The Indian Government Securities Market: Types and Overview

The government securities (G-Secs) market stands as a crucial pillar of the country’s financial system, playing a pivotal role in raising funds to finance government expenditures and maintaining economic stability. With its vast scope and multifaceted nature, comprehending the intricacies of this market is paramount for investors and financial enthusiasts.

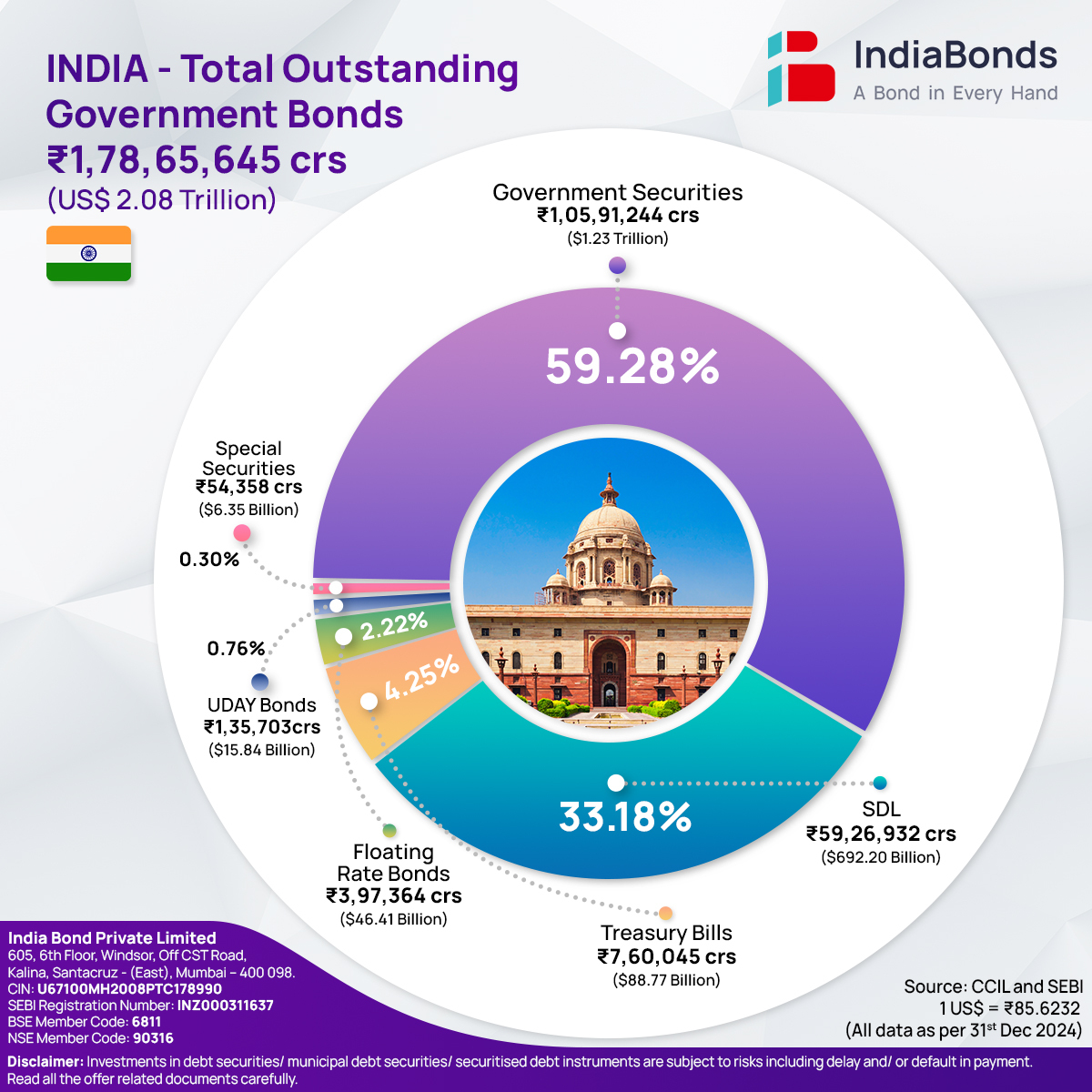

The Indian bond market is currently valued at approximately $2.69 trillion, with $2.08 trillion allocated to government bonds and $602.40 billion to corporate bonds. These statistics highlight the importance of the government securities market in India’s financial landscape. This market continues to attract diverse participants, including domestic and foreign investors, banks, mutual funds, insurance companies and the Reserve Bank of India (RBI), shaping the overall economic climate and investment landscape of the nation.

In our previous article, we delved into the fundamentals, features and benefits of g-secs. Now, let’s take a deeper dive into the types of government securities and gain valuable insights of the market. This article takes you through the dynamic landscape of government securities, providing a comprehensive overview of their various types and allowing you to build a well-rounded portfolio with different types of government securities.

What are Government Securities?

G-Sec, often referred to as government bonds, refers to the debt instruments issued by the government of India to borrow money from the market to finance its fiscal deficit. These securities are considered one of the safest investment options in India as they are backed by the creditworthiness and guarantee of the Indian government. G-secs have different maturities ranging from a few days to several years. They are an integral part of the fixed-income market in India and play a crucial role in the country’s financial system. They provide a risk-free investment avenue for individuals and institutions, contribute to the government’s borrowing program and serve as a benchmark for pricing other debt instruments in the market. Investors, including individuals, banks, financial institutions and foreign entities, can participate in these auctions to purchase G-Secs. The interest on these securities is paid semi-annually and the principal amount is repaid at maturity. G-secs are typically sold through auctions conducted by the Reserve Bank of India (RBI), acting as the agent of the government. These auctions take place on an electronic platform known as E-Kuber. The RBI prepares a semi-annual auction calendar that provides all the details. Approximately one week before each auction, the government of India releases a notification and a press release containing precise information about the securities and the upcoming auction.

