December’23 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from December 6-8, 2023.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% consequently the standing deposit facility is unchanged at 6.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

- These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation fell by about 2% points since the last meeting of the MPC to 4.9% in October 2023 on sharp correction in prices of certain vegetables, deflation in fuel and a broad-based moderation in core inflation (CPI inflation excluding food and fuel).

The MPC expects CPI outlook to be shaped by several factors such as:

- Uncertainties in food prices along with unfavorable base effects are likely to lead to a pick-up in headline inflation in November-December.

- Kharif harvest arrivals and progress in rabi sowing together with El Niño weather conditions need to be monitored.

- Adequate buffer stocks for cereals and a sharp moderation in international food prices, along with pro-active supply side interventions by the Government may keep these food price pressures under check.

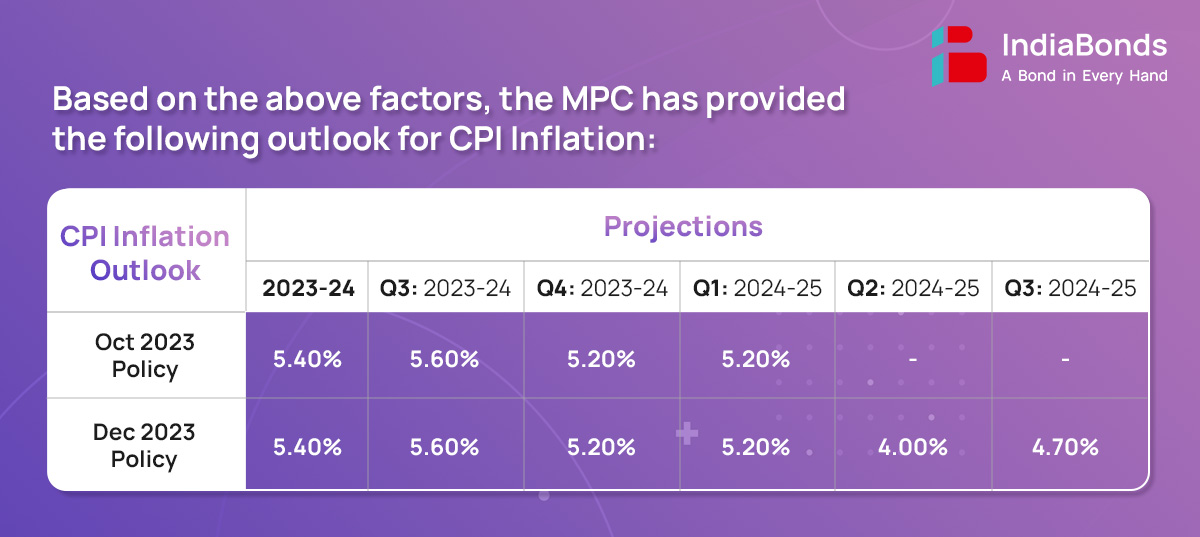

- Taking into account these factors, CPI inflation is projected at 5.4% for 2023-24, with Q3 at 5.6%; and Q4 at 5.2%. Assuming a normal monsoon next year, CPI inflation for Q1:2024-25 is projected at 5.2%; Q2 at 4.0%; and Q3 at 4.7%.

2. Growth

Domestic economic activity is exhibiting resilience. Real gross domestic product (GDP) grew year-on-year (y-o-y) by 7.6% in Q2:2023-24, underpinned by robust investment and government consumption, which cushioned the drag from net external demand. On the supply side, gross value added (GVA) rose by 7.4% in Q2, driven by buoyant manufacturing and construction activities.

The MPC expects real GDP to be based on the following factors:

- Continued strengthening of manufacturing activity, buoyancy in construction, and gradual recovery in the rural sector are expected to brighten the prospects of household consumption.

- Healthy balance sheets of banks and corporates, supply chain normalization, improving business optimism, and rise in public and private capex should bolster investment going forward.

