What is an InvIT (Infrastructure Investment Trust) ?

Introduction

SEBI’s chief Madhabi Puri Buch, predicted at the News18 Rising Bharat Summit on 20th March 2024, that “Infrastructure Investment Trusts (InvITs), Real Estate Investment Trusts (REITs) and municipal bonds combined will become as big as India’s equity markets in the next 10-15 years”.

Why this emphasis on infrastructure? Well, in a bustling city where traffic seems like a perpetual woe and power shortages are a regular occurrence, the need for robust infrastructure is undeniable. Simply put, it’s the backbone of any nation’s growth. The infrastructure sector doesn’t just provide basic amenities but also sets the stage for economic development. Infrastructure Investment Trusts (InvITs) are collective investment vehicles that provide fractional ownership and encourage citizens to invest in India’s infrastructure sector.

As of 2nd May 2024, there are 25 InvITs registered with SEBI. These trusts are playing a pivotal role in attracting investment into the infrastructure sector, ensuring that India’s growth trajectory remains on course.

What is an InvIT (Infrastructure Investment Trust)?

Infrastructure Investment Trusts (InvITs) are investment vehicles designed to pool money from various investors to finance infrastructure projects. These projects can include roadways, highways, power transmission lines and communication projects, among others. An InvIT operates much like a mutual fund, but while mutual funds typically invest in stocks or bonds, InvITs invest in physical infrastructure, providing an opportunity for investors to earn a return through dividends and interest payments from these assets. But why were InvITs created in the first place? The answer lies in the sheer cost of building infrastructure projects. Whether it’s constructing highways, power transmission lines, or other crucial projects, the initial investment required is enormous. Moreover, even after completion, it can take decades, to recover this initial investment. The extended gestation period frequently leaves infrastructure firms laden with debt, impeding their ability to invest in new projects.

Purpose of InvITs

In India, Infrastructure Investment Trusts (InvITs) play a crucial role in driving infrastructure growth and also offering investors attractive income opportunities. InvITs enable infrastructure firms to unlock the value of assets like highways and power transmission networks by pooling them into a trust structure. This setup allows investors to benefit from these revenue-generating assets and receive cash distributions without direct ownership or management responsibilities. Regulated by SEBI (Securities and Exchange Board of India), InvITs provide a transparent, regulated framework, reducing barriers for individual investors interested in large-scale infrastructure projects. This structure not only helps developers raise funds but also broadens investment avenues for those seeking steady, long-term returns from essential assets.

Features of an InvIT

1. Atleast 80% of InvIT assets has to be invested in completed and income generating infrastructure projects.

2. Remaining 20% can be invested in under construction projects, listed / unlisted debt of infrastructure companies, equity of listed companies generating atleast 80% of their income from infrastructure sector, gsecs, money market instruments, liquid mutual funds or cash equivalents

3. Mandatory distribution of at least 90% of income to InVITs unit holders on semi-annual basis

4. SEBI has recently reduced the minimum application value for both Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) to the range of Rs 10,000-15,000. Previously, the minimum investment requirement set by SEBI was Rs 50,000 for REITs and Rs 1 lakh for InvITs. Additionally, trading can now be done in a lot of one unit.

