Fixed Income Showdown – Bonds vs. Traditional Fixed Income Instruments

In this final clash, the war rages on,

Bonds stand strong, their resilience drawn.

Though yields may lure with their tempting might,

Only bonds endure, the victors of this fight.

Having triumphed over the new-age alternative financial products, bonds find themselves encircled by their age-old adversaries: traditional fixed income instruments like Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Fixed Deposits (FDs), National Savings Certificates (NSC) and Senior Citizen Savings Schemes (SCSS). Now, it’s time to confront these old foes and witness a fixed income showdown to determine the ultimate champion. In this article, we pit bonds against their traditional counterparts, eager to discover the victor in this ‘maha’ comparison of bonds with traditional fixed-income products in the ‘fixed-income verse’ of madness!

The Origin Story

Everyone desires safety and trustworthiness when it comes to investing. In the post-independence era, the government introduced financial instruments to achieve two goals: promoting savings and economic growth and fostering nation-building. Over time, fixed deposits became popular. Social security, a concept borrowed from the West, led to the creation of the Public Provident Fund – an instrument aimed to provide retirement security. Kisan Vikas Patra was introduced to instill long-term financial discipline, while National Savings Certificates primarily served to save income tax and catered to mid-low income investors. With limited presence of equity markets, people widely embraced these fixed-income instruments. This trend made the older generations, including Generation X and baby boomers, staunch advocates of these instruments. As a result, your parents might have preferred FDs over bonds or even stocks. However, you are not bound to follow the same path.

Here are 3 reasons why bonds might be a better option:

Higher Returns:

Merely relying on your savings will not be sufficient to fulfill your financial goals. Hence, it’s crucial to invest, not just save. Another factor to consider is the rate of return while investing; inflation has increased over time. Therefore, it’s imperative to aim for an inflation-adjusted return in your investments; most traditional fixed income products barely provide this kind of return, barring a few exceptions. Bonds, especially corporate bonds, offer the potential for higher returns compared to traditional fixed-income options while prioritizing safety.

Liquidity:

PPF has a 15-year lock-in period, with withdrawals permitted after 7 years. FDs are for short term only and incur penalties for premature withdrawal, as do KVP and NSC. In contrast, bonds are significantly more liquid than these traditional instruments; they can be traded in the market. This liquidity enables investors to sell their bonds on the secondary market before maturity, providing flexibility in case of emergencies.

Flexible Maturity Period:

Traditional fixed-income instruments often have relatively longer maturity periods, restricting investors from addressing short-term financial goals or emergencies. In contrast, bonds are available in various durations; G-Secs, for instance, come in a wide range of maturities spanning from 91 days to as long as 40 years. This comprehensive feature supports wealth creation, accumulation, retirement planning and various other financial goals for non-institutional investors.

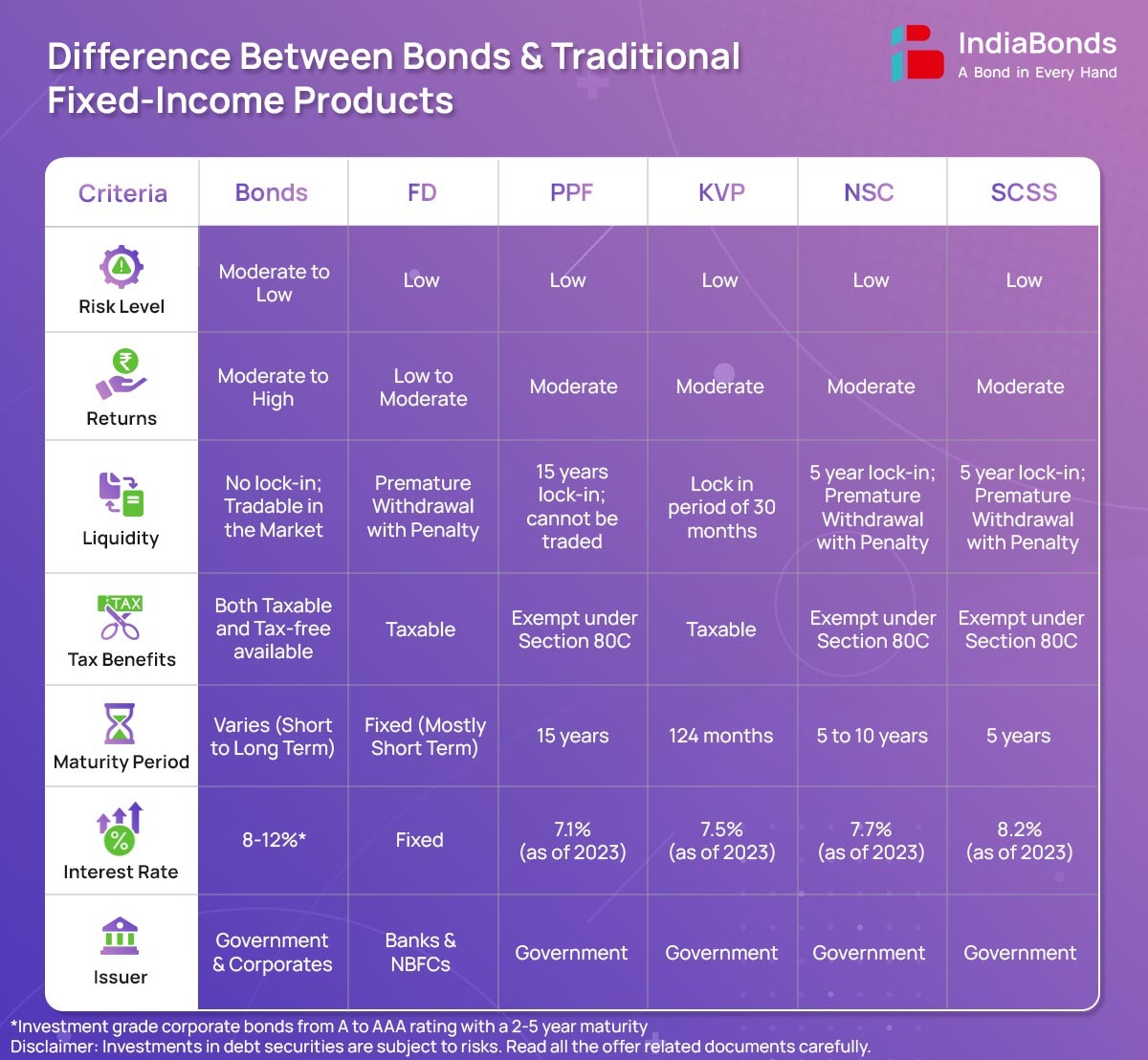

Here is a summary outlining the distinctions between bonds and traditional fixed-income products in a tabular format. Each traditional fixed-income instrument has been comprehensively covered individually in our blogs section; Do check it out for further insights.

Conclusion:

In the grand finale of the fixed-income verse, bonds have emerged as the indisputable champions, proving their mettle against both the onslaught of new-age financial products and the traditional stalwarts like PPF, KVP, FD, NSC and SCSS. Their victory is not just a testament to their resilience and adaptability, but also a signpost pointing towards the future of prudent investing.

Yet, in this epic clash, a profound truth emerges. It’s not about bonds versus traditional fixed income instruments. It’s about the wisdom of building a diversified arsenal of investment instruments. Retail investors, both seasoned and novice, should heed this lesson: the key to a robust and resilient portfolio lies in embracing a variety of investment tools.

Bonds, with their higher returns, liquidity and flexible maturity periods, have proven their worth. However, they are not the sole answer. By combining bonds with other traditional instruments and exploring the vast landscape of investment options, investors can construct portfolios that are truly bullet-proof.

In a world where financial landscapes are ever-changing and economic uncertainties abound, the savvy investor understands the importance of adaptability and diversification. By being open to the spectrum of investment opportunities available, from bonds to stocks, gold to real estate, they fortify their investments against the unpredictable tides of the market.

So, let this be the clarion call for all investors: diversify, adapt and thrive. In the realm of investments, there is no one-size-fits-all approach. Instead, it’s the careful combination of bonds, traditional fixed income instruments and a myriad of other options that crafts a portfolio capable of withstanding the tests of time. In the pursuit of financial security and growth, embracing this holistic strategy will be the true path to victory.

FAQs

Q: What are traditional fixed-income instruments?

A: Traditional fixed-income instruments refer to financial products like Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Fixed Deposits (FDs), National Savings Certificates (NSC) and Senior Citizen Savings Schemes (SCSS) that offer fixed returns on investments.

Q: What is the liquidity advantage of bonds over traditional fixed-income instruments?

A: Bonds are more liquid than traditional instruments like PPF, FDs, KVP and NSC. They can be traded in the market, allowing investors to sell their bonds on the secondary market before maturity, providing flexibility in emergencies.

Q: Is it advisable for retail investors to invest solely in bonds or traditional fixed-income products?

A: No, the key to a robust and resilient portfolio lies in building a well-diversified portfolio. Diversifying investments across bonds, traditional fixed-income products, stocks, real estate, gold, etc. ensures a balanced and secure financial portfolio.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.