields moves upwards and vice-a-versa.

Each and every monetary tool such as OMO, SLR, Repo Rate, etc has more direct impact on government bonds and corporate bonds than other asset classes. The central bank uses these tools as and when required to control money supply and inflation in the economy.