How To invest in Bonds

Introduction

Investing in Bonds is quite simple, convenient and isn’t as complicated as you may imagine. Gone are the days you would have to reach out to your broker or financial advisor to buy a bond and work on tedious paper heavy process to make your investments in bonds. In this blog you will learn how to invest in bonds online anytime anywhere! Right from the process to invest in bonds to ways and means that can help you pick the right bond that is suited for your investment needs, get all your queries answered here. In case you are new to bond investments and wish to learn more about Bonds, you may first want to watch our video on ‘What are Bonds?’

How to buy bonds?

Before we look at how to buy bonds online It’s important to understand what are the different ways you can invest in bonds.

- Primary Market – Companies and government agencies raise money in debt markets through Public Issues which are also sometimes called Bond IPO. Here, the investors buy bonds from the Issuer directly. Hence it is called primary market since that particular bond is issued for the first time.

- Secondary Market – In secondary bond markets, investors buy and sell bonds that have already been issued before in the primary market. So if you have bought a bond in the primary market and you subsequently sell it to another investor, that is a trade in secondary market.

Steps to invest in bonds

Through advent of technology, the landscape of Bond investment in India has changed entirely in comparison to the past few years, making the bond market accessible and transparent to individual investors. IndiaBonds simplifies the whole process to invest in bonds by making it completely digital for you without any hassles.

Here are 3 simple steps on how to invest in bonds Online through IndiaBonds

- Head over to IndiaBonds.com and create your account by signing up.

- Complete your KYC on IndiaBonds in less than 5 minutes – it’s paperless, requires no uploads, verifies you digitally and you simply add your Bank and Demat details.

- That’s it. Now you’re ready to start investing in whichever Bonds you prefer either in the primary or secondary market.

Here’s how you can look for the bonds:

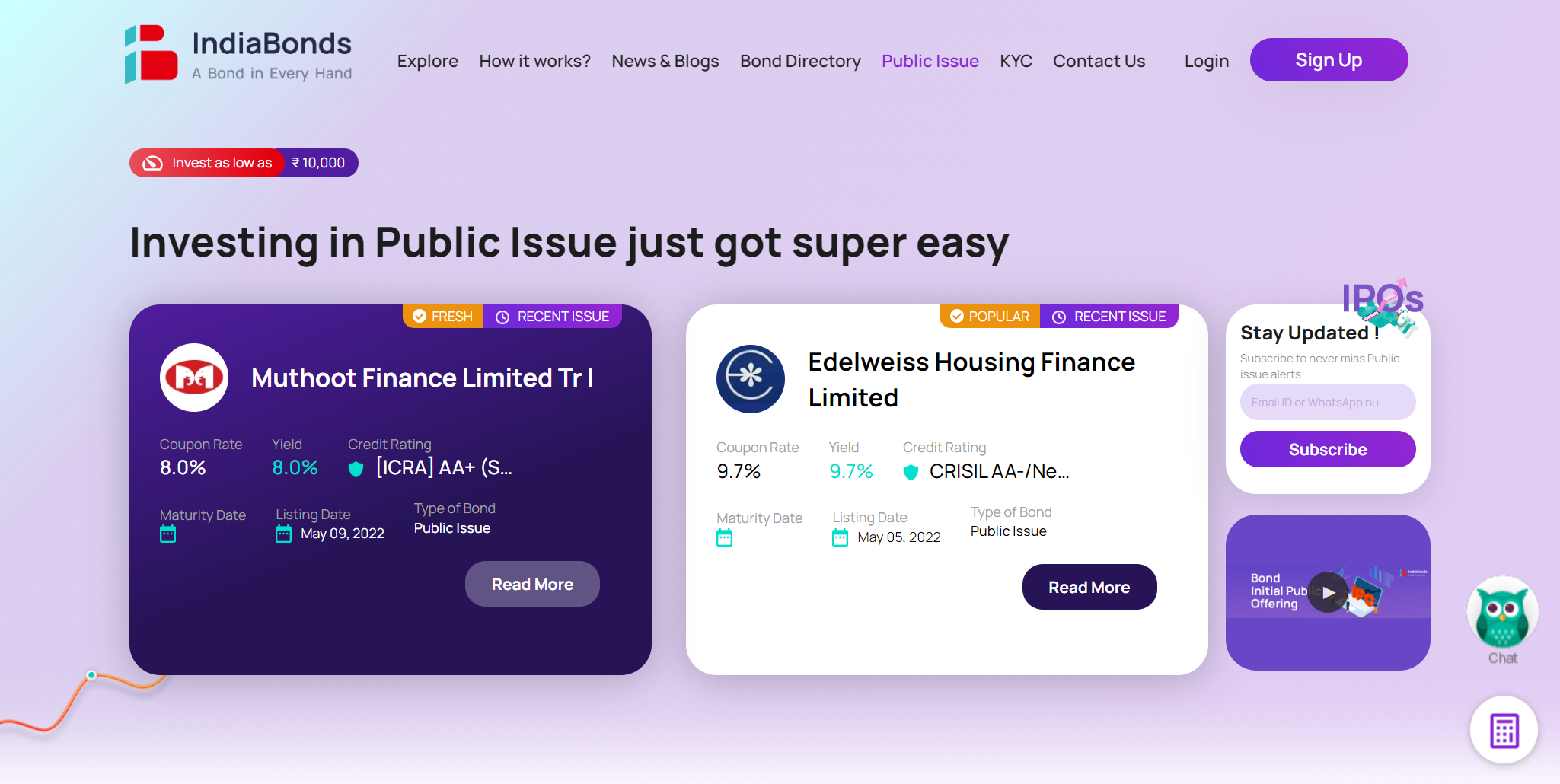

a) Primary market: To invest in the primary market, keep track of the upcoming bond public issues by signing up on our website as well as browsing through the new bond issuances on our Public issue page. If you’re interested to invest in the displayed bonds, click on “Apply Now”, fill and submit the form and complete your payment process. For payments up to INR 5 Lakhs you can transfer via UPI while for application amounts exceeding INR 5 Lakhs, application can be made via ASBA mode (Application Supported by Blocked Amount). To read more details, you can refer to our blog on Bond Public Issue to understand the benefits and payment methods.

