Bond Directory

Investing in bonds has often been seen as a daunting task due to the complexity, jargon and sheer volume of available options, making the fixed income market seem impenetrable and tricky. IndiaBonds, a SEBI-Registered Online Bond Platform Provider, aims to democratize access to this market. With its revolutionary tool, the Bond Directory, IndiaBonds simplifies the investment process, making it more accessible and less intimidating for investors.

Imagine having a treasure map that guides you to the best investment opportunities in the fixed income market. That’s precisely what the Bond Directory is. Housing approximately 20,000 bonds, this directory is a centralized hub that offers detailed profiles on all bonds in the country.

A Centralized Repository

Launched in 2021, one of the major breakthroughs of the Bond Directory is its role as a centralized repository. Instead of scattering your efforts across multiple sources, the Bond Directory consolidates all bond-related information in one place. This repository includes functionalities like search and filter capabilities, comprehensive bond details and a comparability feature. This centralization ensures investors have quick access to all necessary information, aiding them in making tailored investment choices with ease and confidence.

How to Use the Bond Directory

Using the Bond Directory is as intuitive as it gets. Here’s a step-by-step guide to help you make the most of this powerful tool:

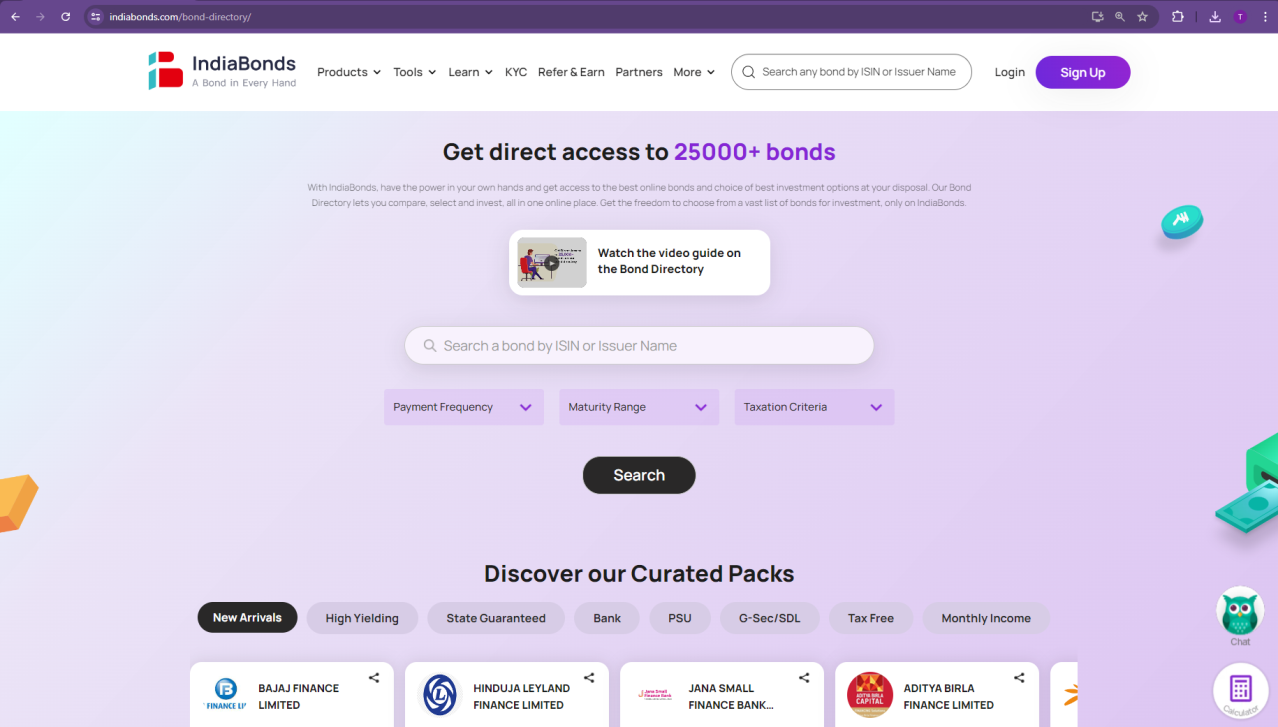

Access the Directory: Start by visiting the Bond Directory on the IndiaBonds website here.

