What is Clean Price and Dirty Price in Bonds?

Mr. Grover recently purchased a bond from a company. The bond promises to pay him a fixed amount of interest every six months, with payments due on the 30th of June and the 31st of December. He enjoys these regular payments and he’s also aware that he can sell the bond to another investor at any time if he needs the money or wants to invest elsewhere. One day, Mr. Grover decides to sell his bond to his friend, Sameer on 1st September. Since Mr. Grover received his last coupon payment on the 30th of June, he knows that he is entitled to the accrued interest for the two months that have passed since then. Therefore, what should the selling price of the bond be? Should Mr. Grover factor in the interest when quoting the selling price to Sameer, or should he sell it at face value? This scenario raises an important question in bond investing – how do we determine the price of a bond when it’s sold in the secondary market? Or putting it in layman’s terms, how does one differentiate clean vs dirty price?

In bond pricing parlance, there is a well-known phrase that goes, “Buy clean, pay dirty“. The clean price represents the actual value of the bond itself, without any accrued interest, while the dirty price includes the accrued interest that the seller is entitled to receive.

Understanding the difference between clean and dirty prices is crucial for bond investors, as it can impact their investment decisions and the profitability of their portfolio. So, let’s dive deeper into these concepts, explore how they work, discuss their differences and provide an example to help you understand them.

What is the Clean Price?

The clean price refers to the bond price that excludes accrued interest. It is the actual price an investor pays to buy a bond without taking into account any interest that the bond has accrued. A clean price is also known as the “flat price” or “quoted price.” When a bond is first issued, the clean price is the price at which the bond is issued. Clean price is widely used to compute yields in the secondary bond market.

Accrued interest refers to the interest amount that has accumulated from the last coupon payment date up to the settlement date.

What is the Dirty Price?

The dirty price represents the bond’s price, which incorporates the accrued interest. It is the actual price an investor pays to buy a bond, taking into account any interest that the bond has accrued. A dirty price is also known as the “full price” or “settlement price.” The dirty price of a bond is the sum of the clean price and the accrued interest.

Difference Between Clean Price vs Dirty Price

The clean price of a bond excludes accrued interest, representing the bond’s pure valuation, while the dirty price includes accrued interest, reflecting the total amount payable upon transaction.

| Clean Price | Dirty Price |

| The price of a bond without accrued interest | The price of a bond with accrued interest included |

| Actual price an investor pays to buy a bond | Actual price an investor pays including interest |

| Bid/Ask prices for trading are quoted using clean price | Settlement is done using a dirty price |

