Online Bond Yield Calculator – Simplifying Bond Yield and Bond Price

On investments in general, financial returns are expressed on per annum or per year basis. Simply put if you invest INR 100 and make INR 10 in one year, then your return is 10%. But if you make the same INR 10 in 2 years, then your return is just 10÷2 = 5%. Bonds typically have income streams spread over years. Hence, accounting for all those future cash flows post investment and expressing it as one single number for easy understanding is essential.

The most important terminology that accounts for all future cashflows in bonds and that one number is Bond Yield. Oxford Dictionary meaning of “yield” is to ‘provide or produce something’.

Hence, Bond Yield just means what a bond produces or what financial returns you get from bonds over its time period of existence.

This is expressed as a percentage. Hence, a Bond Yield of 7.5% means you earn 7.5% returns on the bond when you hold it to its maturity (also known as Yield to Maturity).

What is a Bond Yield Calculator?

Bond Calculator is a mathematical tool that allows investors and issuers to calculate Bond Yield at a specific price or Bond Price at a desired level of yield. Calculations on bonds need various factors as input like coupon interest, coupon payment dates, maturity date, issue price, government holiday calendar for adjustments, principal repayment schedule and many more. Typically, large institutions involved in bond investments build this capability using statistical formulae, as this is their core business. For individual investors, trusts and small treasuries, it is a cumbersome task to stay on top of the thousands of bonds that are outstanding! Hence a standard Bond Calculator can assist where investors have to input all the variables to get their desired calculations.

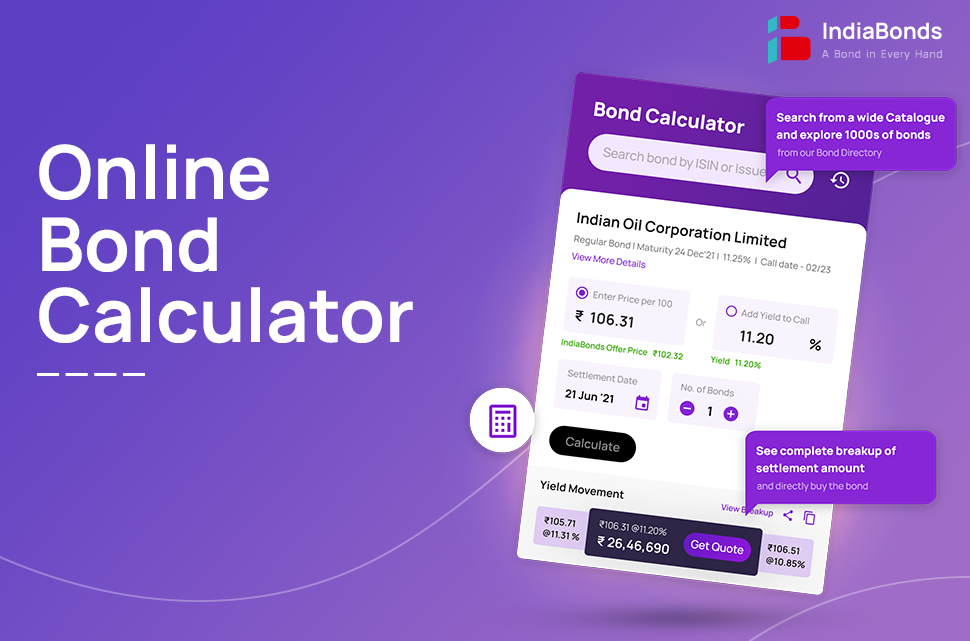

IndiaBonds Bond Calculator

This is an innovative solution for the needs of investors. IndiaBonds Bond Calculator helps you to calculate Bond Yield or Bond Price for thousands of bonds in India. It is a complex mathematical tool that simplifies the task for investors and institutions and gets them numerical answers instantly! All the variables and formulas are already present in this calculator hence user has to just choose the bond, input a price or desired yield and enter settlement date to get answers.

The benefits of this calculator are:

- Access to All – IndiaBonds’ intention is to empower investors with innovative tools for their bond investments. The Bond Calculator can be accessed by anyone simply by signing up on the website. It is for everyone involved or want to learn on bonds, whether they be professionals, individual investors or keen learners.

- Ease of Use – The Bond Calculator sits as a small widget on your IndiaBonds website and can be easily opened up anytime whether on mobile or desktop. The flow is very easy and logical where all you need is to enter price to calculate yield or desired yield for equivalent price. You can get calculations on 1000s of bonds and their yield to maturity in India at your fingertips and even on the move!

- Available Anytime Anywhere – The bond markets rely heavily on complex cashflow spreadsheets for computing bond yields and bond prices. These are usually in office environment and very desktop/laptop oriented. Individual investors have to call their advisors or build their own spreadsheet for calculation or even for verifying prices. All this goes away in a second! No more waiting for offices to open or someone to pick up your call to give you the answers. You can do this yourself on your mobile. Bond Calculator is available to you 24/7 – anytime and anywhere!

- Detailed Breakup – The Bond Calculator does not simply just tell you bond yields and bond prices. It actually gives you a detailed breakup of principal, accrued interest and total settlement amounts. It also lets you adjust settlements dates to match your cash flows. The calculator takes into account the holiday calendars as well for accuracy.

- Swap and Compare Bonds – We completely understand that bond investors may need to compare different bonds to suit their investment needs. The Bond Calculator lets you compare and swap between bonds with ease. You do not have to input the bonds you are looking at again and again. Just quickly continue from the bonds you were working on once logged in the calculator. This is designed to make your life simpler!

- Make Requests for Price – This calculator allows you to easily request for a bid or offer price on any particular bond of your choice with ease. While IndiaBonds has the largest inventory of bonds on offer, we are more than happy to accommodate your requests and work towards delivering your investment goals.

- Connect with a Bond Manager – The Bond Calculator is designed to make decisions by investors simpler. The navigation and computation are easy to understand as we know investors like to explore things at their own leisure and time. However, in case you feel the need to speak with an expert, you can connect with our Bond Managers anytime with a click either through live chats or phone calls.

Watch the video to learn how to use Indiabonds’ Bond Calculator!

The Future of Bond Investments is Here

At IndiaBonds, we aim to provide investors with tools and solutions to make their investment decisions easier. True technology revolutions are about innovative ideas to make consumer activity simpler. The Online Bond Yield Calculator is one such powerful tool for bond investors all across the country. Not only is it our mission to have a Bond in Every Hand… but also a Bond Calculator in Every Hand!

Unleash the power of the online Bond Yield Calculator now and here

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.