Interim Union Budget FY 2024-25

Finance Minister Nirmala Sitharaman presented the interim Union Budget for FY 2024-25 on February 1st, 2024. Here are some excerpts from the presentation:

Fiscal Deficit

In the Interim Union Budget of 2024-25, the government has revised India’s fiscal deficit target downwards to 5.8% of GDP for FY24 from the previously estimated 5.9% of GDP. It has also reduced its deficit target to 5.1% of GDP for FY25, which is lower than the market expectation of 5.3%. In absolute terms, the government estimates fiscal deficit to decrease from Rs. 17.87 lakh crore BE to Rs. 17.35 lakh crore in FY24 RE. Further for FY25, fiscal deficit is estimated downwards at Rs. 16.85 lakh crore.

The details of the revenues, expenditures and fiscal deficit are provided in the table below:

Deficit Statistics

| 2022-2023 Actuals | 2023-2024 BE | 2023-2024 RE | 2024-2025 BE | |

| Fiscal Deficit | 17.38 | 17.87 | 17.35 | 16.85 |

| (6.4%) | (5.9%) | (5.8%) | (5.1%) | |

| Revenue Deficit | 10.70 | 8.70 | 8.41 | 6.53 |

| (3.9%) | (2.9%) | (2.8%) | (2.0%) | |

| Revenue Receipts | 23.83 | 26.32 | 27.00 | 30.01 |

| Revenue Expenditure | 34.53 | 35.02 | 35.40 | 36.55 |

| Capital Receipts | 18.10 | 18.71 | 17.91 | 17.64 |

| Capital Expenditure | 7.40 | 10.01 | 9.50 | 11.11 |

Revised Estimates 2023-24

- The Revised Estimate of the total receipts other than borrowings is Rs. 27.56 lakh crore, of which the net tax receipts stood at Rs. 23.24 lakh crore.

- The Revised Estimate of the total expenditure is Rs. 44.90 lakh crore, of which the capital expenditure stands at Rs. 11.11 lakh crore.

- Revenue receipts at Rs. 30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy.

Budget Estimates 2024-25

- The total receipts other than borrowings and the total expenditure are estimated at Rs. 30.80 lakh crore and Rs. 47.66 lakh crore respectively.

- The net tax receipts are estimated at Rs. 26.02 lakh crore.

- Non-tax revenue under revenue receipt is estimated at Rs. 3.9 lakh crore.

| Financial Year | FY’23 Actuals | FY’24 BE | FY’24 RE | FY’25 BE |

| Net Market Borrowing | 11.06 | 11.8 | 11.80 | 11.75 |

The Path to Fiscal Consolidation

The government reinforced its commitment to the path of fiscal consolidation, to reach a fiscal deficit of 4.5% by 2025-26:

| Financial Year | FY’22 Actuals | FY’24 BE | FY’24 RE | FY’25 BE | FY’26 BE |

| Fiscal Deficit % of GDP | 6.4 | 5.9 | 5.8 | 5.1 | 4.5 |

Market Borrowings

- The gross market borrowings for FY25 are estimated at Rs. 14.13 lakh crore which was below the market expectation.

- To finance the fiscal deficit in 2024-25, the net market borrowings from dated securities are estimated at Rs. 11.75 lakh crore.

- The balance financing of fiscal deficit is expected to come from small savings and other sources.

