15G & 15H Forms – for TDS on Listed Bonds

Introduction

The ever-changing financial landscape necessitates the continuous updating of financial regulations. Therefore, the Union Budget 2023 has introduced a notable modification that impacts investors involved in listed debt securities. From April onwards, Tax Deduction at Source (TDS) will be applicable to interest income earned from listed bonds. This move is aimed at increasing transparency, streamlining tax collection and ensuring that individuals and institutions fulfill their tax obligations. Let’s dive deeper into the details and explore how this change will impact investors, including the role of Form 15G and Form 15H in managing TDS deductions.

Understanding TDS on Listed Bonds

Listed bonds will now fall under the purview of TDS. This means that any individual or institution earning interest income from listed bonds will have tax deducted at source by the issuer at the time of payment. The inclusion of listed bonds under the TDS mechanism is primarily driven by the goal of enhancing tax compliance and simplifying the tax collection process. Additionally, this move brings transparency to the system, as the tax deducted will be reflected in the Form 26AS statement of the taxpayer.

Impact on Investors

For those investing in listed bonds, the introduction of TDS will have implications as the expected cashflow and returns from such investments change. It is important for investors to consider the TDS deduction while calculating their expected returns. However, there can be some respite for individuals and HUF from this TDS deduction on listed bonds, if they were to fill Form 15G and Form 15H.

What are 15G and 15H forms?

You must have come across the terms 15G 15H numerous times making you wonder what are they. Let’s understand what is Form 15G and 15H? Form 15G (for those below 60 years of age) and Form 15H (for above 60 years) provide a means for individuals to claim TDS relief on their interest income. Form 15G and Form 15H are considered self-declaration forms rather than certificates. It is advisable to complete either Form 15G or Form 15H at the beginning of the financial year to prevent TDS on interest income. In the case of holding corporate bonds, TDS is deducted if the interest income exceeds Rs 5,000. To avoid this deduction, you can submit either Form 15G or Form 15H to the issuer, requesting non-deduction of TDS. It is important to note that the TDS provision applies only to bonds issued by companies. Government bonds, including sovereign gold bonds, are exempt from the TDS requirement.

Conditions and requirements for Submitting Form 15G & Form 15H

| Conditions | Form 15G | Form 15H |

| Requirements | Requirements | |

| 1. Eligible Entities | Individual or Hindu Undivided Family (HUF) | Individual |

| 2. Residential Status | Indian | Indian |

| 3. Age Limit | Less than 60 years | Aged 60 years or will turn 60 during the relevant financial year |

| 4. Tax Liability | Tax calculated on income should be NIL | Tax calculated on income should be NIL |

| 5. Total Income | Total income for the year must be below the basic exemption limit of that year which is Rs.2.5 lakh | For individuals aged 60-80 years, the taxable annual income must be at least 3 lakhs. |

Examples to Understand Who Can Submit Form 15G and Form 15H

| Scenario | Age | Total Income (₹) | Taxable Income (₹) | Form Eligible |

| An Indian individual below 60 years | 35 | Below the basic exemption limit of that year | No | Form 15G |

| An Indian individual below 60 years | 35 | Above the basic exemption limit of that year | Yes | Not eligible |

| An Indian senior citizen retired from service | 65 | Below the basic exemption limit of that year | No | Form 15H |

| Scenario | Age | Total Income (₹) | Taxable Income(₹) | Form Eligible |

| An Indian senior citizen retired from service | 65 | Below the basic exemption limit of that year | No | Form 15H |

| An Indian senior citizen with taxable income | 70 | Above the basic exemption limit of that year | Yes | Not eligible |

In short, the eligibility for form 15G is that one should be an Indian resident below the age of 60 years with total taxable income below the exemption limit and no tax liability for that financial year.

Similarly, the eligibility for form 15H is that one should be an Indian resident of or above the age of 60 years with total taxable income below the exemption limit and no tax liability for that financial year.