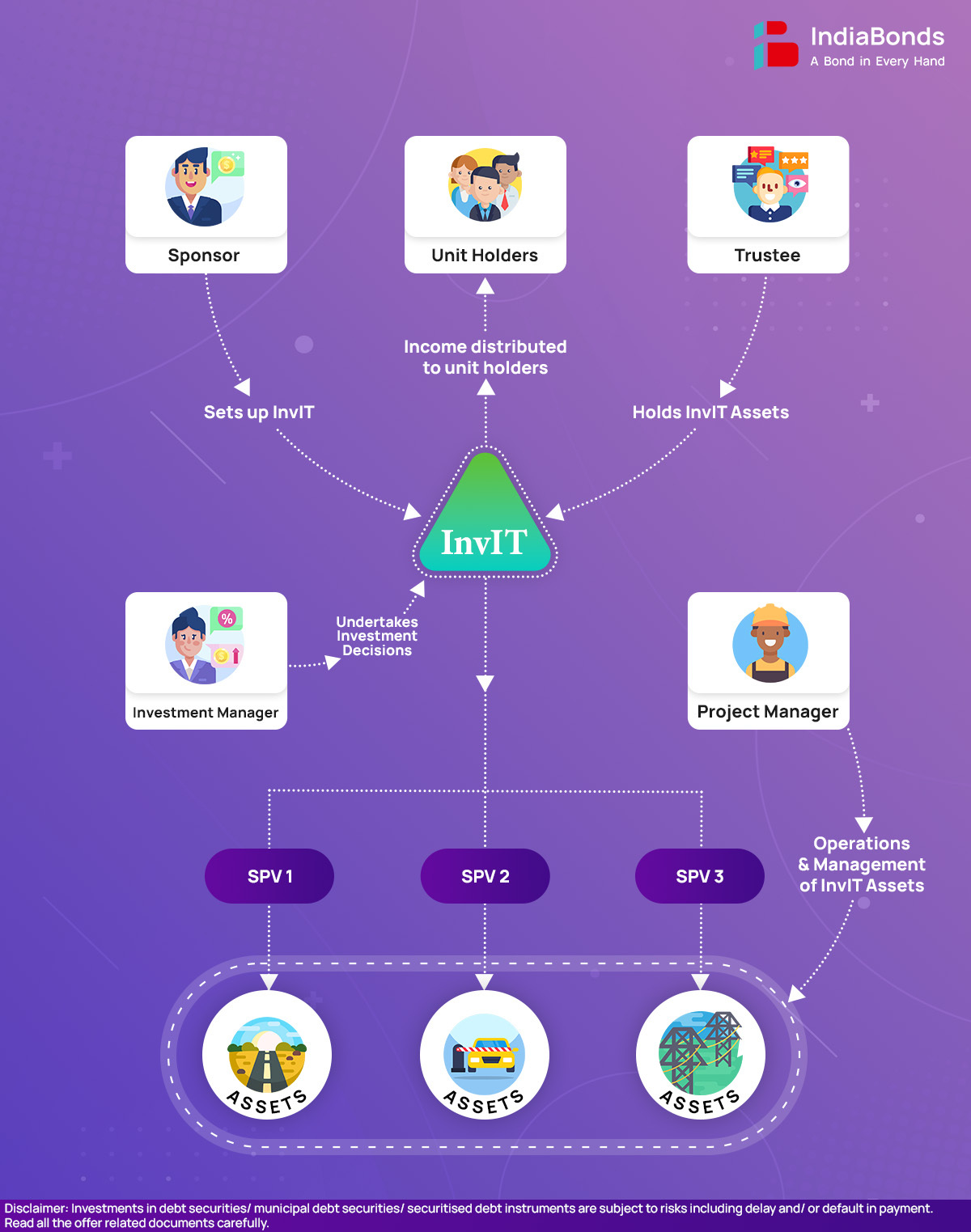

Structure of InvITs in India

The structure of InvITs in India is meticulously regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and safety for investors. An InvIT is established as a trust and must have the following components:

Sponsor(s): The sponsor is usually the promoter of the InvIT and is responsible for setting up the InvIT. The sponsor must have a certain minimum net worth of Rs 100 crore and experience in the infrastructure sector of at least 5 years. They are required to hold a minimum 15% of the total units of the InvIT for a period of 3 years.

Trustee: The debenture trustee, registered with SEBI, must be an independent entity approved by the regulatory authority. Its fiduciary responsibility is to safeguard the interests of the unit holders, ensuring that the InvIT complies with all regulatory, operational and compliance frameworks set by SEBI. Importantly, the trustee should have no association with the sponsor.

Investment Manager: The investment manager oversees the assets and investments of the InvIT, making crucial investment decisions. They are also responsible for all activities related to issuing and listing units, ensuring the resolution of investor grievances.

Project Manager: The role of the project manager is to execute the project and doesn’t take any investment decision. They oversee the actual ground-level operations of the infrastructure projects, including construction, management and maintenance activities. Unit Holders: These are the investors in the InvIT. They hold units issued by the InvIT and have voting rights on important matters as per the regulations. The rights and responsibilities of unit holders are well defined in the trust deed.

Operation of an InvIT

Imagine an InvIT named “ABC Highway InvIT” which is set up to manage and invest in highway projects across India. Here’s how it would typically function:

Asset Pooling: ABC Highway InvIT pools together several operational toll roads under its management. These roads are either directly owned by the InvIT or owned through SPVs. Each SPV might own individual toll roads, isolating financial and operational risks.

Fund Raising: The InvIT raises funds by publicly listing its units, allowing individual and institutional investors to buy into the trust. It might also raise additional debt secured against its toll road assets to further finance expansions or new projects.

Revenue Generation: The primary source of revenue is the income generated from the assets such as tolls, transmission lines, etc. This revenue is used to maintain the assets, service any debts and fund new projects.

Distribution: As per SEBI regulations, the InvIT is required to distribute at least 90% of its net distributable cash flow to its investors semi-annually. This provides a regular income stream to investors, akin to dividends. Growth and Reinvestment: Surplus revenues after distributions can be reinvested into acquiring new infrastructure projects or upgrading existing assets, which can lead to asset value appreciation.

How Do InvITs Generate Returns for Investors?