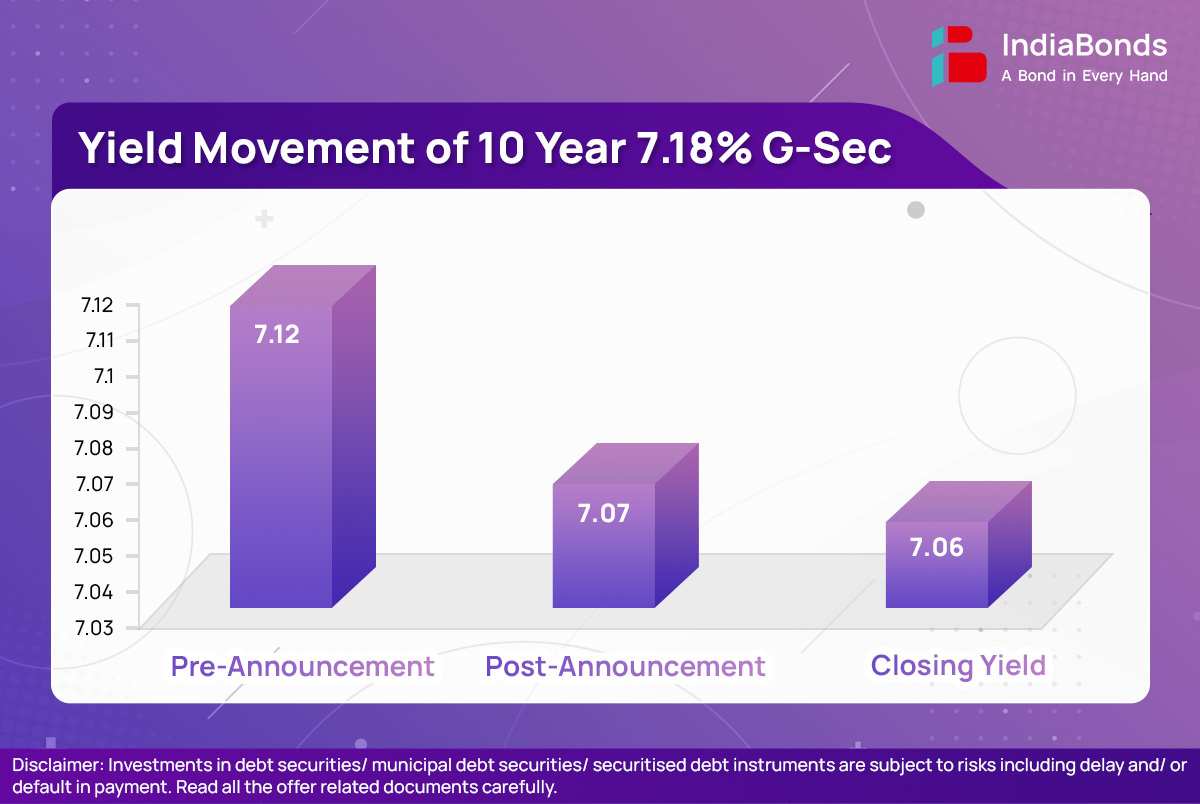

Impact on Bond Yields:

- The 10-year benchmark paper (7.18% GS 2033) rallied as much as 8 bps to 7.05% to settle at 7.07% post interim budget announcement, after the lower than expected target for borrowings.

- Going forward, the bond market yields will be guided by the RBI’s upcoming monetary policy on 8th Feb 2024.

Capital Expenditure:

- Government spending on capital account has sustained momentum and remained a major focus that aims at stimulating growth.

- The capital outlay for FY25 has been increased from Rs. 10 lakh in FY24 crore to Rs. 11.11 lakh crore, reflecting an increase of 11.11%.

- For FY24, actual capex came at Rs. 9.50 lakh (RE) against 10.00 Lakhs (BE) but still registering a growth of 28% over FY23.

- As support to state governments for capital investment, the government has decided to continue the 50-year interest free loan to state governments for one more year to spur investment in infrastructure and to incentivize them for complementary policy actions, with keeping the outlay similar to FY24 at Rs. 1.3 lakh crore.

Other Key Announcements

The interim budget largely represented continuity in the policies and no major announcements were made. The sector-wise announcements made in the budget were as follows:

A. Infrastructure Development:

- Infrastructure outlay increased by 11.1% to Rs.11.11 lakh crore

- 50-year interest-free loans to state governments extended for another year under Gati Shakti master plan

- Three major economic railway corridor programmes will be implemented. These are: (1) energy, mineral and cement corridors, (2) port connectivity corridors, and (3) high traffic density corridors.

- 40,000 normal rail bogies will be converted to the Vande Bharat standards to enhance safety, convenience and comfort of passengers.

- Expansion of existing airports and development of new airports

- NAMO trains and metro rail services will be added in more cities

- Expansion of e-vehicle ecosystem by supporting manufacturing and charging infrastructure and greater adoption of e-buses for public transport networks

B. Banking and Insurance sectors:

Corpus for long-term financing for sunrise sectors

A corpus of Rs.1 lakh crore will be created to provide 50-year loans at low or nil interest rates to encourage the private sector to scale up research and innovate in sunrise sectors.

