BondCase – Basket of Bonds

Introduction

Imagine you’re standing in a lush vineyard, surrounded by rows of vines, each one heavy with grapes. You’re not just picking one or two bunches; you’re carefully selecting a variety that will blend perfectly into your very own vintage. This, in essence, is what investing in bonds should feel like—personal, tailored, and satisfying. That’s where BondCase by IndiaBonds comes in. Just like crafting your signature wine, BondCase allows you to engage in thematic bond investments, curating a unique collection of bonds that are perfectly aligned with your financial palette and investment goals.

What is BondCase by IndiaBonds?

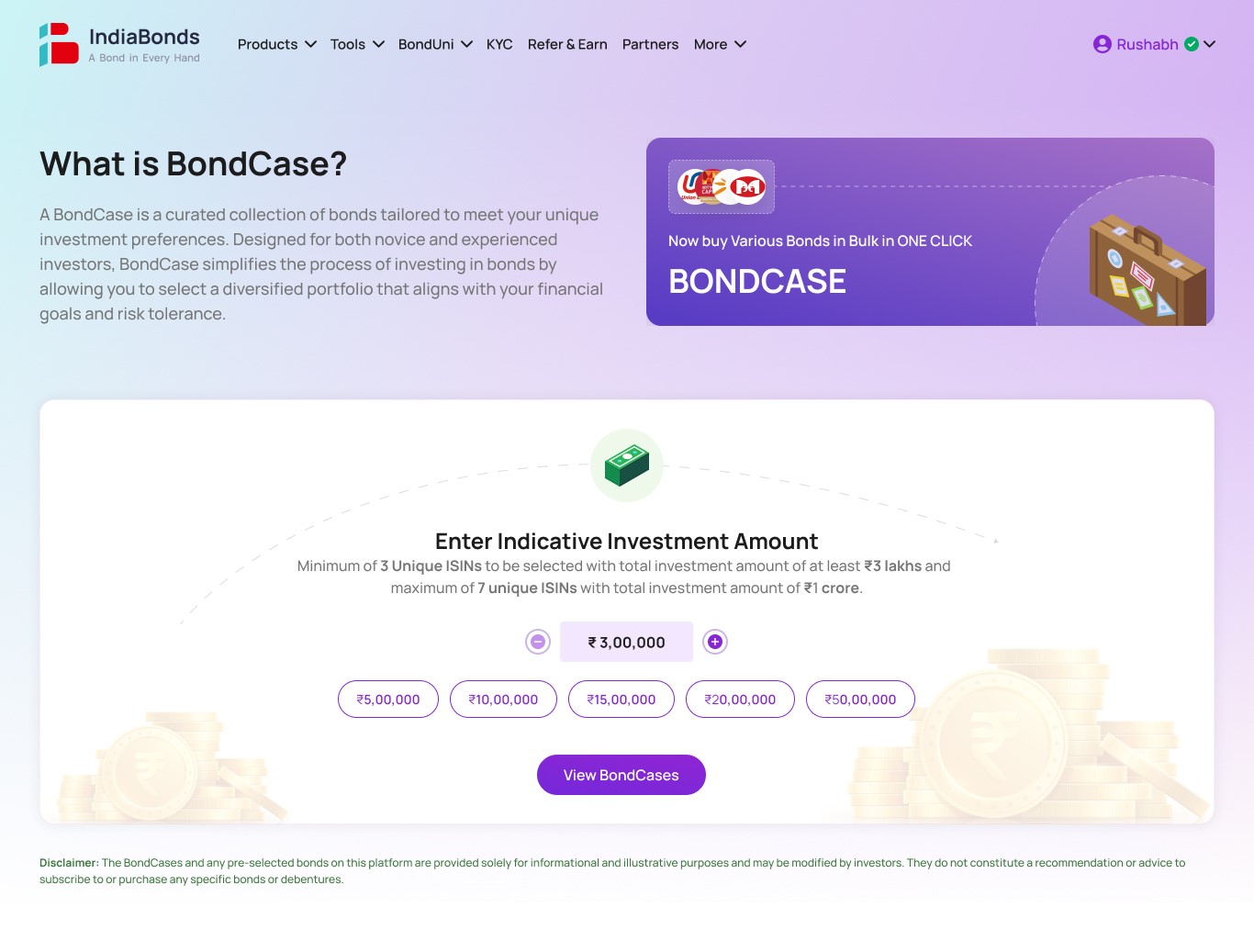

BondCase by IndiaBonds – A revolutionary investment tool that enables you to invest in multiple bonds simultaneously, allowing you to create and customize your own bond basket. At IndiaBonds, we understand that your investment journey should be straightforward and personalized. BondCase offers you the flexibility to either choose from pre-curated, themed bond collections or to create your own bespoke basket of bonds. Whether you’re seeking high returns, tax efficiency, or strategic diversification, BondCase is your gateway to a more personalized and seamless bond investment experience.

