What is Credit Macaulay Duration?

Introduction

When you invest in bonds, especially those issued by corporations or lower-rated entities, understanding how long your money is at risk and how sensitive the bond is to interest rate changes becomes critical. One widely used concept in the bond world is Macaulay Duration. It helps investors get a sense of when they’ll recover their initial investment through the bond’s cash flows.

But here’s the catch: this measure assumes the bond will pay every promised rupee. That’s often true for government or top-rated bonds, but not always the case with credit-risky instruments. That’s where Credit Macaulay Duration comes in—it adjusts the traditional metric to reflect the possibility of default and recovery, giving a more realistic picture for risk-aware investors.

What is Macaulay Duration?

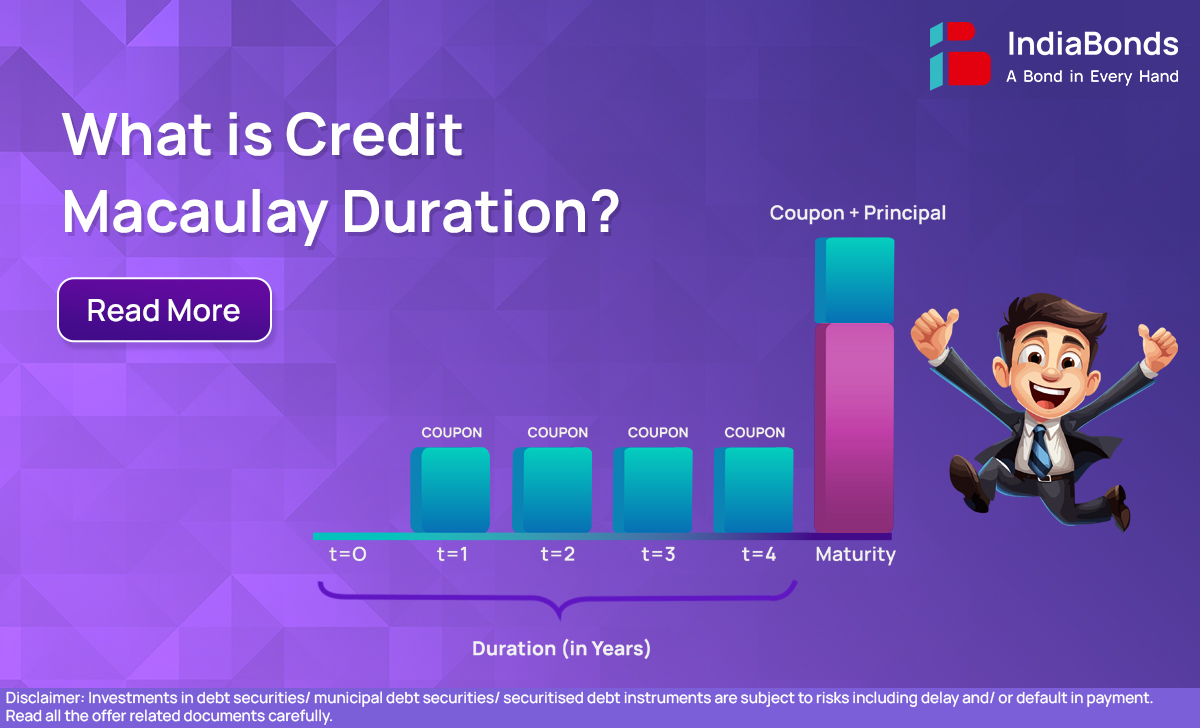

At its core, Macaulay Duration calculates the weighted average time—expressed in years—it takes for an investor to recoup the bond’s present value through its coupon payments and principal. It reflects both the time and amount of cash flows.

Why is this useful? Because it tells you how sensitive a bond is to interest rate movements. Generally, the longer the duration, the more a bond’s price will move when rates change. However, this model assumes no credit risk. For bonds where there’s a real chance of missed payments or losses, we need to dig deeper.

Credit Macaulay Duration – The Real-World Adjustment

In the real world, not all bonds pay in full and on time. Some issuers default, some recover partially, and some disappear entirely. Credit Macaulay Duration accounts for this by factoring in two key elements:

Probability of default

Expected recovery rate

By discounting future cash flows to reflect these risks, this adjusted duration provides a more accurate timeline for recovering investment value, especially in the corporate bond space.

How is Macaulay Duration Calculated?

The formula for Macaulay Duration is as follows:

D = ∑ [ t × Ct / (1 + r)^t ] / ∑ [ Ct / (1 + r)^t ]

Where:

t = time period in years

Ct = cash flow at time t

r = yield per period

When calculating Credit Macaulay Duration, this same structure is used—but the cash flows (Ct) are adjusted downwards based on the chance of default and expected recovery. It’s more conservative and reflects potential losses.

Why Use Macaulay Duration?

A few key variables shape this number:

Coupon rate:

Bonds with higher coupon payments have shorter durations because you recover your capital faster.

Maturity:

Longer-term bonds tend to have higher durations and are more volatile with rate changes.

Yield to maturity (YTM):

Higher yields discount future cash flows more heavily, shortening the duration.

Creditworthiness:

Bonds with higher default risk make traditional duration calculations less reliable.

Macaulay Duration vs Modified Duration

These two terms are often used together but serve different purposes.

Macaulay Duration helps you understand how long your money is tied up.

Modified Duration tells you how much the bond’s price will move when interest rates shift.

Here’s the relationship:

Modified Duration = Macaulay Duration / (1 + r)

In short, if you’re tracking interest rate sensitivity, Modified Duration is your tool. If you want to know how long you’ll wait to break even (factoring in cash flows), stick with Macaulay.

How to Use Macaulay Duration in the Indian Context?

For Indian investors, knowing how to apply duration metrics is vital:

Government bonds and AAA-rated debt: Since the risk of default is very low, standard Macaulay Duration works well.

Corporate or lower-rated bonds: This is where Credit Macaulay Duration shines. It gives a clearer sense of the real time horizon, adjusted for credit concerns.

Bond mutual funds and ETFs: Fund managers publish duration metrics to help investors choose options aligned with their risk appetite and rate outlook.

Final Thoughts

In fixed-income investing, especially outside the realm of gilt-edged securities, metrics like Credit Macaulay Duration are more than just technical jargon—they’re essential decision-making tools.

If you’re dealing with corporate bonds, especially those offering higher yields, using the credit-adjusted version of duration can prevent costly misjudgements. It accounts for the uncertainty that comes with credit exposure and helps you plan better.

In a world where yield-hunting often leads investors toward riskier bonds, a deeper understanding of duration adjusted for credit could be the difference between a smart call and a regrettable one.

FAQs

Q1: Why is Macaulay Duration important for bond investors?

A: It helps investors measure the time-weighted average period for cash flow recovery, aiding in risk assessment and investment planning.

Q2: Why is Macaulay Duration important for bond investors?

A: It factors in credit risk by adjusting cash flows based on default probabilities and expected recovery rates.

Q3: Why is Macaulay Duration important for bond investors?

A: Macaulay Duration measures cash flow timing, while Modified Duration measures interest rate sensitivity. The latter is derived from the former.

Q4: Can Macaulay Duration predict bond price movements?

A: Not directly. For price sensitivity, Modified Duration is a better metric.

Q5: How should Indian investors use Macaulay Duration?

A: It is useful for evaluating government bonds, corporate bonds, and bond funds, with adjustments for credit risk when necessary.

Disclaimer : Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.