April’24 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from April 3-5, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% consequently the standing deposit facility is unchanged at 6.25%

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%

- The reverse repo rate under the LAF stands unchanged at 3.35%

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

Headline inflation softened to 5.1% during January-February 2024, from 5.7% in December. After correcting in January, food inflation edged up to 7.8% in February primarily driven by vegetables, eggs, meat and fish. Fuel prices remained in deflation for the sixth consecutive month in February. CPI core (CPI excluding food and fuel) disinflation took it down to 3.4% in February – this was one of the lowest in the current CPI series, with both goods and services components registering a fall in inflation.

The MPC expects CPI outlook to be shaped by several factors such as:

- Food price uncertainties would continue to weigh on the inflation outlook. An expected record Rabi wheat production in 2023-24, however, will help contain cereal prices.

- The recent firming up of international crude oil prices warrants close monitoring. Geo-political tensions and volatility in financial markets also pose risks to the inflation outlook.

- Tight demand supply conditions in certain pulses and the prices of key vegetables need close monitoring. Fuel price deflation is likely to deepen in the near term following the recent cut in LPG prices.

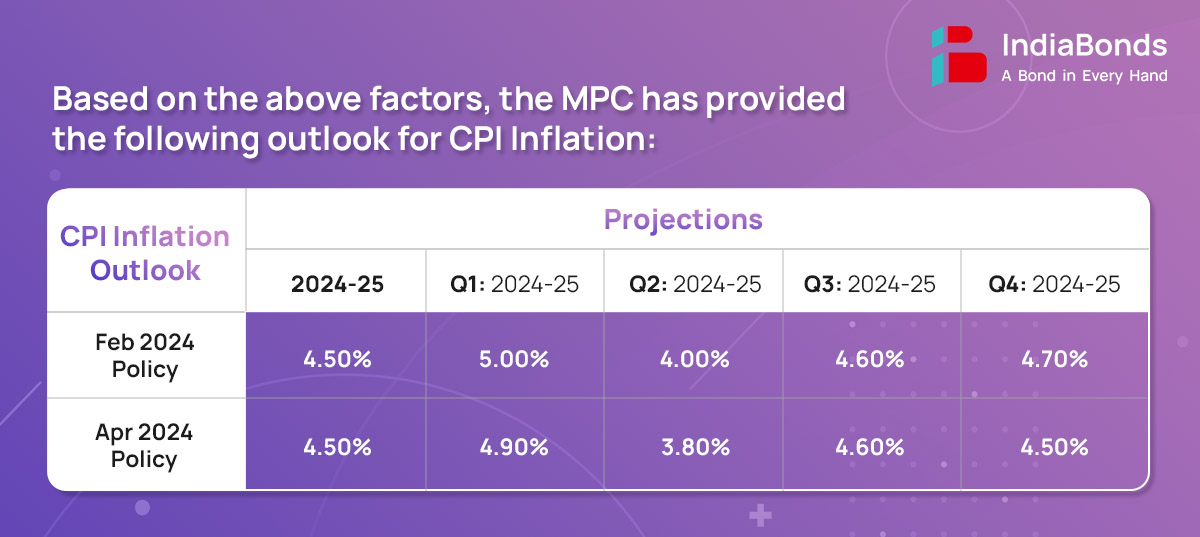

- Taking into account these factors and assuming a normal monsoon, CPI inflation for 2024-25 is projected at 4.5% with Q1 at 4.9%; Q2 at 3.8%; Q3 at 4.6%; and Q4 at 4.5%.

2. Growth

The domestic economy is experiencing strong momentum. As per the second advance estimates (SAE), real gross domestic product (GDP) expanded at 7.6% in 2023-24 on the back of buoyant domestic demand. Real GDP increased by 8.4% in Q3, with strong investment activity and a lower drag from net external demand. On the supply side, gross value added recorded a growth of 6.9% in 2023-24, driven by manufacturing and construction activity.

The MPC expects real GDP to be based on the following factors:

- The prospects of fixed investment remain bright with business optimism, healthy corporate and bank balance sheets, robust government capital expenditure and signs of upturn in the private capex cycle.

- Headwinds from geopolitical tensions, volatility in international financial markets, geo-economics fragmentation, rising Red Sea disruptions, and extreme weather events, however, pose risks to the outlook.