Features and Benefits of BondCase by IndiaBonds

1. Multiple bonds, Single click

Simplifying your investment process, BondCase allows you to invest in a minimum of three and up to seven unique ISINs with just one click. With a total investment amount ranging from at least ₹50,000 to ₹1 crore, this convenience not only saves time but also streamlines your portfolio management, making it easier than ever to diversify and grow your investments.

2. DIY and Free to Edit

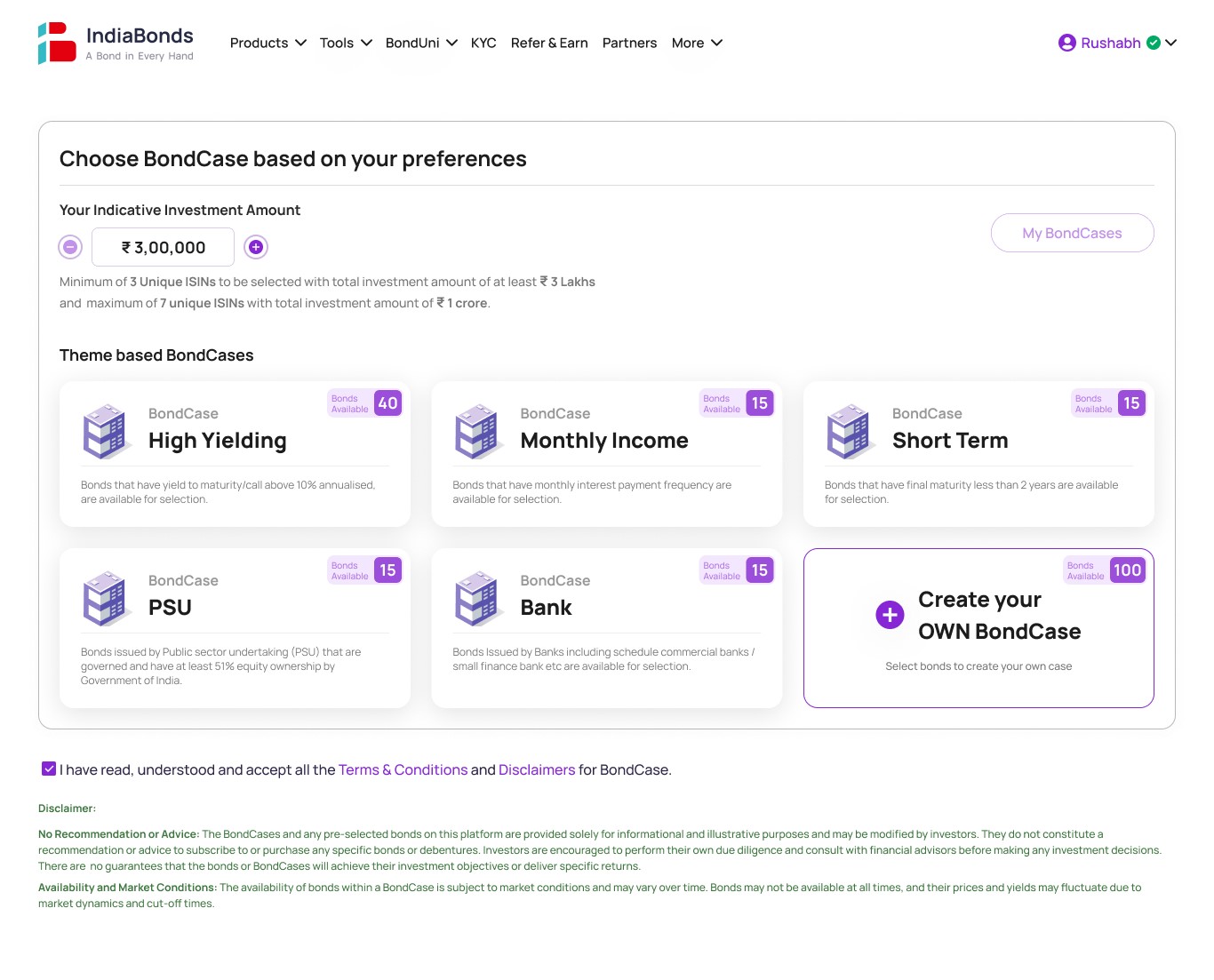

BondCase gives you the freedom to do-it-yourself (DIY). You can select pre-curated bond themes or freely edit and customize your bond basket to match your specific investment goals. This flexibility ensures that your bond portfolio truly reflects your financial strategy.

3. Enhanced Diversification

One of the cornerstones of successful investing is diversification. With BondCase, diversification within bonds becomes effortless. You can spread your investment across different bonds, themes, industries, and credit ratings, reducing risk and potentially enhancing returns. It’s like having a well-balanced meal, where each bond adds a unique flavor and benefit to your financial health.

4. Tax Benefits

When it comes to tax efficiency, bonds often have the upper hand over debt mutual funds. Depending on the bonds you select, you could enjoy more favorable tax treatment, potentially leading to better post-tax returns. BondCase makes it easy to maximize these benefits by helping you choose the bonds that align with your tax strategy.

5. Ease of Transaction and Doing Business

BondCase is designed to offer an unparalleled ease of transaction. From selecting bonds to completing your investment, the entire process is smooth and user-friendly. This seamless experience extends to the backend as well, ensuring that managing your investments is as easy as making them.

How to invest in BondCase by IndiaBonds?

Investing in BondCase is as easy as 1-2-3. Simply start by logging in to IndiaBonds and Choose BondCase, make sure to mention your indicative investment amount.

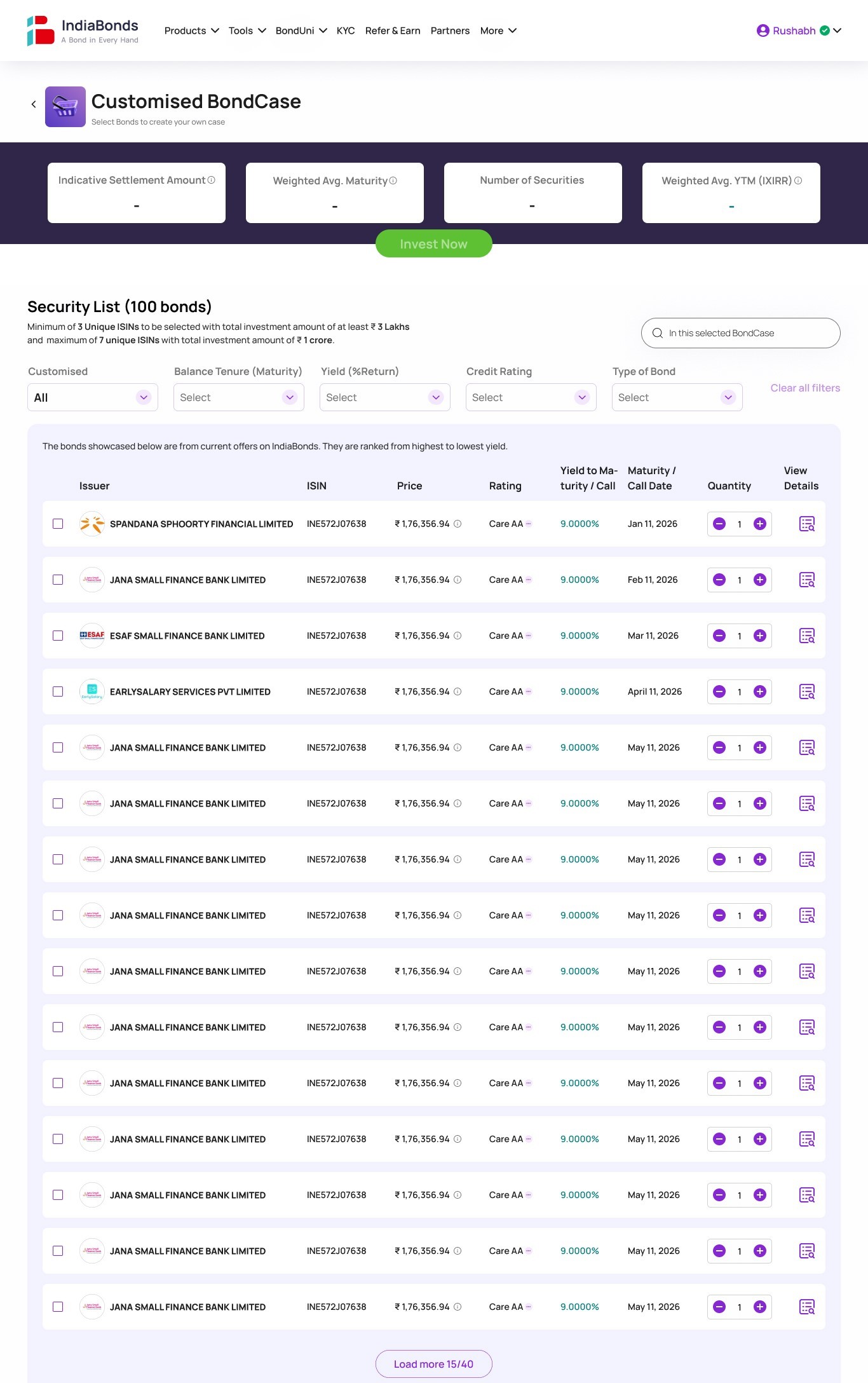

1. Choose Your Theme: Start by selecting from a range of curated themes such as (High-yielding, PSU, bank, etc.) that align with your investment goals. Each theme bunches together a selection of bonds, ranked by the highest YTM/YTC, to cater to different financial objectives, whether focused on income generation or capital preservation. If you have specific preferences, you can also create your own bond case from a wide selection of 70-100 bonds available on IndiaBonds at any given time.

2. Select Bonds: Once you’ve chosen a theme, you can either approve the preselected bonds or customize your own bond case. This flexibility ensures that your bond portfolio is tailored precisely to your needs.

3. One-Click Investment: With your bonds selected, simply proceed to invest with a single click. We have developed the ideal digital infrastructure to facilitate hassle-free payment systems, enabling you to make informed investment decisions and focus on what matters most—your financial future.

Conclusion

BondCase by IndiaBonds is more than just another investment tool—it’s a breakthrough in how we approach bond investing. It exemplifies the power of customization, giving you control over your financial journey with precision and ease. With BondCase, you’re free from the constraints of a one-size-fits-all approach. Instead, you can craft a bond portfolio that aligns with your unique financial aspirations. Whether you’re focused on generating steady income, preserving capital, or seizing growth opportunities, BondCase provides the tools to tailor your investments to your exact needs.

Thematic bond investments become your reality as you handpick bonds that resonate with your goals, risk tolerance, and return objectives. What makes BondCase truly compelling is its ability to merge the security and predictability of bonds with the flexibility and personalization often associated with other investment vehicles. This unique combination makes bond investing not just accessible, but also engaging and deeply satisfying.

Start curating your BondCase today, and take a decisive step toward a more diversified, tax-efficient, and liquid investment portfolio. With BondCase, you can easily bundle bonds to suit your unique goals, ensuring your financial future isn’t just secured—it’s tailored, optimized, and poised for success.

FAQs

Q. What is the minimum investment required for BondCase?

A. The minimum investment for BondCase is ₹50,000. However, it is designed to be accessible to a broad range of investors.

Q. Can I change the bonds in my BondCase after investing?

A. Once you have invested in a BondCase, the bonds in that basket are fixed. However, you have the flexibility to sell individual bonds in the market using the IndiaBonds RFQ platform.

Q. How are the themes in BondCase curated?

A. Themes are simply collections of bonds that are grouped by issuer, maturity, yield, etc.

Q. What are the tax implications of investing in BondCase?

A. Tax implications vary depending on the types of bonds included in your BondCase. Some bonds may offer better tax efficiency compared to others. It’s advisable to consult with a tax advisor to understand the specific benefits for your situation.

A. Is BondCase suitable for beginners?

A. Absolutely! BondCase is designed to simplify bond investing, making it an excellent choice for both beginners and experienced investors. The user-friendly interface and curated themes make it easy to start building a diversified bond portfolio.

Key Disclaimer: This is not advisory; it is a tool for informational purposes only

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.