InvITs provide returns to investors through dividend, interest, rental income and return of capital:

Income Distributions (Dividend and Interest): These are payouts made from the operating income of the assets, typically distributed quarterly. The stability and predictability of these payments depend on the cash flows generated by the infrastructure projects.

Capital Appreciation: Over time, the value of the infrastructure assets may increase, potentially providing capital gains to investors. This appreciation is realized when assets are sold.

Types of InvITs

InvITs can be categorized into two types:

Publicly Listed InvITs: These InvITs are listed on stock exchanges and offer units to both institutional and retail investors. These are more liquid, meaning investors can buy and sell units on the exchange.

Private InvITs: These are not listed on public exchanges and are only available to institutional and high-net-worth individuals. The minimum investment is typically higher and they offer less liquidity compared to their public counterparts.

Who Should Invest in InvITs?

InvITs are best suited for investors looking for:

Stable Passive Income: They offer a stream of payments through dividends, interests appealing to those needing payouts.

Long-term Investment: Given the long gestation and life of infrastructure projects, InvITs are suitable for long-term investment horizons.

Moderate Risk Appetite: While less risky than equities, InvITs involve certain sector-specific risks, making them suitable for investors with a moderate risk appetite.

Advantages and Disadvantages of InvITs

Advantages:

Cash Flows: InvITs are required to distribute at least 90% of their net cash flows through dividend and interest payouts, thereby ensuring cash flows.

Diversification: Provides exposure to the infrastructure sector, diversifying an investor’s portfolio.

Professional Management: Managed by experienced professionals, reducing the burden on individual investors to manage and understand complex infrastructure projects.

Disadvantages:

Market Risk: Subject to market volatility and the economic climate’s impact on infrastructure projects.

Regulatory and Political Risks: InvITs investing in infrastructure projects may face regulatory uncertainties or changes in government policies, which could affect the viability and returns of these projects. Political instability or geopolitical tensions could also impact infrastructure investments.

Failure of Projects: Infrastructure projects undertaken by InvITs may face risks such as delays, cost overruns, or even project failures. These risks could lead to lower-than-expected returns or potential losses for investors if projects do not perform as anticipated.

How to Invest in InvITs?

Investing in publicly listed InvITs involves purchasing units through stock exchanges, just like stocks. You’ll require a demat account. For private InvITs, investments are typically made through private placements and entry is restricted to eligible investors who can invest large sums. The stability of InvITs’ income relies on the stability of income from their assets. Therefore, conduct proper due diligence before investing and choose InvITs with better transparency.

Prospects of InvITs in India

The outlook for InvITs in India is quite promising, supported by the Government’s strong emphasis on infrastructure and tax incentives for investors. Backed by SEBI regulations, InvITs have become appealing for both institutional and individual investors. These trusts are expected to channel significant funds into sectors like highways, renewable energy, and urban transport, fueling India’s development goals. As India races forward to attract more foreign investments, InvITs offer a structured, regulated entry into the thriving infrastructure market. For Indian investors, InvITs provide steady income, diversification benefits, and reduced risk, making them an attractive option in today’s evolving investment landscape.

Difference between REITs and InvITs

| Aspect | InvITs | REITs |

| Asset Focus | Infrastructure Assets (Roads, power transmission lines, etc.) | Real Estate Properties (Office buildings, malls, etc.) |

| Regulation | SEBI (Infrastructure Investment Trusts) Regulations, 2014 | SEBI (REIT) Regulations, 2014 |

| Liquidity | Medium | Medium |

| Risk Profile | May carry risks due to project execution and regulatory factors | Fewer political and regulatory risks. |

| Minimum Subscription Amount | Earlier Rs 1,00,000. Now between Rs 10,000-Rs 15,000 | Earlier Rs 50,000. Now between Rs 10,000-Rs 15,000 |

To learn more about REITs, click here.

Conclusion

Infrastructure Investment Trusts (InvITs) are emerging as a significant investment avenue, attracting both domestic and foreign investment into India’s infrastructure sector. With the potential to become as significant as India’s equity markets in the next decade, InvITs offer investors stable returns, exposure to the infrastructure sector and professional management. As the government continues to focus on infrastructure development, InvITs are poised to play an increasingly critical role in financing and maintaining the country’s infrastructure assets, contributing to India’s economic growth and development.

FAQs

Q. Where can InvITs Invest?

A. Transport & logistics, energy, water & sanitation, communication, social & commercial infrastructure.

Q. Are InvITs a safe investment?

A. Safety in investment typically depends on the underlying assets’ performance. InvITs, managed under strict regulatory oversight, offer a comparatively stable investment in infrastructure.

Q. How are returns from InvITs taxed?

A. Returns from InvITs are taxed according to the nature of income (interest, dividend, capital gains) at applicable rates. It’s advisable to consult a tax advisor for detailed implications

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.