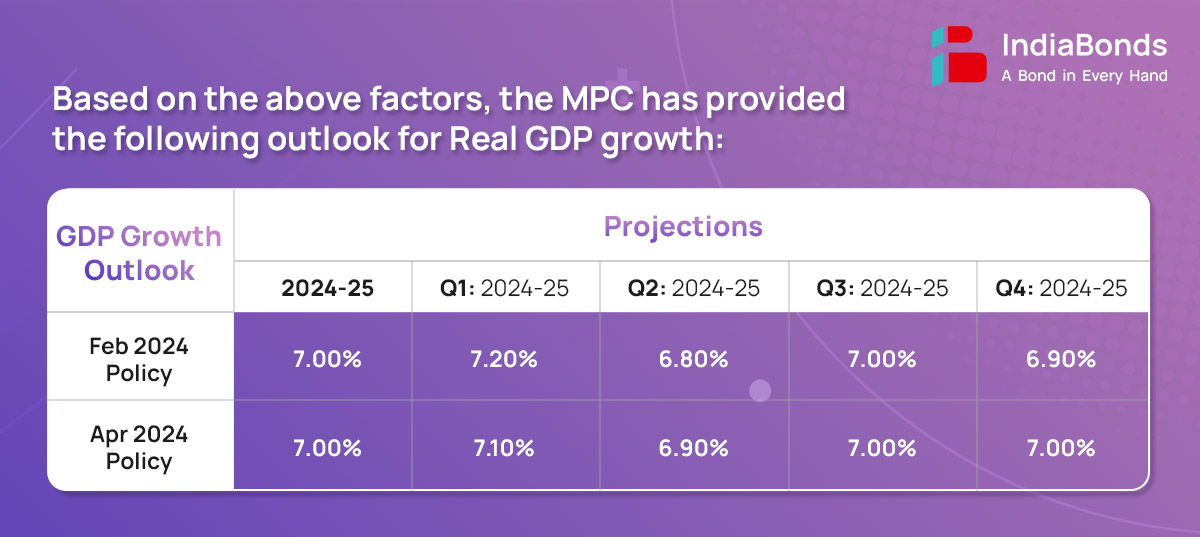

- Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.0% with Q1 at 7.1%; Q2 at 6.9%; Q3 at 7.0%; and Q4 at 7.0%.

3. Liquidity

- Liquidity conditions eased during February and March in the wake of increased government spending, the Reserve Bank’s market operations and the return-leg of a USD-INR sell buy swap auction.

- The liquidity situation improved in March with system liquidity turning intermittently surplus in the first half of the month. In these circumstances, the Reserve Bank conducted fourteen fine tuning variable rate reverse repo (VRRR) operations during February and early March to absorb intermittent surplus liquidity.

- Reflecting these liquidity developments, the weighted average call rate (WACR) exhibited a softening bias and has hovered near the repo rate since the last policy meeting.

- In tandem, rates in the collateralized segment of the call money market have also softened. Financial conditions remained conducive as reflected in reduced term spread in the G-sec market and stable risk premium in the bond market.

4. Global Economy

The global economy exhibits resilience and is likely to maintain its steady growth in 2024. Inflation is treading down, supported by favorable base effects though stubborn services prices are keeping it elevated relative to targets. As the central banks navigate the last mile of disinflation, financial markets are responding to changing perceptions on the timing and pace of monetary policy trajectories. Equity markets are rallying, while sovereign bond yields and the US dollar are exhibiting bidirectional movements. Gold prices have surged on safe haven demand.

Part B: Key Statements on Developmental and Regulatory Policies:

I – Financial Markets

1. Trading of Sovereign Green Bonds in IFSC

RBI has decided to permit eligible foreign investors in the International Financial Services Centre (IFSC) to invest in Sovereign Green Bonds (SGrBs). A scheme for investment and trading in SGrBs by eligible foreign investors in IFSC will be notified separately in consultation with the Government and the IFSC Authority.

2. RBI Retail Direct Scheme – Introduction of Mobile App

RBI has decided to introduce a mobile application of the Retail Direct portal. The move is expected to further improve ease of access and the app will enable investors to buy and sell instruments on the go, at their convenience. The app will be available for use shortly.

II – Regulations

3. Review of LCR Framework

RBI has proposed certain modifications to the LCR framework to facilitate better management of liquidity risk by banks. The modifications are made after taking into account the increased ability of depositors to quickly withdraw or transfer deposits during times of stress, using digital banking channels. A draft circular in this regard shall be issued shortly for comments from all stakeholders.

4. Dealing in Rupee Interest Rate Derivative products – Small Finance Banks

Currently, Small Finance Banks (SFBs) are allowed to use Interest Rate Futures (IFR) for proprietary hedging purposes. Now, these institutions are permitted to deal in permissible rupee interest derivative products according to the Rupee Interest Rate Derivatives (Reserve Bank) Directions, 2019. A circular regarding this matter shall be issued shortly.

III – Payment Systems and Fintech

5. Enabling UPI for Cash Deposit Facility

The facility of cash deposit is presently available only through use of debit cards. Given the popularity and acceptance of UPI, as also the benefits seen from the availability of UPI for card-less cash withdrawal at ATMs, it is now proposed to facilitate cash deposit facility through use of UPI. Operational instructions will be issued shortly.

6. UPI access for Prepaid Payment Instruments (PPIs) through third-party applications

To provide more flexibility to PPI holders, RBI has proposed to permit linking of PPIs through third-party UPI applications. This will enable the PPI holders to make UPI payments like bank account holders. Instructions in this regard will be issued shortly.

7. Distribution of CBDCs through Non-bank Payment System Operators

RBI has proposed to make CBDC-Retail accessible to a broader segment of users in a sustained manner, by enabling non-bank payment system operators to offer CBDC wallets. This is expected to enhance access and expand choices available to users apart from testing the resiliency of the CBDC platform to handle multi-channel transactions.

The next meeting of the MPC is scheduled during June 5 to 7, 2024.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.