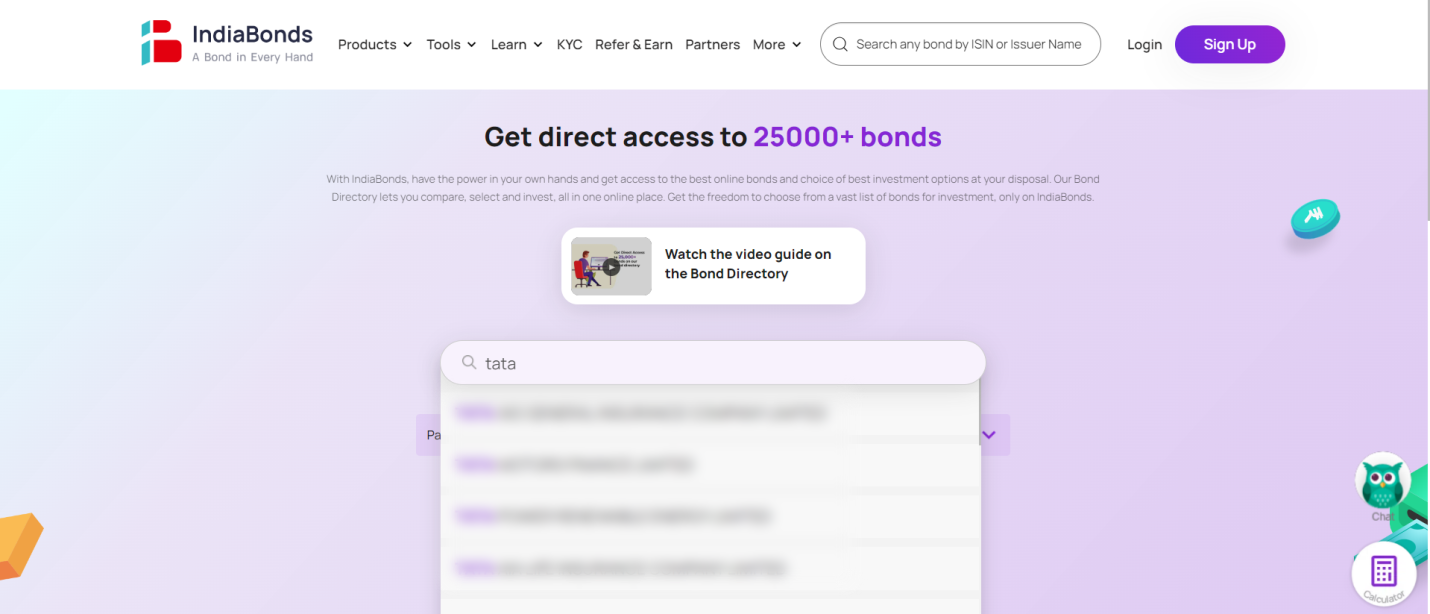

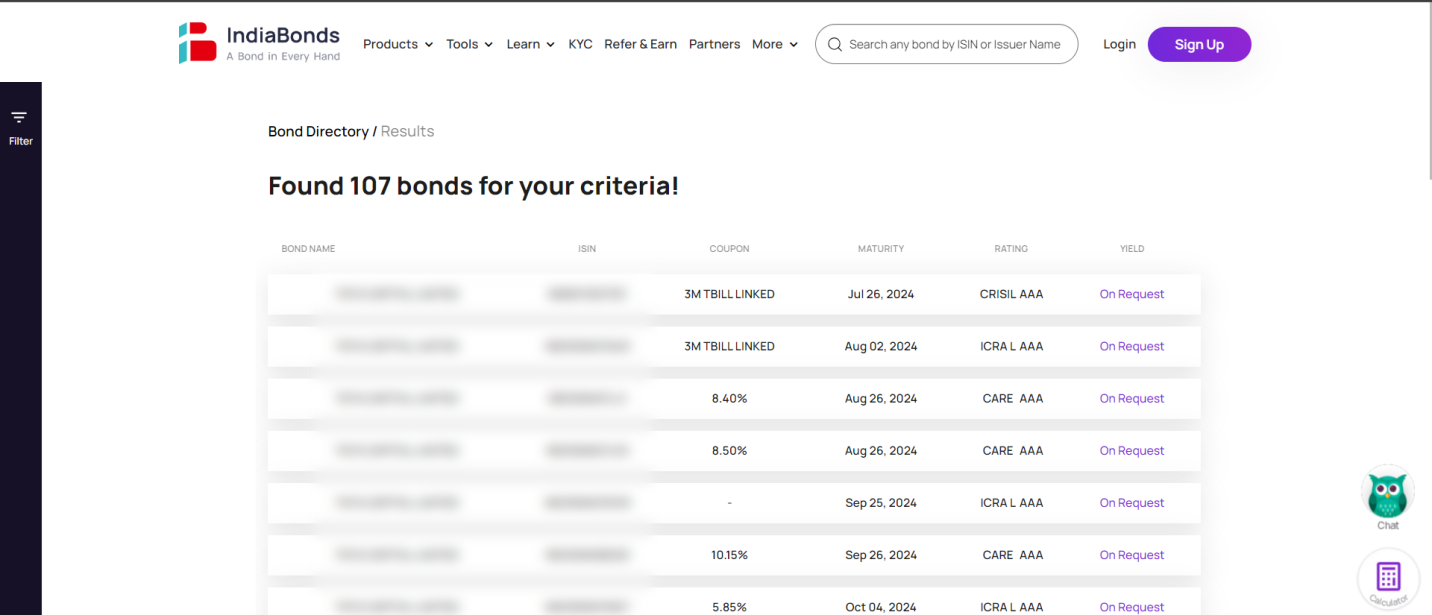

Search by Name: If you know the specific bond you’re interested in, simply type its name or ISIN into the search bar. This direct approach saves time and gets you to the information you need swiftly.

