Why Bond Prices and Yields move in Opposite Directions?

Introduction

For a retail investor exploring the financial markets, a nuanced understanding of the mechanisms that drive asset prices is essential. This is particularly true for bonds, an asset class known for its complexity and subtlety. In this article, we explore why bond prices and yields move in opposite directions—a fundamental concept that is crucial for both novice and experienced investors.

Investment Terminology

Every asset class has its own jargon or terminology. It is essential that investors are familiar with the terms used in an asset before putting their money to work. For example, when you buy equities, gold, real estate or mutual fund units – all you care about is the “price” which is the level that you can transact at.

When it comes to the price of a bond, it is pretty straightforward—it reflects the cost of the bond. Yield, however, represents the return investors can expect to receive, calculated based on the price they pay. This return includes interest payments, making yield a critical factor in bond investment decisions.

Relationship Between Bond Price and Yield

For Bonds we use any one of the TWO terms to determine the level of transaction – price or yield. Price is simple to understand as most things that money can buy have a price. Now, as bonds are fixed income securities offering stable regular interest rate, people are focused on the total returns on their investment. This total return of any bond at a particular price is called it’s “yield”. Naturally, it is understandable that if your purchase price of an asset is ‘lower’, then your returns on it will be ‘higher’. For bonds if the ‘price’ or investment amount is lower, then the return on it or ‘yield’ is higher – establishing the relationship that for Bonds: Price and Yield move in opposite directions.

Reasons for Change in Bond Price

In order for us to understand the main reasons why bond prices change, let us use and example of bonds issued by a company. Let’s assume company ABC wants to borrow money today for 5 years. It does a primary bond issue at Rs.100 face value per bond and finds investor demand at 10% – implying that it will pay 10% (coupon) every year for 5 years (maturity) to investors and return everyone’s money after 5 years. Of course, nothing in life including financial markets can remain the same for 5 years! Similarly, the price of this bond may change due to the following main factors:

- The level of interest rates in the economy. Central Banks all over the world (RBI in India) determine level of interest rates in their country based on numerous economic factors such as growth rate, inflation, employment etc. Hence if interest rates do change, the price of the bond issued by company ABC will also change as investors align to the ‘new’ RBI driven level.

- The financial strength or creditworthiness (provided as a Credit Rating of the bond) of issuer ABC. During the 5years, company ABC may do better or worse. As a result, the change in financial health of the company will result in a change in its bond prices.

- Liquidity or demand and supply. These influence almost every asset class and so is the case with bonds. More buyers (demand) than sellers (supply) will get ABC’s bond prices to rise and vice versa.

Example of Bond Price and Yield movement

Let’s stay with the example above that company ABC has issued bonds for 5 years at 10% and a bondholder Mr.X has subscribed to it. Now the bondholder wants to sell this after 6 months and in that time interest rates in the economy have moved lower. Investors will come to buy this bond as it offers high interest versus other low interest options which will drive the bond price higher – let’s say to Rs.110. Now when bondholder Ms.Y buys this bond at Rs.110, the total return (or Yield) that she gets for paying this higher price is only 7.5% as she will receive Rs.10 every year for 5 years plus the principal of Rs.100 back after 5 years.

Similarly, if interest rates have moved higher or the Credit Rating of company ABC has deteriorated, investors will sell this bond to invest in other higher rated options or better companies. This will make the bond trade at Rs.90 now and Ms.Y will get a Yield of 12.8% for investing at Rs.90 – so her yield has gone higher as the bond price has gone lower.

This is represented in the simple chart below where we show yield for different prices:

