February’24 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from February 6-8, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% consequently the standing deposit facility is unchanged at 6.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI Headline inflation moderated to an average of 5.5% during Apr’23-Dec’23 from 6.7% during FY22-23. Food price inflation, however, continued to impart considerable volatility to the inflation trajectory. In contrast, the deflation in CPI fuel deepened and core inflation moderated to a four-year low of 3.8% cent in Dec’23.

The MPC expects CPI outlook to be shaped by several factors such as:

- The inflation trajectory, going forward, would be shaped by the outlook on food inflation, about which there is considerable uncertainty. Adverse weather events remain the primary risk with implications for the rabi crop.

- Increasing geopolitical tensions are leading to supply chain disruptions and price volatility in key commodities, particularly crude oil.

- On the positive side, Rabi sowing progress is good, promising a fruitful season. Key vegetable prices, like onions and tomatoes, are correcting seasonally.

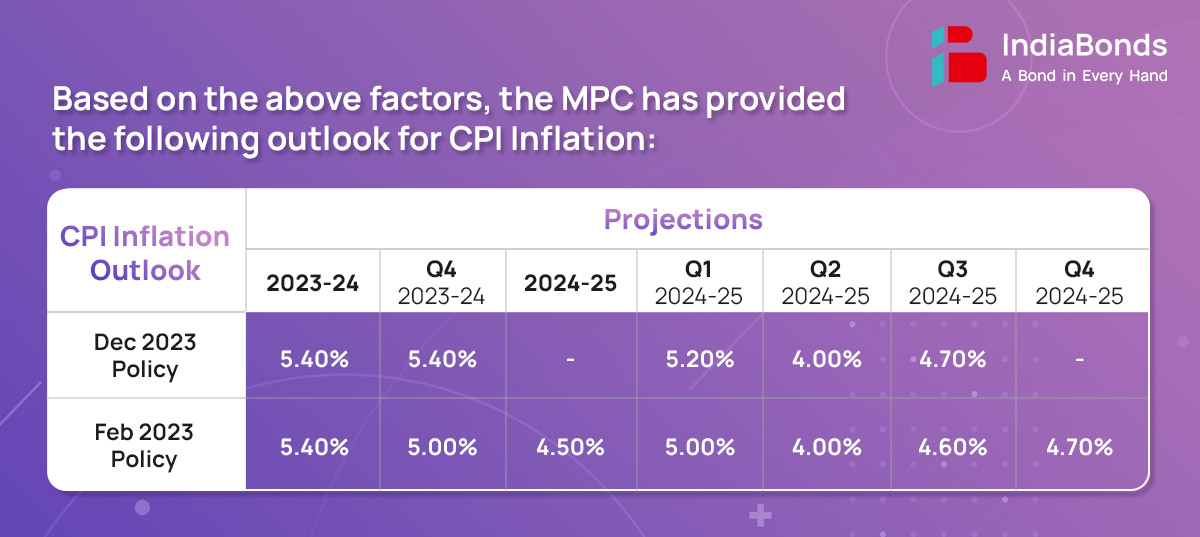

- Taking into account these factors, CPI inflation is projected at 5.4% for FY23-24 with Q4FY24 at 5.0%. Assuming a normal monsoon next year, CPI inflation for FY24-25 is projected at 4.5% with Q1FY25 at 5.0%; Q2FY25 at 4.0%; Q3FY25 at 4.6%; and Q4FY25 at 4.7%.

2. Growth

Domestic economic activity remains strong. The first advance estimates (FAE) placed the real gross domestic product (GDP) growth at 7.3% for 2023-24, marking the third successive year of growth above 7%.

The MPC expects real GDP to be based on the following factors:

- Agricultural activity is holding up well despite lower rainfall, lower reservoir levels and delayed sowing. Rabi sowing has surpassed last year’s level as well as the normal acreage.

- Industrial activity is gaining steam on the back of improving performance of manufacturing. The purchasing managers’ index (PMI) for manufacturing is displaying expansion along with strengthening of future activity index.

