October’24 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from October 7-9, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% by a majority of 5 out of 6, consequently the standing deposit facility is unchanged at 6.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%.

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC has unanimously changed its stance to ‘neutral’ and to remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation softened significantly in July and August with favorable base effect playing a major role in July (base effect of 2.9%). Also the food inflation experienced a certain degree of correction during these two months (average of 5.2% from an average of 8.0% during the previous 8 months). Additionally, fuel group deepened deflation on account of softening electricity and LPG prices, while core inflation including the service inflation edged up. However, September CPI may witness jump due to fading of base effect (base effect of 1.1%) supported by pick up in food price momentum due to supply side issues.

The MPC expects CPI outlook to be shaped by several factors such as:

- Normal monsoon, better kharif sowing (101.1% of the full season normal area), high reservoir levels and good soil condition for ensuing rabi crops, could lead to softening of food inflation pressures over the course of the year.

- Rising geopolitical tensions in the Middle East and geo economic fragmentation may disrupt global supply chains, negatively impacting inflation.

- The recent uptick in food and metal prices, as seen in the Food and Agricultural Organisation (FAO) and the World Bank price indices for September, if sustained, can add to the upside risks.

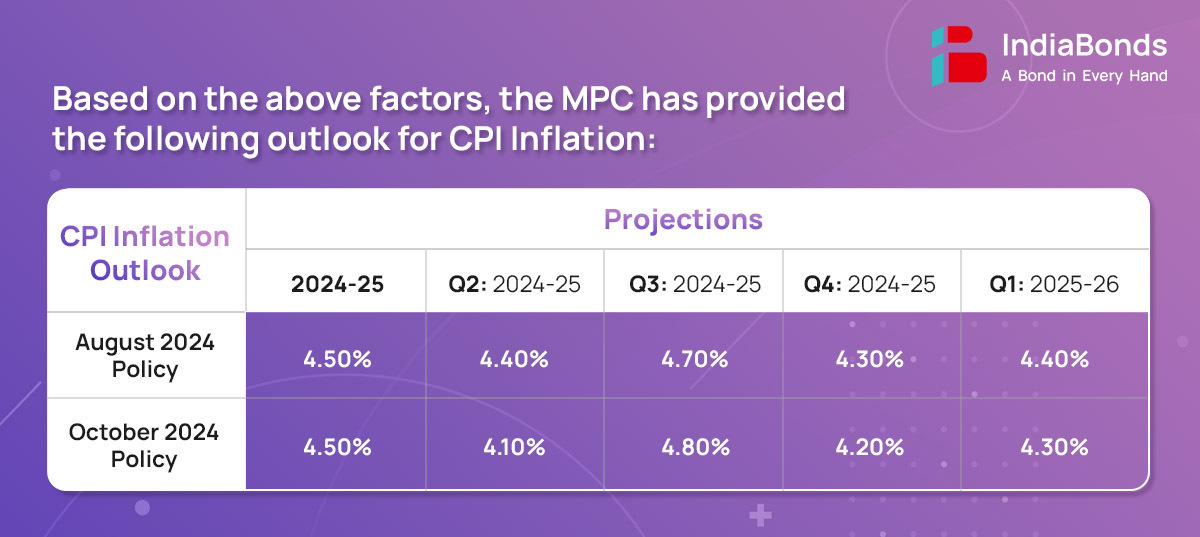

- Witnessing current conditions, CPI inflation for FY24-25 is projected at 4.50% with Q2 at 4.10%; Q3 at 4.80%; Q4 at 4.20% and for FY25-26 Q1 at 4.30%.

Based on the above factors, the MPC has provided the following outlook for CPI Inflation:

2. Growth

During 2024-25 so far, domestic economic activity has remained resilient, supported by a revival in private consumption (with a 7-quarter high of 7.4% in Q1:2024-25) and improvement in investment, as its share in GDP reached the highest level since 2012-13. On the supply side, gross value added (GVA) expanded by 6.8% surpassing GDP growth, driven by strong industrial and services sector activities. However, the government expenditure contracted. Also the eight core industries output fell by 1.8% in August on a high base. Both manufacturing and services PMI’s remained elevated. Private investment continues to grow supported by expansion in in non-food bank credit, higher capacity utilization, etc. FPI flows have reversed from net outflows of USD 4.2 billion in April-May 2024 to a net inflow of USD 19.2 billion during June-October (as of October 7, 2024).

The MPC expects real GDP to be based on the following factors:

- Rural demand is trending upwards, while urban expenditure remains steady, supporting household consumption.

- With the pickup in the pace of government expenditure at both the Centre and the states, it is expected that growth will remain robust.

- Strong financial positions of banks and corporations, rising private investments, will likely boost fixed investment.