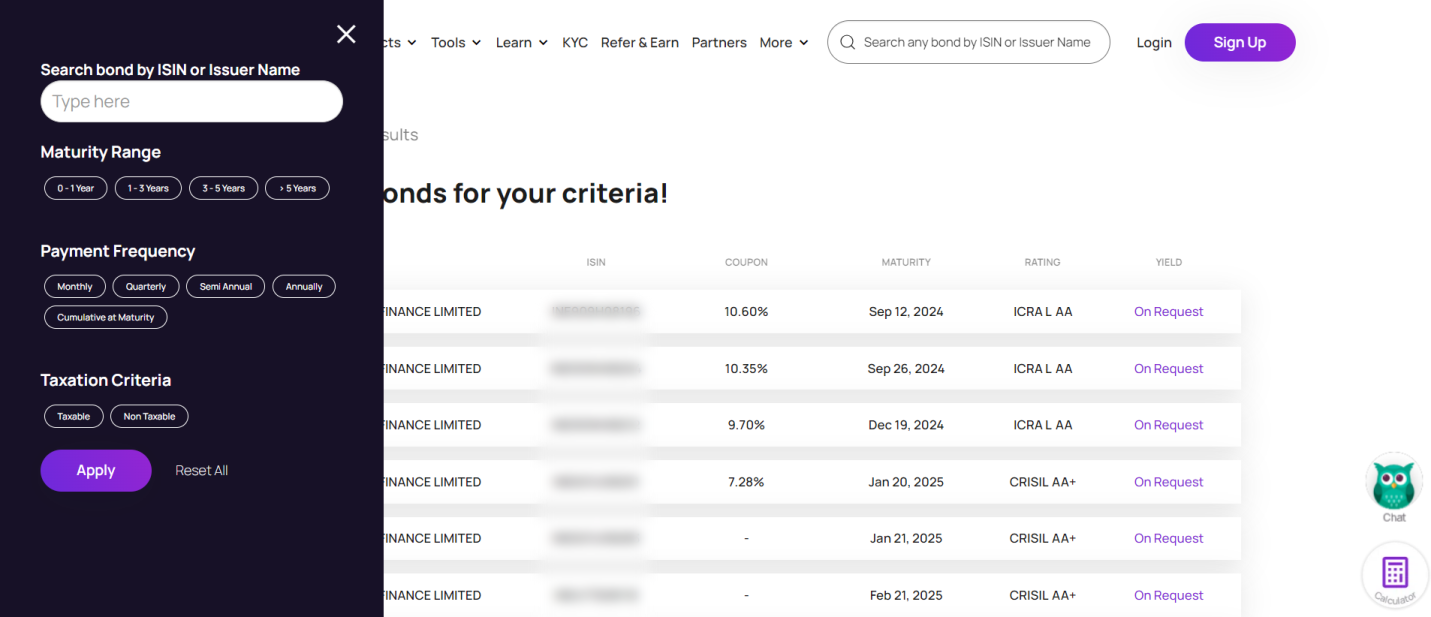

Filter by Categories: Not sure which bond to invest in? The filter feature allows you to narrow down your options based on various categories such as maturity range, payment frequency and taxation criteria. This ensures you can tailor your search to match your investment criteria.