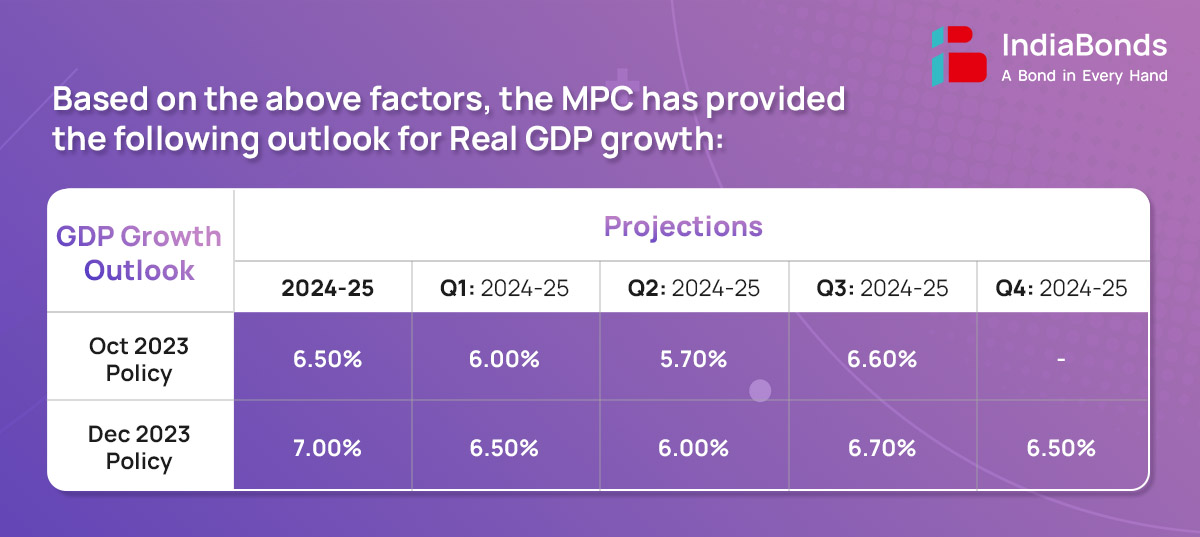

- Taking all these factors into consideration, real GDP growth for FY24-25 is projected at 7.0% with Q1FY25 at 7.2%; Q2FY25 at 6.8%; Q3FY25 at 7.0%; and Q4FY25 at 6.9%.

3. Liquidity

- System liquidity was in surplus from Apr-Aug’23, but turned into a deficit in Sept’23 for the first time in four and a half years. Despite this, when adjusted for government cash balances, the banking system retains a surplus of potential liquidity.

- During December-January, the Reserve Bank pro-actively injected liquidity through both the main and the fine- tuning repo operations to ease liquidity tightness in the system.

- With government spending picking up and augmenting system level liquidity, the Reserve Bank undertook six fine- tuning variable rate reverse repo (VRRR) auctions during February 2-7, 2024 to absorb surplus liquidity.

- The reversal of liquidity facilities under both SDF and MSF even during weekends and holidays, announced in our December policy statement, has facilitated better funds management by the banks.

4. Global Economy

Global growth is expected to remain steady in 2024 with heterogeneity across regions. Though global trade momentum remains weak, it is exhibiting signs of recovery and is likely to grow faster in 2024. Amidst the current headwinds, elevated level of public debt is raising serious concerns on macroeconomic stability in many countries, including some of the advanced economies (AEs).

Part B: Key Statements on Developmental and Regulatory Policies:

I – Financial Market

1. Review of the regulatory framework for Electronic Trading Platforms

Under the framework, which aimed to ensure fair access through transparent, safe, and efficient trading processes, robust trading infrastructures and prevent market abuse, 13 ETPs operated by 5 operators have since been authorized. In view of these developments, it has been decided to review the regulatory framework for ETPs. The revised regulatory framework will be issued separately for public feedback.

2. Hedging of gold price risk in the Over the Counter (OTC) market in the International Financial Services Centre (IFSC)

Resident entities can now hedge gold price risk in the over-the-counter (OTC) segment in the IFSC, in addition to recognised exchanges. This decision enhances flexibility and access to derivative products for hedging gold exposure. Instructions regarding this expansion are forthcoming, aiming to facilitate smoother operations for resident entities.

II – Regulations

3. Key Fact Statement (KFS) for retail and MSME loans & advances

The RBI has mandated all regulated entities to provide a Key Fact Statement (KFS) to borrowers for all retail and MSME loans. This move aims to enhance transparency in loan pricing and empower borrowers with critical information such as the all-inclusive interest cost, aiding them in making informed decisions. The KFS requirement extends beyond scheduled commercial banks to encompass digital lending and microfinance sectors, ensuring consistency and clarity across the lending landscape.

III – Payment Systems and Fintech

4. Enhancing the robustness of AePS

AePS, managed by NPCI, facilitates digital payments for over 37 crore users, enhancing financial inclusion. To enhance security, the onboarding process for AePS touch point operators will be streamlined, with mandatory due diligence and enhanced fraud risk management.

5. Principle-based framework for authentication of digital payment transactions

The Reserve Bank aims to enhance digital payment security by adopting a principle-based framework for authentication, moving beyond SMS-based OTP. This shift aligns with emerging technological innovations in authentication methods. Specific instructions will follow separately.

6. Introduction of programmability and offline functionality in Central Bank Digital Currency (CBDC) pilot

The CBDC-R pilot plans to expand functionalities by enabling programmability for defined benefits and corporate expenditures. Additionally, offline functionality will be introduced to facilitate transactions in areas with poor internet connectivity. Various offline solutions will be tested across different locations.

The next meeting of the MPC is scheduled during April 3-5, 2024.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.