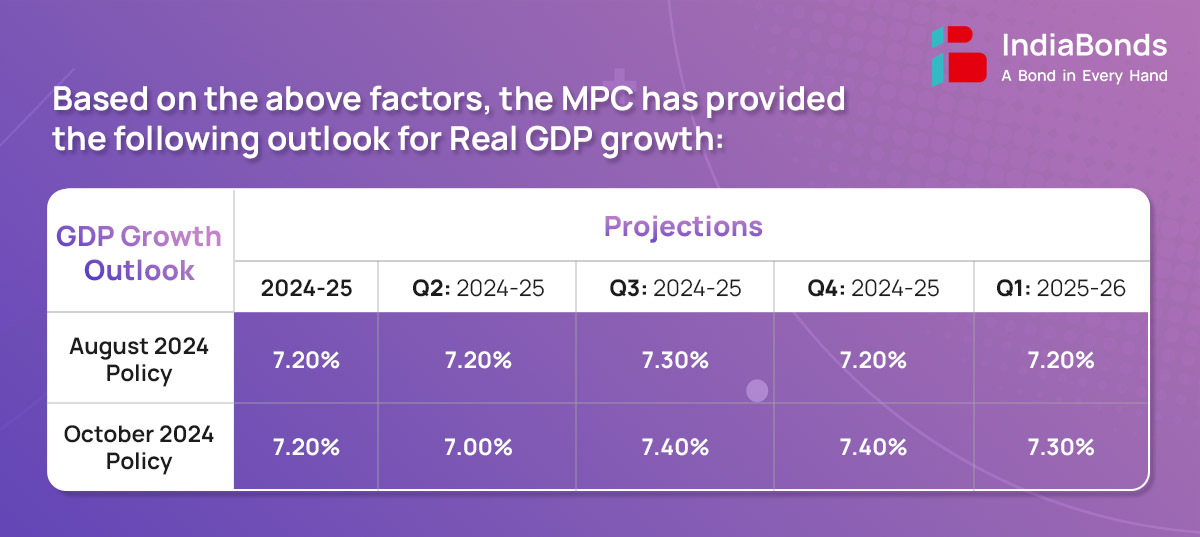

- Taking all these factors into consideration, real GDP growth for FY24-25 is projected at 7.20% with Q2 at 7.00%; Q3 at 7.40%; Q4 at 7.40% and FY25-26 Q1 7.30%.

Based on the above factors, the MPC has provided the following outlook for Real GDP growth:

3. Liquidity

- System liquidity remained in surplus during August-September and early October, with a pickup in government spending and decline in currency in circulation. However, the liquidity turned into deficit during the latter half of September with the build-up of government cash balances on account of tax related outflows.

- In tune with the changing liquidity conditions, the Reserve Bank conducted two-way operations to ensure alignment of inter-bank overnight rate with the policy repo rate.

- The Reserve Bank mopped up surplus liquidity through variable rate reverse repo (VRRR) auctions during August-October (till 7th), while injected liquidity via variable rate repo (VRR) operations during September (17th-24th).

- Going forward, RBI will remain nimble and flexible in its liquidity management operations to ensure that money market interest rates evolve in an orderly manner.

4. Global Economy

The global economy has remained resilient, despite ongoing risks from escalating geopolitical tensions, geo-economic fragmentation, financial market volatility, and high public debt. While manufacturing is slowing down, the services sector continues to perform well. With easing in inflation and growing divergence in inflation-growth dynamics across countries, various advanced economies including U.S. and emerging market economies have started lowering their policy rates.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Responsible Lending Conduct – Levy of Foreclosure Charges/ Pre-payment Penalties on Loans

The Reserve Bank has taken several measures over the years to safeguard consumer’s interest. As part of these measures, Banks and NBFCs are not permitted to levy foreclosure charges/ pre-payment penalties on any floating rate term loan sanctioned to individual borrowers for purposes, other than business. It is now proposed to broaden the scope of these guidelines to include loans to Micro and Small Enterprises (MSEs). A draft circular in this regard shall be issued for public consultation.

2. Discussion Paper on Capital Raising Avenues for Primary (Urban) Co-operative Banks

The Reserve Bank has undertaken several initiatives in recent years to strengthen the Urban Co-operative Banking (UCB) Sector. Such initiatives include issuance of regulatory guidelines in 2022 for issue and regulation of share capital and securities by UCBs. To provide more flexibility and avenues for UCBs to raise capital, a Discussion Paper on Capital Raising Avenues for UCBs will be issued for feedback and suggestions from stakeholders.

3. UPI Creation of Reserve Bank Climate Risk Information System (RB-CRIS)

Climate change is emerging as a significant risk to the financial system world over. This makes it necessary for regulated entities to undertake robust climate risk assessment, which is sometimes hindered by gaps in high quality climate related data. To bridge these data gaps, the Reserve Bank proposes to create a data repository, namely, the Reserve Bank – Climate Risk Information System (RB-CRIS).

4. UPI – Enhancement of Limits

UPI has transformed India’s financial landscape by making digital payments accessible and inclusive through continuous innovation and adaptation. To further encourage wider adoption of UPI and make it more inclusive, it has been decided to (i) enhance the per-transaction limit in UPI123Pay from Rs.5,000 to Rs.10,000; and (ii) increase the UPI Lite wallet limit from Rs.2,000 to Rs.5,000 and per-transaction limit from Rs.500 to Rs.1,000.

5. Introduction of Beneficiary Account Name Look-up Facility

At present, UPI and Immediate Payment Service (IMPS) provide a facility for the remitter of funds to verify the name of the receiver (beneficiary) before executing a payment transaction. It is now proposed to introduce such a facility for the Real Time Gross Settlement System (RTGS) and the National Electronic Funds Transfer (NEFT) system. This facility will enable the remitter to verify the name of the account holder before effecting funds transfer to him/her through RTGS or NEFT. This will also reduce the possibility of wrong credits and frauds.

The next meeting of the MPC is scheduled during December 4 to 6, 2024

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.