Form 15G Example

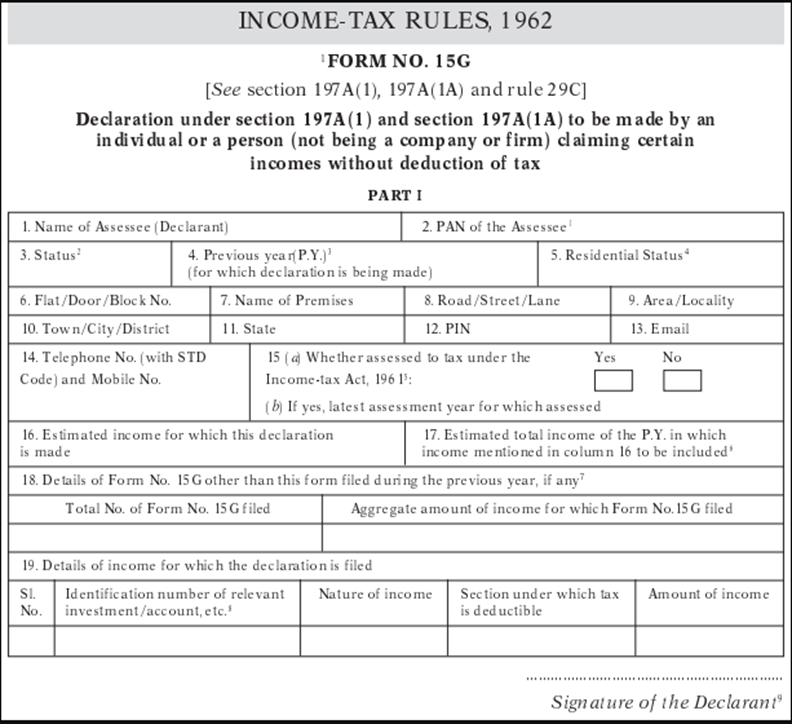

Here is a sample of Form 15G

You can access form 15G online through the online portals of various institutions where you have investments or from online portals of the tax department.

