Budget 2021-22 – Key Takeaways and Analysis

Fiscal Deficit

In the Union Budget, the government revised its fiscal deficit targets significantly upwards for FY2020-21 and FY2021-22 citing severe stress on its finances on account of the unprecedented nature of the Covid-19 pandemic’s impact on the economic growth and with a view to supporting economic output. The details of the revenues, expenditures and fiscal deficit are provided in the table below:

Deficit Statistics

| 2019-2020 Actuals | 2020-2021 BE | 2020-2021 RE | 2021-2022 BE | |

|---|---|---|---|---|

| Fiscal Deficit | 9.34 | 7.96 | @18.49 | 15.07 |

| 4.60% | 3.50% | 9.50% | 6.80% | |

| Revenue Deficit | 6.67 | 6.09 | 14.56 | 11.41 |

| 3.30% | 2.70% | 7.50% | 5.10% | |

| Revenue Receipts | 17.53 | 22.46 | 16.02 | 19.76 |

| Expenditure | 26.86 | 30.42 | 34.50 | 34.83 |

Figures In lakh crores, BE: Budget estimates, RE: Revised estimates

The fiscal deficit for FY2020-21 was increased dramatically from Rs. 7.96 lakh crore (3.5% of GDP) to 18.49 lakh crore (9.5% of GDP). Fiscal deficit for FY21-22 has been budgeted at 15.07 lakh crore (6.8% of GDP), out of which market borrowing is budgeted at Rs 12 lakh crore. The simultaneous increase in expenditure by the Government on health and economic stimulus and a significant reduction in revenue receipts (including significant drop in disinvestment receipts) is the reason for the increase in fiscal deficit. The funding for the significant increase in the fiscal deficit for FY2020-21 is explained as mentioned in the table below:

| Financial Year | 2019-2020 | 2020-2021 | 2020-2021 | 2021-2022 |

|---|---|---|---|---|

| Actuals | BE | RE | BE | |

| Fiscal Deficit | 9.34 | 7.96 | 18.49 | 15.07 |

| 4.60% | 3.50% | 9.50% | 6.80% |

Primary Sources of Funding

| 2019-2020 | 2020-2021 | 2020-2021 | 2021-2022 | |

|---|---|---|---|---|

| Dated Securities (Gross Market Borrowing) | 7.10 | 7.80 | 12.80 | 12.06 |

| Dated Securities (Net Market Borrowing) | 4.74 | 5.45 | 10.53 | 9.25 |

| Net Short Term Borrowings (T-Bills, etc) | 1.50 | 0.25 | 2.25 | 0.50 |

| Net Securities against Small Savings | 2.40 | 2.40 | 4.81 | 3.92 |

| Net External Debt | 0.09 | 0.05 | 0.55 | 0.02 |

However, the fiscal deficit is expected to reduce in FY2021-22 in anticipation of increase in gross tax revenues and a reduction in expenditure.

Market Borrowings

The Government expects to borrow additional Rs 80,000 crore from the markets in the final two months of FY2020-21. Accordingly, the revised estimates indicated a gross market borrowing at Rs 12.80 lakh crores and net market borrowing of Rs. 10.53 lakh crores for FY 2020-21 as provided in the table below:

| Financial Year | FY’20 Actuals | FY’21 BE | FY’21 RE | FY’22 BE |

|---|---|---|---|---|

| Gross market Borrowings (+) | 7.10 | 7.80 | 12.80 | 12.06 |

| Repayment (-) | 2.36 | 2.35 | 2.27 | 2.81 |

| Net Market Borrowing | 4.74 | 5.45 | 10.53 | 9.25 |

Figures In lakh crores, BE: Budget estimates, RE: Revised estimates

The Government’s expenditure includes RS 5.54 lakh crore of capital expenditure, an increase of 34.5% over the budgeted estimate for FY2021-22. The gross market borrowing for FY2021-22 is budgeted at Rs. 12.06 lakh crores and the net market borrowing at Rs.9.25 lakh crore. The additional borrowing is expected to be largely funded by National Small Savings Fund.