| Quoted price | Settlement price |

Example of Clean and Dirty Price

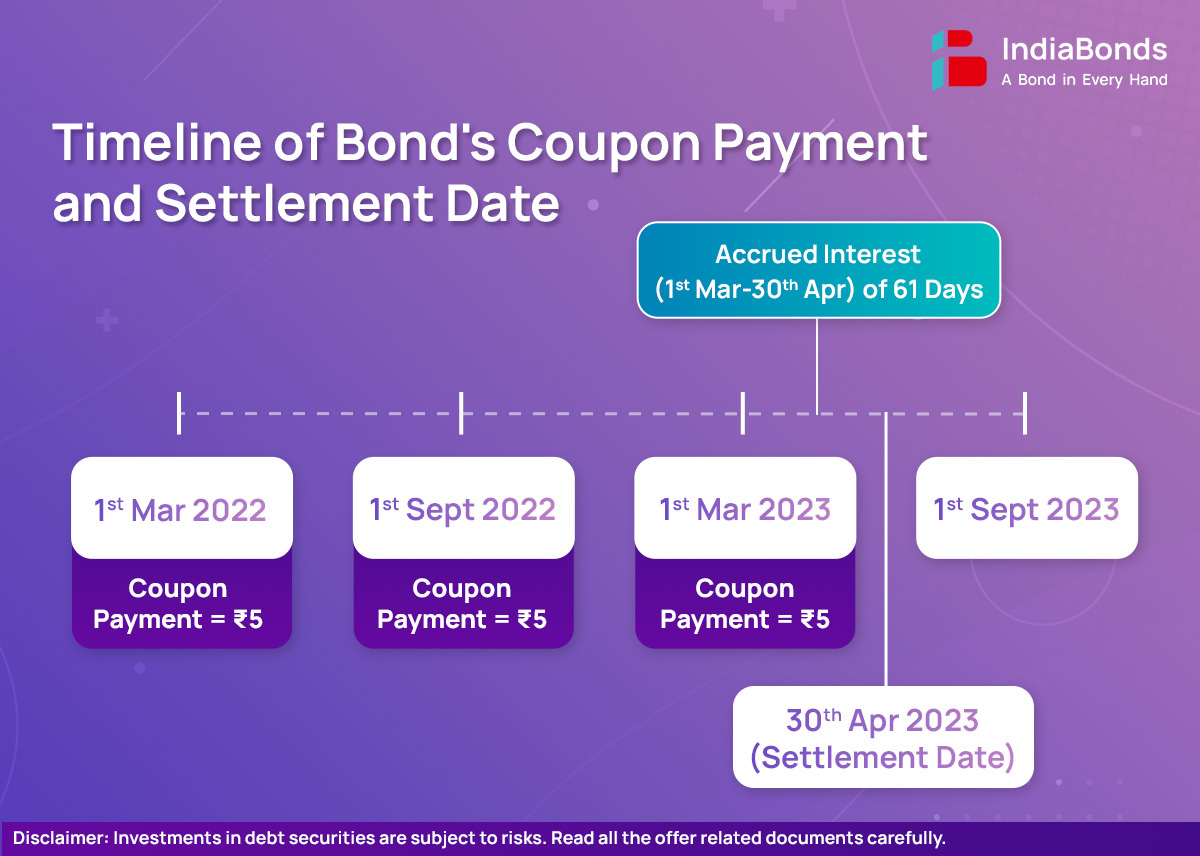

Let’s consider an example of a bond with a face value of Rs.100 and a coupon rate of 10%. The bond pays a semi-annual coupon (March and September). The bond was sold on 30th April 2023. Calculate the bond’s dirty price and accrued interest:

1. Calculate coupon for 6 months (180 Days)

Face value x Coupon Rate /2

(2, since the coupon payment is semi-annual)

= 100 x 10%/2

= Rs. 5

2. Calculate coupon for 1 Day

= 6 months coupon /180 Days

= Rs. 5/180 days

= Rs. 0.0278 per day

3. Accrued Interest for 61 Days

= 61 Days x Coupon for 1 day

= 61 x 0.0278

= Rs. 1.69

4. Settlement Price (Dirty Price)

= Clean price + Accrued Interest

= Rs. 100 + 1.69

= Rs. 101.69

The clean price of the bond is Rs. 100 and the accrued interest is Rs. 1.69. Therefore, the dirty price of the bond is Rs. 101.69 which is the sum of the clean price and the accrued interest. It can also be concluded that aiming to purchase a bond immediately after the coupon payment allows one to avoid the accrued interest component and pay the clean price for the bond.

The example mentioned above is relatively simple and does not require a significant amount of calculation. However, in the real world, bond pricing becomes considerably more complex. To simplify this process, IndiaBonds has introduced a disruptive innovation in the fintech sector called the Bond Calculator. This tool allows users to not only access the real-time clean and dirty prices of their bonds but also provides information on exact yields, detailed reports and settlement amounts. To know more about this award-winning product, click here.

FAQs

Q. What happens to the clean and dirty price of a bond as it approaches the interest payment date?

A. Before the payment date, the spread between the clean and dirty price is at maximum. However, as the payment date approaches, the portion of accrued interest keeps growing; resulting in the clean price eventually matching the dirty price on the payment date, as there is no accrued interest until the following payment date.

Q. What happens if a bond is traded between interest payment dates?

A. If a bond is traded between interest payment dates, the buyer has to compensate the seller for the accrued interest. Therefore, the buyer will pay the dirty price.

Q. Why is it important to understand the difference between clean price vs dirty price in Bonds?

A. Understanding the difference between a bond’s dirty price and a clean price is crucial because it affects the value of the bond and the yield an investor receives. A bond’s clean price is used to determine the market value of a bond, while the dirty price is the actual price an investor pays.

Q. Which is better clean price vs dirty price bonds?

A. In bond trading, both the dirty price and the clean price are important concepts, but they serve different purposes. But when evaluating bond performance, the dirty price is more relevant because it reflects the total return an investor will receive if they buy the bond and hold it until maturity. It takes into account either the price appreciation or depreciation of the bond and the interest earned through accrued interest.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.