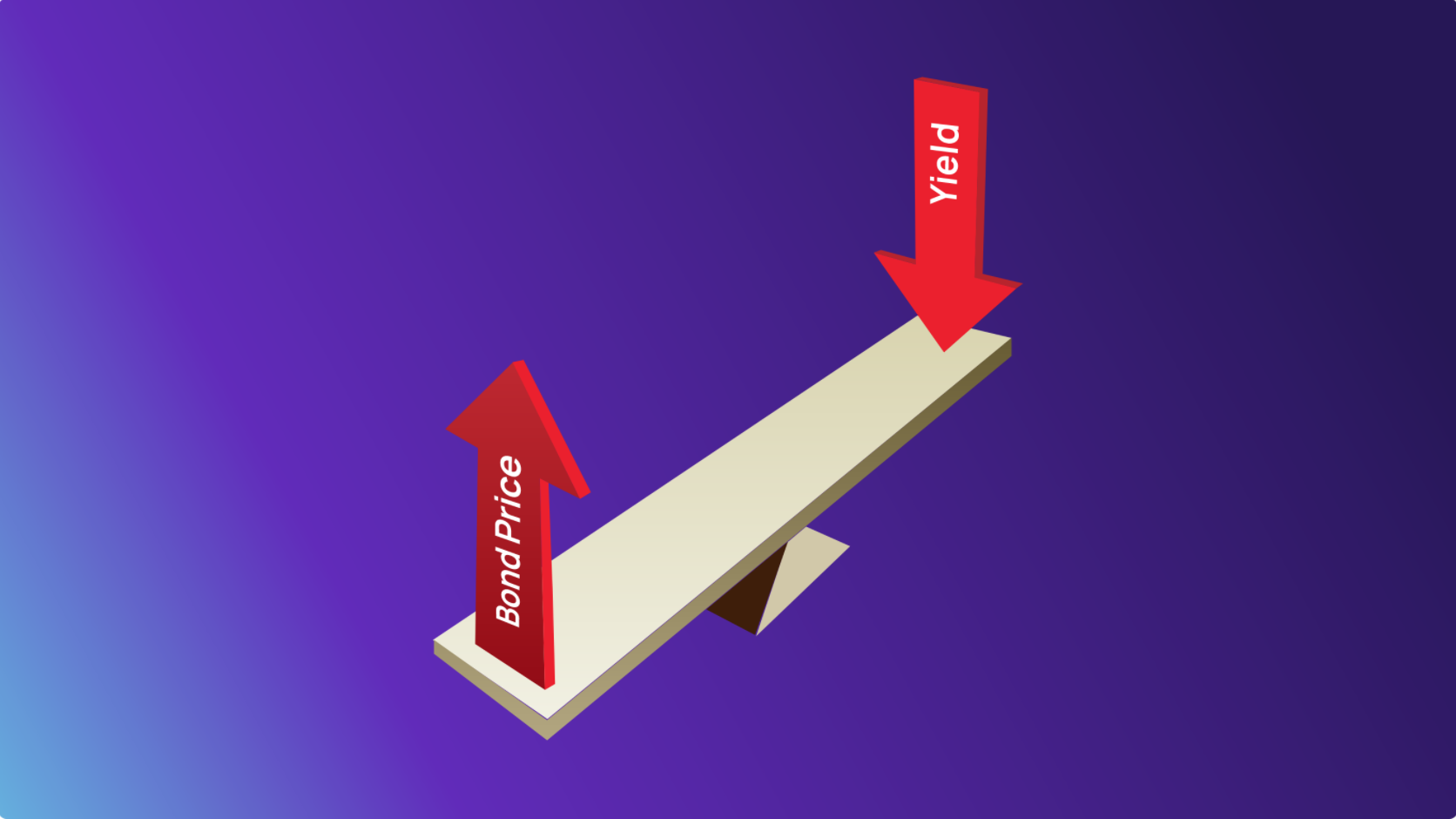

As an investor, do not get confused as a bond may be quoted on it’s Price or Yield. It’s just two different ways of saying the same thing! When the investment amount goes up, returns go down and vice versa. For Bonds it’s Higher the Price – Lower the Yield. Think of it’s relation as a See-Saw!

Conclusion

Understanding the yield and bond price inverse relationship is crucial for anyone looking to invest in bonds. It explains how various factors like economic changes, issuer creditworthiness, and market dynamics can affect bond investments. Recognizing this relationship helps investors make informed decisions, maximizing their potential returns while managing risks.

FAQs

Q. Why are bond price and yield inversely related?

A. The yield and bond price inverse relationship is fundamental in bond markets. When a bond’s price increases, its yield decreases because the fixed income from the bond becomes a smaller percentage of the higher price paid. Conversely, if the bond’s price decreases, its yield increases, as the same fixed income represents a higher return on the lower price paid. This demonstrates why do bond prices and yields move in opposite directions.

Q. What is the relationship between bond yields and stock prices?

A. The relationship between bond yields and stock prices is typically inverse: as bond yields rise, indicating higher interest rates, stock prices often fall due to increased borrowing costs and reduced economic growth prospects. However, this relationship can vary; in times of strong economic growth, both bond yields and stock prices may rise together as investors anticipate higher earnings. Conversely, during economic uncertainty, both might fall as investors seek safer investments.

Q. What is the relationship between bond yields and rates?

A. The relationship between bond yields and interest rates is direct: as interest rates increase, new bonds are issued with higher yields to remain competitive, causing yields on existing bonds to rise to match new market conditions. Conversely, when interest rates decrease, new bonds have lower yields, and existing bonds’ yields decrease accordingly to align with the new market environment. This highlights the relationship between yields and bond prices.

Q. What happens to bond price if yield increases?

A. When the yield on a bond increases, its price decreases. This is a clear illustration of the yield and bond price inverse relationship because the higher yield (or return) makes the bond more appealing, but this higher yield is only achieved by a lower purchase price relative to the bond’s fixed coupon payments. For the yield to increase, the bond must be bought at a cheaper price, hence the drop in its price.

Q. What is the relationship between bond price and yield to maturity?

A. The relationship between bond price and yield to maturity is inversely proportional. Yield to maturity encompasses the total expected return on a bond if held to its maturity date, considering all coupon payments and the redemption at par value. If the bond’s market price exceeds its par value (premium), the yield to maturity decreases. Conversely, if the bond trades below its par value (discount), the yield to maturity increases, reflecting the relation between bond price and yield.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.