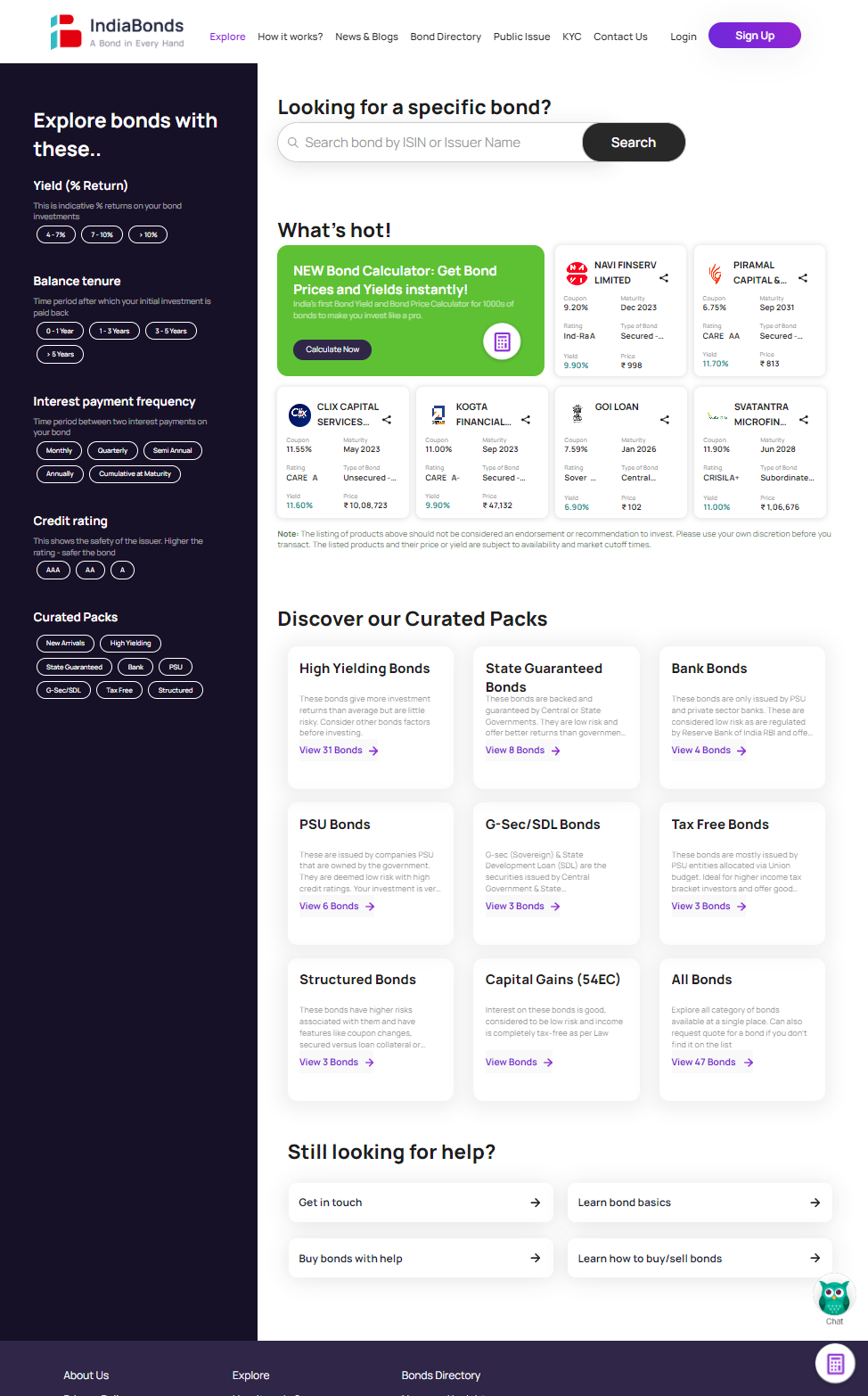

b) Secondary Market: To invest in secondary bonds visit the Explore page and choose from the available bond inventories to invest in. The Explore Bonds Page categorizes and buckets all available Bond inventory in the form of the Bond Type. You can choose to browse our curated selection either through Bond type or use the filters to customize your search. Simply choose a bond you’re interested in from a wider variety of bonds such as High Yield Bonds, Government Bonds, Tax Free Bonds, Bank Bonds, PSU Bonds, Capital Gain Bonds, etc.

Benefits of investing in bonds

- Stable and regular income

Investments in Fixed Income are investments in debt securities that provide a stable and regular income than other asset classes like equity or real estate. Also higher interest rates than traditional fixed income investments like Bank Fixed Deposits and Corporate FDs. - Portfolio diversification

During uncertainties you may lose out on your investments because market shocks come in unannounced. So, remember just investing in stock markets and mutual funds is not enough! You should also invest in bonds as it enables efficient portfolio diversification. - Liquidity

Most listed bonds are liquid and tradeable on exchanges. So in case of an emergency you can exit your investments before the bond maturity date quite easily in comparison to some of the other illiquid Fixed Income products like Fixed Deposits. - Higher Interest rates

In Public Issue of Bonds, companies usually offer higher interest rates to individuals than institutional investors. Hence, individual investors tend to benefit more. Also these are higher rates in comparison to traditional Fixed Deposits and Corporate FDs. - Interest Payout frequency

Bonds are a great way to receive regular predictable income. Investors can choose bonds on the basis of the interest payout frequency options offered by the issuer (monthly, quarterly or annually) and invest in the ones that best suit their needs. - Transparent Pricing

In Bond Public Issues the pricing is very transparent for individual investors. Investors can stay assured since the pricing is uniform. - Low Minimum investment