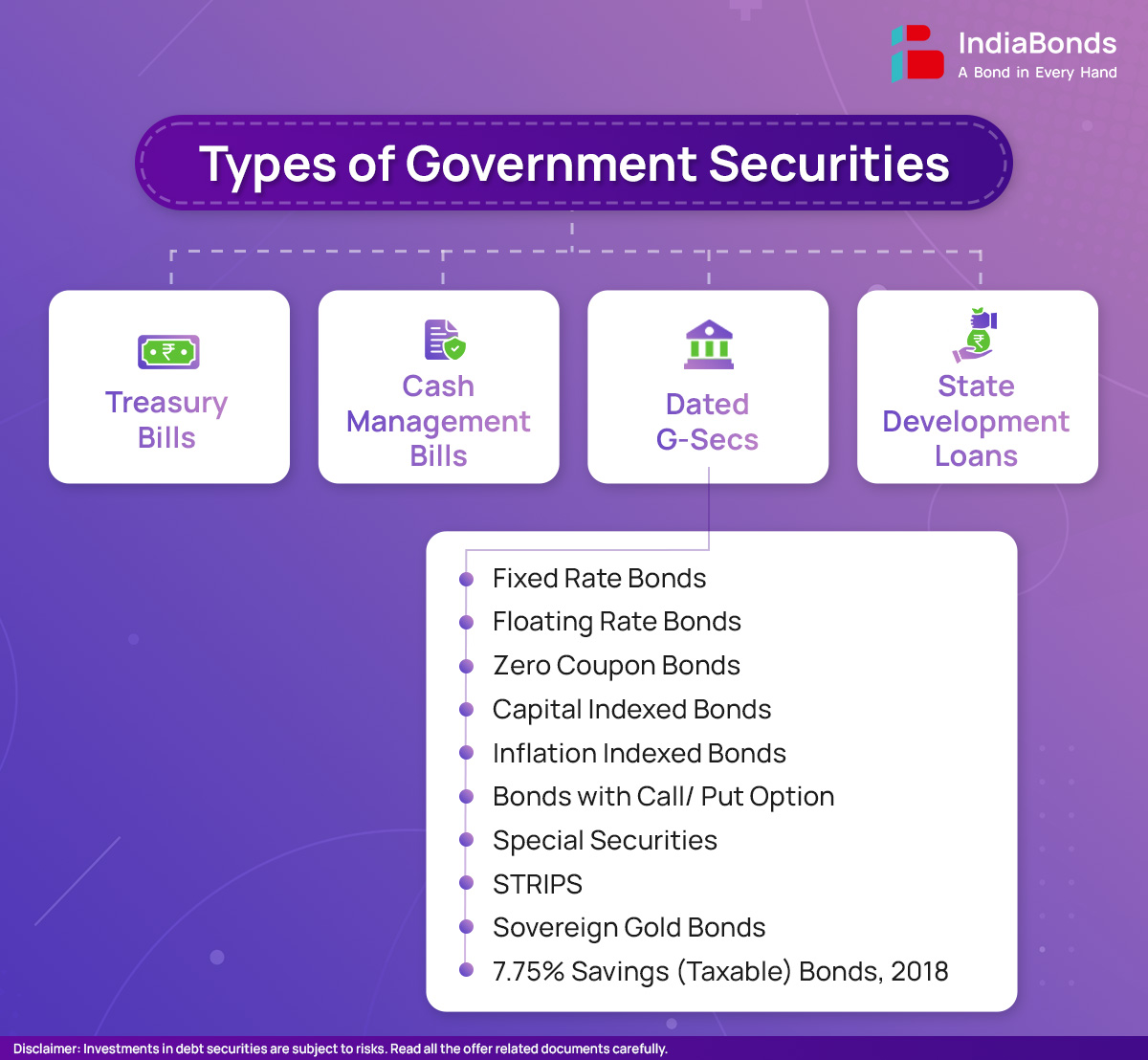

Different Types of Government Securities

1. Treasury Bills

Treasury bills, also known as T-bills, are short-term financial instruments utilized in the money market. These instruments are issued by the Indian government with three different maturity periods: 91 days, 182 days and 364 days. T-bills function as zero-coupon securities, meaning they are initially issued at a discounted price and subsequently redeemed at their full face value. The disparity between the discounted price and the face value represents the investor’s return, without any interest component involved. Thus, T-bills offer a straightforward investment opportunity with no interest payments involved.

2. Cash Management Bills

Cash management bills, also known as CMBs, bear a resemblance to treasury bills; however, their issuance involves significantly shorter maturity periods, typically less than 91 days. The introduction of CMBs took place in 2010 as a means to tackle temporary deficiencies in cash flow.

3. Dated G-Secs

Dated government securities, known as dated G-secs, are debt instruments with fixed-income characteristics that are issued by the government. These securities have tenures ranging from 5 to 40 years and offer a fixed or floating coupon rate, which is paid semi-annually. The Reserve Bank of India’s Public Debt Office (PDO) functions as the designated depository for g-secs. Dated government securities can be traded in the secondary market. Here are a few dated government securities example:

a. Fixed Rate Bonds

Fixed rate bonds refer to government securities that offer a fixed interest rate throughout their tenure. These bonds provide a predetermined interest payment to the bondholder at regular intervals. The fixed rate remains constant regardless of any changes in market interest rates during the bond’s lifespan.

b. Floating Rate Bonds (FRB)

Floating rate bonds represent a category of government securities characterized by a variable coupon rate rather than a fixed one. The variable coupon rate is periodically reset, at intervals of six months or one year, with the adjustments being announced in advance.

c. Zero Coupon Bonds

Zero coupon bonds, unlike traditional bonds, do not make periodic coupon payments. Instead, they are initially issued at a discounted price and later redeemed at their full face value. The difference between the discounted price and the face value represents the interest earned, similar to Treasury bills.

d. Capital Indexed Bonds

Capital indexed bonds are a type of financial instrument designed to protect investors against inflation. The principal amount of the bond is linked to an inflation index. This ensures that the purchasing power of the investor’s capital is maintained in real terms.

e. Inflation Indexed Bonds

Inflation Indexed Bonds, also known as inflation-linked bonds or inflation-protected bonds, are financial instruments designed to protect investors against the effects of inflation. These bonds are structured in a way that the principal value and interest payments are adjusted based on changes in an official inflation index like Wholesale Price Index or Consumer Price Index.

f. Bonds with Call/Put Options

Bonds with call/put options are debt securities that provide the issuer or the bondholder with the right to either call (redeem) or put (sell back) the bonds before their maturity date. Call options allow the issuer to buy back the bonds before the scheduled maturity, while put options grant the bondholder the ability to sell the bonds back to the issuer before maturity. These options provide flexibility to the parties involved and can be exercised under specific conditions outlined in the bond agreement.

g. Special Securities

These are a category of debt securities that are specifically issued to different entities, including oil marketing companies, fertilizer companies and the Food Corporation of India. These entities commonly receive them in the form of oil bonds, fertilizer bonds and food bonds, respectively. These securities serve as compensation to these companies instead of cash subsidies. They have extended maturity periods and offer higher coupon rates compared to dated securities. The entities receiving these securities have the option to sell them in the secondary market to banks, insurance companies, primary dealers, etc. to raise funds.

h. STRIPS

Separate Trading of Registered Interest and Principal of Securities are financial instruments that are formed by segregating the cash flows linked to a conventional Government Security (G-Sec). This entails separating each semi-annual coupon payment and the final principal payment into distinct securities. As an illustration, let’s consider the 8.32% GS 2032 bond with a face value of ₹100. When this bond is stripped, each individual cash flow, such as the semi-annual coupon payment of ₹4.16, becomes a coupon STRIP. Additionally, the principal payment of ₹100 at maturity transforms into a principal STRIP. These separated cash flows are traded independently as distinct securities within the secondary market.

i. Sovereign Gold Bonds

Sovereign Gold Bonds (SGBs) are a financial instrument introduced by the government to enable individuals to invest in gold in a paperless form. The value of these bonds is directly linked to the price of gold. One of the key advantages of SGBs is that they provide an alternative to purchasing physical gold, eliminating concerns related to storage and security. Additionally, SGBs offer an interest rate on the invested amount, providing an additional incentive to investors.

j. 7.75% Savings (Taxable) Bonds, 2018

These bonds were introduced by the Government of India in 2018. These bonds are open for investment to individuals, excluding Non-Resident Indians, who can invest in their individual capacity, jointly with others, or on behalf of a minor as a father, mother, or legal guardian. Hindu Undivided Families are also eligible to invest in these bonds. There is no upper limit on the investment amount for these bonds. The interest earned on these bonds will be subject to taxation. However, the bonds are exempt from wealth tax under the Wealth Tax Act, 1957.

4. State Development Loans (SDLs)

State Development Loans are debt instruments issued by the state governments to fund their developmental and infrastructure projects. These loans are primarily utilized to finance various state-level expenditures, such as the construction of roads, bridges, schools, hospitals and other public infrastructure.

The Golden Opportunity

The digital revolution has considerably heightened awareness among retail investors, leading them to recognize the importance and benefits of integrating government securities into their portfolios. They now appreciate the stability, predictability and security that bonds offer as part of their diversification strategy.

In February 2021, the government introduced an online platform named RBI Retail Direct, enabling investors to directly apply for government securities. This initiative attracted significant attention from investors. Additionally, the ticket size in the bond market has decreased and the emergence of Online Bond Platform Providers (OBPPs) in collaboration with SEBI has further expanded the reach of the bond market in India. These efforts have instilled a sense of confidence in investors, leading to increased retail participation in the bond market, which is expected to grow even more.

To conclude, through this blog, you have now acquired insights into the types of government securities and understood the nuances and benefits of these investment instruments in diversifying your portfolio. Discover the potential of bonds & explore the different types of government securities on IndiaBonds.

FAQs

Q. What are corporate bonds?

A. Corporate bonds are issued by corporations to raise capital. They’re issued to fund various activities such as expansion, research and development and working capital. Corporate bonds offer investors the potential for regular income through interest payments and the return of principal at maturity. For additional information on corporate bonds

Q. What are UDAY bonds?

A. UDAY bonds refer to the financial instruments issued as part of the Ujwal DISCOM Assurance Yojana (UDAY), a scheme introduced by the Government of India in 2015. UDAY aims to improve the financial health of state electricity distribution companies (DISCOMs) in India. These bonds are used to restructure the debt of DISCOMs by converting a portion of their outstanding loans into bonds.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.