MAS FINANCIAL SERVICES LIMITED

Sector Focus

Secured MSME

Highest Credit Rating

AA- (Stable) by CARE RATINGS LIMITED

Dec 19, 2024

Yield

10.0333% XIRR

Coupon

9.6000 % p.a

Rating

AA- (Stable)

ISIN

INE348L07241

Maturity Date

23 Dec, 2026

Key Strengths

Equity Infusion by Marquee Investors

In June 2024, the company raised ₹500 crores through a Qualified Institutional Placement (QIP) with participation from renowned investors, including Nippon India Mutual Fund, ICICI Prudential MF, Aditya Birla Sun Life MF, Bandhan MF, Baroda BNP Paribas MF, and White Oak Capital Management

Experienced Promoters

Promoters Mr. Kamlesh Gandhi and Mr. Mukesh Gandhi bring over two decades of expertise in the lending business. Together, they hold approximately 67% of the company’s stake

Adequate Liquidity Comfort

The company maintains a robust liquidity position with a Capital to Risk-Weighted Assets Ratio (CRAR) of 26.5%, well above the RBI’s minimum requirement of 15%. Its asset quality remains stable, with Net NPA (NNPA) consistently between 1.5% and 1.6% from March 2023 to September 2024

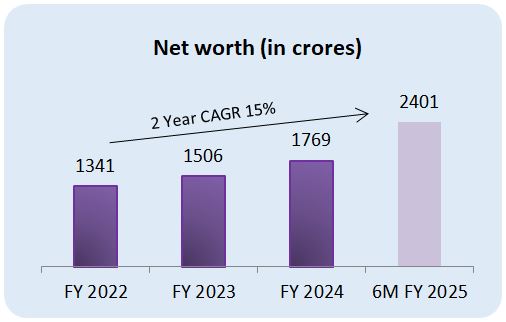

Scaling Profitability

MFSL achieved its highest-ever profit of ₹247 crores in FY24 and ₹147 crores in H1 FY25

Diversified Resource Base

The company has established borrowing relationships with over 40 banks, NBFCs, and financial institutions, enabling timely fund-raising at competitive interest rates and providing significant financial flexibility

Bonds you may like...

SATYA MICROCAPITAL LIMITED

Coupon

14.2000%

Maturity

Apr 2029

Rating

Type of Bond

Subordinate Debt

Yield

14.8000%

Price

₹ 1,01,810.59

KRAZYBEE SERVICES PRIVATE LIMITED

Coupon

10.3000%

Maturity

Jun 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.6000%

Price

₹ 98,869.55

VARTHANA FINANCE PRIVATE LIMITED

Coupon

11.5000%

Maturity

Sep 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.3700%

Price

₹ 87,903.61

AVANTI FINANCE PRIVATE LIMITED

Coupon

10.9000%

Maturity

Dec 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4621%

Price

₹ 99,790.96

NAMRA FINANCE LIMITED

Coupon

11.0000%

Maturity

May 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4531%

Price

₹ 1,01,717.81

AYE FINANCE PRIVATE LIMITED

Coupon

9.9500%

Maturity

Dec 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 98,375.44

AYE FINANCE PRIVATE LIMITED

Coupon

10.6000%

Maturity

Jan 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0500%

Price

₹ 99,925.29

MUTHOOT CAPITAL SERVICES LIMITED

Coupon

10.0000%

Maturity

Jun 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.0000%

Price

₹ 99,171.22

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).