Form 15H example

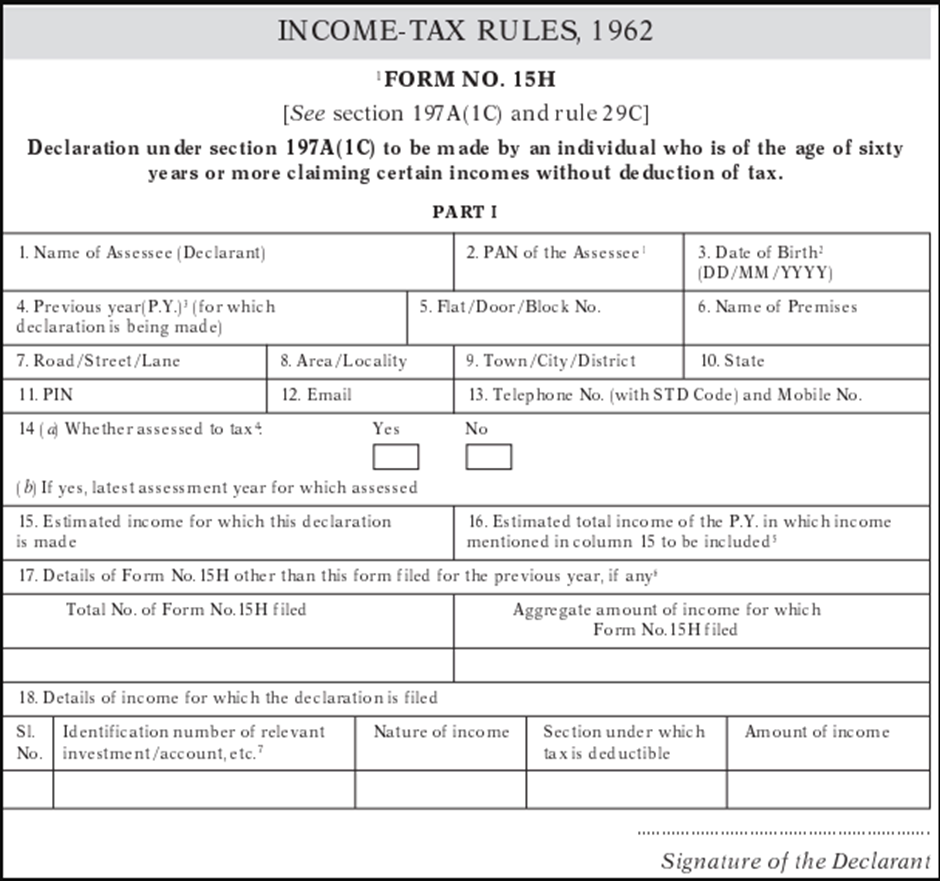

Here is a sample of Form 15H

You can access form 15H online through the online portals of various institutions where you have investments or from online portals of the tax department.

Where Can You Submit Form 15G and Form 15H Apart From Banks?

While banks are the most common institutions for submitting Form 15G and Form 15H, these forms can also be submitted to other entities, including:

- NBFCs: Individuals with investments or deposits in NBFCs

- Post offices: For fixed deposits and other interest-paying schemes.

- Provident Fund Office: Employees contributing to a recognized provident fund can submit Form 15G or 15H directly to their employer’s provident fund office.

- Bond issuers: Companies or organizations paying interest on listed bonds.

- Mutual fund houses: Applicable for certain interest payments or dividends.

- Corporate registrars: Entities managing bond or equity issuances.

- Submitting form 15G or 15H ensures that your interest income is received without TDS deductions across various financial instruments.

Positive Outcomes to Expect

The inclusion of listed bonds under TDS is expected to bring several benefits to the financial ecosystem. It will encourage tax compliance by ensuring that individuals and institutions accurately report their interest income. This move will significantly expand the taxpayer base and increase tax revenues for the government.

Conclusion

Form 15G and Form 15H are valuable tools for individuals seeking TDS relief on their interest income from bonds. By understanding their features, purpose, submission timelines and designated submission points, taxpayers can effectively navigate the process and optimize their savings. It is recommended to consult a tax professional or refer to the official guidelines for specific instructions pertaining to individual cases.

By introducing TDS on interest income from listed bonds, the government has taken a significant step towards strengthening tax compliance and revenue collection. This move aims to bring transparency, enhance tax compliance and streamline tax recovery processes. It is crucial for individuals and institutions investing in listed bonds to understand the implications of this change and incorporate it into their financial planning. Ultimately, this step will contribute to the overall growth and development of the financial ecosystem, fostering a more robust and accountable economy. As investors, let’s stay informed and adapt to these changes, ensuring that we fulfill our tax responsibilities while making informed financial decisions.

FAQs

Q. Can an NRI submit the Form 15G and Form 15H?

A. No, NRIs (Non-Resident Indians) are not eligible to submit Form 15G or Form 15H. These forms are specifically meant for resident individuals and Hindu Undivided Families (HUF) in India. NRIs are not eligible for the benefits provided by these forms.

Q. Where to submit the forms 15G and 15H for bondholders?

A. To submit these forms, you need to connect with the respective registrar of the issue.

Q. Can Form 15G or Form 15H be submitted online?

A. Yes, many banks and institutions offer the facility to submit Form 15G or Form 15H online through their websites or mobile apps.

Q. What happens if I fail to submit Form 15G or Form 15H on time?

A. If you fail to submit these forms, TDS may be deducted from your interest income. However, you can claim a refund for the deducted TDS while filing your income tax return.

Q. Can Form 15G or Form 15H be used to avoid TDS on capital gains?

A. No, these forms are only applicable to interest income, not capital gains.

Q. How often do I need to submit Form 15G or Form 15H?

A. These forms need to be submitted at the start of each financial year or when you begin earning interest income from a new entity.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.