Impact on Bond Yields

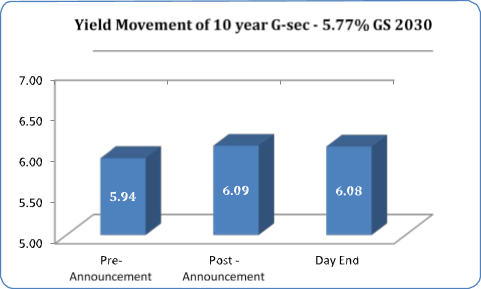

- The 10 year G-Sec Benchmark paper (5.77% GS 2030) rose sharply by 14 bps post the budget announcements and closed the day at 6.08% as the increase of fiscal deficit target from 3.5% to 9.5% for FY2020-21was well beyond market expectations of around 7.5%.

- The Government’s decision to increase market borrowing for the current fiscal by an additional Rs 80,000 crore led to the spike in yields. However, the market borrowing plan of Rs.12 lakh crore for FY2021-22 was higher than the market expectations. The bond yields rose to a high of 6.09% and settled at 6.08%.

- Going forward, the bond market yields are expected to be guided by the RBI’s upcoming monetary policy on 5th Feb 2021 and the inflation numbers for January.

Financial Sector Announcements

Capital Market

- Single Security Market Code by consolidating the provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007

- A permanent institutional framework to be created to purchase investment grade debt securities

- Warehousing development and regulatory authority to set up a commodity market eco system arrangement

- To develop an investor charter as a right of all financial investors

Banks/NBFCs

- Rs 20,000 crore recapitalizations of PSBS during 2021-22

- DICGC act to be amended to give depositors easy and time bound access to their deposits to the extent of insurance cover

- Minimum loan size eligible for debt recovery under the SARFAESI act, 2002 to be reduced from Rs 50 lakhs to Rs 20 lakhs for NBFCS with asset size of Rs 100 crore

Stressed Assets

- Asset reconstruction company limited and asset management company to be set up to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization

Other Announcements

Disinvestment

- Disinvestment target has been pegged for FY21 at Rs 1.75 lakh crore. Government had set a target of Rs 2.1 lakh crore in FY20

- Strategic disinvestment of BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam limited etc. to be completed in 2021-22

- Other than IDBI Bank, two Public Sector Banks and one General Insurance company to be privatized IPO of LIC to complete this fiscal

Foreign Portfolio Investment

- FDI limit increased from 49% to 74% in the insurance sector

- Permission to allow foreign ownership and control with safeguards

- Under the new structure, the majority of Directors on the Board and key management persons would be resident Indians, with at least 50% of Directors being Independent Directors, and specified percentage of profits being retained as general reserve

Company Law

- Decriminalization of the procedural and technical compoundable offences under the Limited Liability Partnership (LLP) Act, 2008

- Paid up capital threshold of Small companies to be increased from Rs 50 Lakh to Rs 2 Crore and turnover from 2 Crore to Rs 20 Crore

- One Person Companies to be allowed to grow without any restrictions on paid up capital and turnover, allowing their conversion into any other type of company at any time. Residency limit for an Indian citizen to set up an OPC reduced from 182 days to 120 days and also Non-Resident Indians (NRIs) allowed to incorporate OPCs in India

- NCLT framework will be strengthened, e-Courts system shall be implemented and alternate methods of debt resolution and special framework for MSMEs shall be introduced

Direct Taxation

- Exemption from filing tax returns for senior citizens over 75 years of age and having only pension and interest income; tax to be deducted by paying bank.

- Reduced timeline for re-opening of tax returns to 3 years and proposal to make I-T Appellate Tribunal Faceless

- Alteration in double taxation rules and taxation for NRIs, especially who return to India.

- Tax audit threshold raised to Rs 10 crore for digital transactions o Dividend payment by REITs and InvITs not subject to TDS

- Advance tax liability to arise only after payment of dividends

- Infrastructure debt funds may issue tax efficient zero coupon bonds

- Affordable housing – Rs 1.5 lakh tax deduction given on housing loans extended till 31 March 2022

Indirect Taxation

- Revised, distortion-free customs duty structure by reviewing more than 400 old exemptions.

- Customs duty reduced uniformly to 7.5% on non-alloy, alloy, and stainless steels.

- Anti-Dumping Duty and Counter-Veiling Duty revoked on certain steel products.

- Custom Duty raised across multiple products to encourage domestic processing.

Conclusion Remarks

The budget was an expansionary one that focused on health, infrastructure and banking sector; boosted government’s capital expenditure by 35% rise over a year ago while it maintained a status quo on the direct taxes.

With there being no increase in tax rates or tax incidence on either individual or corporate taxpayers, the FM has attempted to meet the requirement of increased public spending through government borrowing and proposed monetization/ disinvestment plan.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.