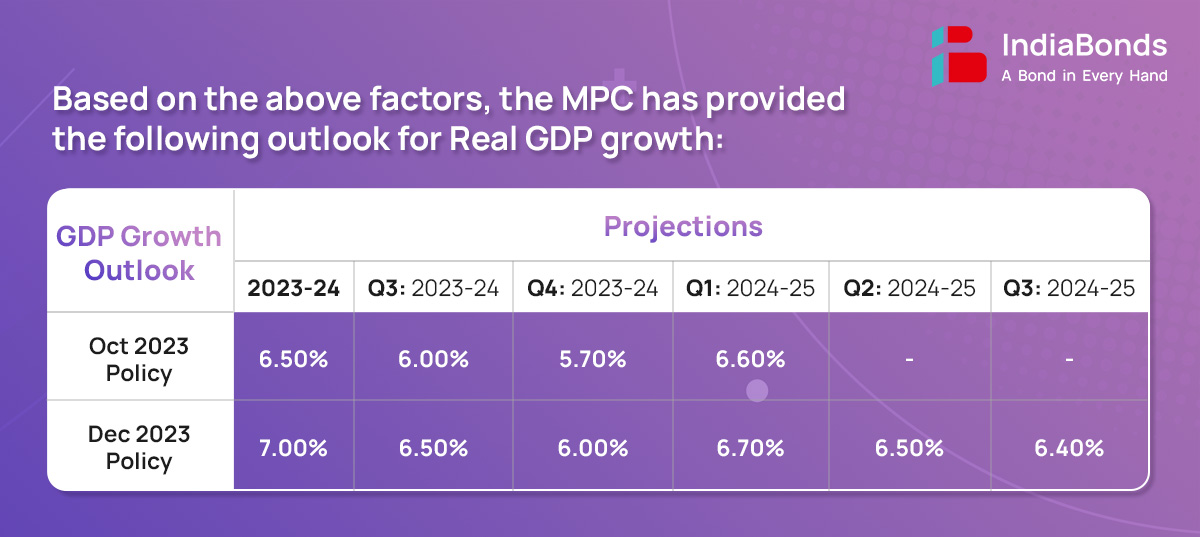

- Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 7.0% with Q3 at 6.5%; and Q4 at 6.0%. Real GDP growth for Q1:2024-25 is projected at 6.7%; Q2 at 6.5%; and Q3 at 6.4%

3. Liquidity

- System liquidity, as measured by the net position under the liquidity adjustment facility (LAF), turned into deficit mode for the first time in September 2023 after a gap of nearly four and a half years since May 2019.

- The overall tightening of liquidity conditions is attributed mainly to higher currency leakage during the festive season, government cash balances and Reserve Bank’s market operations.

- Driven by these autonomous factors, system liquidity tightened significantly compared to what was envisaged in the October policy statement. Consequently, the need to undertake auction of OMO sales has not arisen so far.

- Reversal of liquidity facilities under both SDF and MSF even during weekends and holidays with effect from December 30, 2023. It is expected that this measure will facilitate better fund management by the banks. This measure will be reviewed after six months or earlier, if needed.

4. Global Economy

Global growth is slowing at a divergent pace across economies. Inflation continues to ebb though it remains above target with underlying inflationary pressures staying relatively stubborn. Market sentiments have improved since the last MPC meeting – sovereign bond yields have declined, the US dollar has depreciated, and global equity markets have strengthened. Emerging market economies (EMEs) continue to face volatile capital flows.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Review of the regulatory framework for hedging of foreign exchange risks

The regulatory framework hedging of foreign exchange risks has been made more comprehensive by consolidating the directions in respect of all types of transactions – over-the-counter and exchange traded – under a single Master Direction. The framework would enhance operational efficiency and ease access to foreign exchange derivatives, especially for users with small exposures.

2. Framework for Connected Lending

Connected lending or lending to persons who can control the decision of a lender can lead to compromise in pricing and credit management, if the lender does not maintain an arm’s length relationship with such borrowers. RBI has decided to come out with a unified regulatory framework on connected lending for all the regulated entities. A draft circular will be issued for public comments.

3. Regulatory Framework for Web-Aggregation of loan products

RBI has decided to bring loan aggregation services offered by the Lending Service Providers (LSPs) under a comprehensive regulatory framework which will focus on enhancing the transparency in the operations of WALPs, increase customer centricity and enable the borrowers to make informed choices.

4. Enhancing UPI transaction limit for Specified Categories

To encourage the use of UPI for medical and educational services, it is proposed to enhance the limit for payments to hospitals and educational institutions from ₹1 lakh to ₹5 lakh per transaction.

5. E-Mandates for recurring online transactions – Enhancement of limit for specified categories

RBI proposed to exempt the requirement of Additional Factor of Authentication (AFA) for transactions up to ₹1 lakh for the following categories, viz., and subscription to mutual funds, payment of insurance premium and payments of credit card bills. The other existing requirements such as pre- and post-transaction notifications, opt-out facility for user, etc. shall continue to apply to these transactions.

6. Establishment of Cloud Facility for the Financial Sector in India

RBI will establish a cloud facility for the financial sector to enhance the security of financial sector data and business scalability. The cloud facility will initially be operated by Indian Financial Technology & Allied Services (IFTAS), a wholly-owned subsidiary of RBI and eventually, will be transferred to a separate entity owned by the financial sector participants.

7. Setting up of Fintech Repository

RBI has proposed to set-up a repository for capturing essential information about FinTechs, encompassing their activities, products, technology stack, financial information etc. FinTechs would be encouraged to voluntarily provide data to the Repository which will aid in designing appropriate policy approaches. The Repository will be operationalized by the Reserve Bank Innovation Hub in April 2024 or earlier.

The next meeting of the MPC is scheduled during February 6-8, 2024

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.