Housing for the middle class

The government will launch a scheme for deserving sections of the middle class living in rented houses or slums to build or buy their own houses.

Increased coverage for Ayushman Bharat

Healthcare cover under Ayushman Bharat will be extended to ASHA workers, Anganwadi workers and Helpers.

C. Green Energy: Commitment for ‘net-zero’ by 2070

- Viability gap funding will be provided for harnessing offshore wind energy potential for initial capacity of one giga-watt.

- Coal gasification and liquefaction capacity of 100 MT will be set up by 2030. This will also help in reducing imports of natural gas, methanol, and ammonia.

- Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes will be mandated.

- Financial assistance will be provided for procurement of biomass aggregation machinery to support collection

- A new scheme of bio-manufacturing and bio-foundry will be launched. This will provide environment friendly alternatives such as biodegradable polymers, bio-plastics, bio- pharmaceuticals and bio-agri-inputs.

- A scheme for restoration and adaptation measures, and coastal aquaculture and mariculture with integrated and multi-sectoral approach will be launched

D. Dairy Development and Matsya Sampada Schemes

- The government will formulate a comprehensive programme for supporting dairy farmers. Efforts are already on to control foot and mouth disease.

- The programme will be built on the success of existing schemes such Rashtriya Gokul Mission, National Livestock Mission, and Infrastructure Development Funds for dairy processing and animal husbandry.

Matsya Sampada

- Implementation of Pradhan Mantri Matsya Sampada Yojana (PMMSY) will be stepped up to

- Enhance aquaculture productivity from existing 3 to 5 tons per hectare

- Double exports to Rs 1 lakh crore and

- Generate 55 lakh employment opportunities in the near future

- Five integrated aquaparks will be setup

E. Research and Innovation

A corpus of rupees one lakh crore will be established with fifty-year interest free loan for the private sector to scale up research and innovation significantly in sunrise domains. The corpus will provide long-term financing or refinancing with long tenors and low or nil interest rates. A new scheme will be launched for strengthening deep-tech technologies for defense purposes

F. Tourism

- States will be encouraged to take up comprehensive development of iconic tourist centres, branding and marketing them at global scale.

- A framework for rating of the centre based on quality of facilities and services will be established. Long-term interest free loans will be provided to States for financing such development on matching basis.

- Projects for port connectivity, tourism infrastructure, and amenities will be taken up on islands.

G. Announcements for key sections of society

PM Awas Yojana (Grameen):

2 crore more houses will be taken up in the next five years to meet the requirement arising from increase in the number of families.

Rooftop solarization and muft bijli:

Through rooftop solarization, one crore households will be enabled to obtain up to 300 units free electricity every month.

Housing for middle class:

Government will launch a scheme to help deserving sections of the middle class “living in rented houses, or slums, or chawls and unauthorized colonies” to buy or build their own houses.

Medical Colleges:

Government plans to set up more medical colleges by utilizing the existing hospital infrastructure under various departments. A committee for this purpose will be set-up to examine the issues and make relevant recommendations.

Cervical Cancer Vaccination:

Government will encourage vaccination for girls in the age group of 9 to 14 years for prevention of cervical cancer.

Maternal and child health care:

Upgradation of anganwadi centres under “Saksham Anganwadi and Poshan 2.0″ will be expedited for 14 improved nutrition delivery, early childhood care and development

Ayushman Bharat:

Healthcare cover under Ayushman Bharat scheme will be extended to all ASHA workers, Anganwadi Workers and Helpers.

Lakhpati Didi:

The scheme has been enhanced to cover 3 crore women members of Self Help Groups (SHGs) from earlier 2 crore.

H. Announcements on Taxation

- The government proposed to not make any changes relating to taxation and propose to retain the same tax rates for direct taxes and indirect taxes including import duties

- Certain tax benefits to start-ups and investments made by sovereign wealth or pension funds as also tax exemption on certain income of some IFSC units are expiring on 31.03.2024. The same has been extended to 31.03.2025

- Outstanding direct tax demands up to twenty-five thousand rupees (Rs 25,000) pertaining to the period up to financial year 2009-10 and up to ten-thousand rupees (Rs 10,000) for financial years 2010-11 to 2014-15 shall be withdrawn.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.