Investing in Bonds doesn’t require you to have deep pockets! If you’re looking to invest in the primary market by way of Bond Public Issues, then you can start by investing from as low as INR 10,000. - Listed on exchange

As per regulatory guidelines, Public Issue of Bonds in India are required to be listed on exchanges. This helps investors monitor their portfolio better! - Advantage during bankruptcy

Unlike equity investors who are last in line during bankruptcy and who may also lose their entire investments, Bond investors are the first in line to get their amount invested as they are lenders. Additionally, Bonds are generally backed by assets (also called as collaterals)

What types of bonds are there

Bonds can be broadly classified on two metrics:

- On the basis of Issuer – the one who is issuing these bonds.

Some examples include- Government securities

- Gsecs

- SDL (State Development Bonds)

- PSUs – Public Sector Undertakings

- Corporate Bonds (Private companies)

- Bank Bonds

- NBFC Bonds

- Government securities

- On the type of its structure – some broad categories include

- Fixed Coupon Rate bonds

- Floating coupon rate bonds

- Zero Coupon Bonds

- Callable and Puttable Bonds

- Subordinated Bonds

- Perpetual Bonds

- Tax-Free Bonds

- Capital gains Bonds and many more!

To read in detail read our article “Types of Bonds in India” where we explain in length on each of these Bond Types

Choose the right bond with our tool

Now that you know how to buy bonds online, if you’re still unsure of where to begin, use our tool to select the bonds that best suit your needs.

The ‘Bonds for You’ tool is a unique feature on IndiaBonds for first time bonds investors that assists investors seeking to set their goals. Basis your responses, it curates a list of bonds that would likely fit your investment requirements. All this while answering 3 simple questions!

- Why do you want to invest in Bonds?

- How Long do you want to invest for?

- What do you want to earn?

Bond Investment Note!

When it comes to investing in bonds, important factors to look at is the Bond Yield and Bond Price. Bond yield calculation can be complicated but you can now calculate it within seconds!

IndiaBonds Bond Calculator helps you to calculate Bond Yield or Bond Price for thousands of bonds in India. Just add the price or yield and the settlement date to get answers. Click here to start calculating or if you need more information or read our blog on “ Online Bond Yield Calculator”

FAQs

Are bonds a good investment?

Bonds are not only a great way to diversify your portfolio but also to generate a stable and regular higher income in comparison to traditional fixed income investments like Bank Fixed Deposits and Corporate FDs. Depending your investment needs different types of bonds offer different advantages. E.g.; Bank Bonds can be a better investment alternative to fixed deposits which give lower returns in comparison, State guaranteed bonds can be a better investment alternative to National Savings Certificate, RBI Savings Bonds and Post Office FD. Similarly, sovereign gold bonds are a better investment alternative to investing in physical gold because it helps you earn additional interest along with capital appreciation.

What is the minimum amount to invest in bond?

Bonds come with different face values. A Government Of India Bond typically comes with a face value of Rs. 100. An investor can subscribe to multiple units of bonds, which can be as low as Rs.100. However transnationally there are a few limitations that come into play. When it comes to public issue of Bonds that mean when the Bonds are issued in the primary market, the minimum investment amount required for investing is Rs. 10,000 for 10 units. However, if investors are looking at investing in Bonds through the Secondary market then the minimum units to purchase can be as low as 1.

How do bonds pay interest?

Bonds are flexible when it comes to interest payout frequency options. Investors can choose bonds on the basis of the interest payout frequency offered by the issuer (monthly, quarterly, semi-annually, annually and cumulative).

Can bonds be sold before maturity?

Listed Bonds can be easily liquidated in case you want to exit your investments. To simply answer, yes, Bonds can be sold before they mature. Most bonds are listed on exchange (BSE / NSE). Therefore, tradeable and can be sold before maturity in the secondary market.

Is it mandatory to have a demat account?

Yes, a Demat account is necessary when investing in bonds to hold your investment.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.