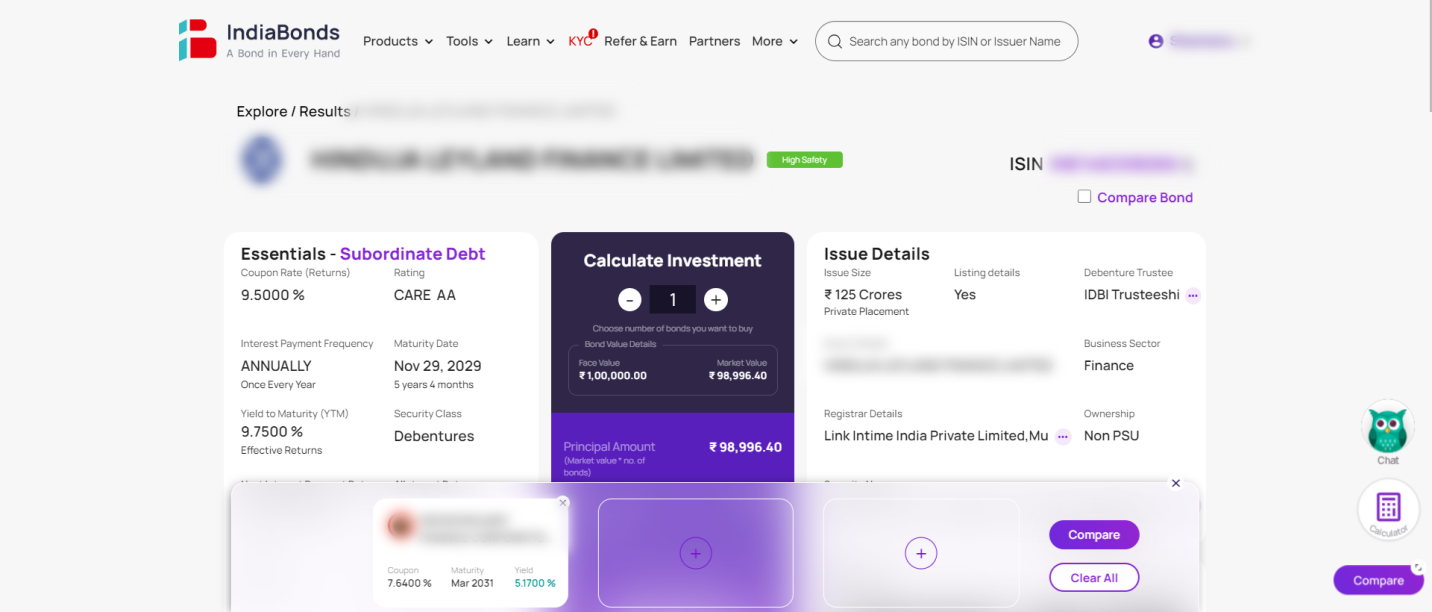

Detailed Bond Profiles: Each bond listed in the directory comes with a comprehensive profile. You’ll find crucial information such as the coupon rate, maturity date and the rating. These details are vital for assessing the risk and return of each bond.

Comparability Feature: One of the standout features of the Bond Directory is the ability to compare different bonds side-by-side. This functionality enables you to evaluate multiple bonds based on your preferred parameters, making the decision-making process more informed and efficient.

The Benefits of Using the Bond Directory

Transparency: With all the necessary information at your fingertips, you can make informed investment decisions. The directory provides an unparalleled level of transparency, reducing the risk associated with bond investments.

Efficiency: Instead of scouring multiple sources for bond information, the Bond Directory consolidates everything in one place. This not only saves time but also enhances the accuracy of the data you rely on.

Accessibility: The Bond Directory is designed to be user-friendly. Whether you’re a seasoned investor or a beginner, navigating the directory is straightforward and intuitive.

Live Offers and Purchasing

The Bond Directory doesn’t just stop at providing information of over 20,000 bonds. It goes a step further by highlighting the top few bonds that are live offers. This feature allows you to immediately purchase bonds that meet your investment criteria, streamlining the entire investment process from research to acquisition.

Conclusion

The Bond Directory by IndiaBonds is more than just a tool; it’s the Yellow Pages for bonds, revolutionizing the way investors’ access and analyze bond information. By offering a centralized, transparent and user-friendly platform, IndiaBonds has simplified navigating the fixed income market like never before. Whether you’re a novice investor or a seasoned professional, the Bond Directory is your key to realizing the potential of bond investments.

FAQs

Q. What is the Bond Directory?

A. The Bond Directory is a comprehensive online tool by IndiaBonds that lists detailed profiles of over 20,000 bonds in India.

Q. How can I search for a specific bond?

A. You can search for a specific bond by typing its name or ISIN into the search bar on the Bond Directory page.

Q. Can I filter bonds based on specific criteria?

A. Yes, the directory allows you to filter bonds based on various categories such as payment frequency, maturity range, taxation criteria.

Q. Is it possible to compare multiple bonds?

A. Yes, there is a comparability feature that allows you to compare different bonds side-by-side.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitized debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully