Bond Portfolio Analysis Tool

A well-balanced portfolio isn’t just about having a mix of assets; it’s about understanding how those assets perform together. Stocks, bonds, real estate and gold all play important roles in a portfolio. However, bonds can be a bit tricky, with interest rates, maturities and credit ratings all requiring careful consideration. Additionally, diversification across bonds is essential to protect against the risk of an issuer not fulfilling its obligation. That’s where the IndiaBonds Portfolio Analysis Tool comes in. This innovative tool serves as a personal bond dashboard, transforming the way investors manage their fixed-income investments.

The Importance of a Diversified Portfolio

Before diving into the specifics of our Portfolio Analysis Tool, it’s essential to understand the significance of a well-diversified investment portfolio. Diversification is a fundamental strategy to manage risk and enhance returns. By spreading investments across different asset classes, sectors and geographies, you can mitigate the impact of market volatility on your overall portfolio. While equities often take the spotlight, bonds play a crucial role in diversification, providing a stable income stream and reducing portfolio risk. Globally, a common approach is to allocate 60% of a portfolio to equities and 40% to fixed-income securities.

The Need for a Bond Portfolio Dashboard

Despite the availability of numerous portfolio and analytical tools for equity investors, retail bond investors have been underserved in this regard. This gap in the market inspired us to launch the IndiaBonds Portfolio Analysis Tool in 2023, designed specifically for bond investors. This tool is not just a tracking mechanism; it is a comprehensive solution that offers a holistic view of your bond holdings, empowering you to make informed investment decisions.

The IndiaBonds Portfolio Analysis Tool

Imagine having a tool that not only tracks your bond investments but also provides detailed analytics to optimize your portfolio. The IndiaBonds Portfolio Analysis Tool does just that and more. Here’s how it transforms your bond investment experience:

Comprehensive Analytics

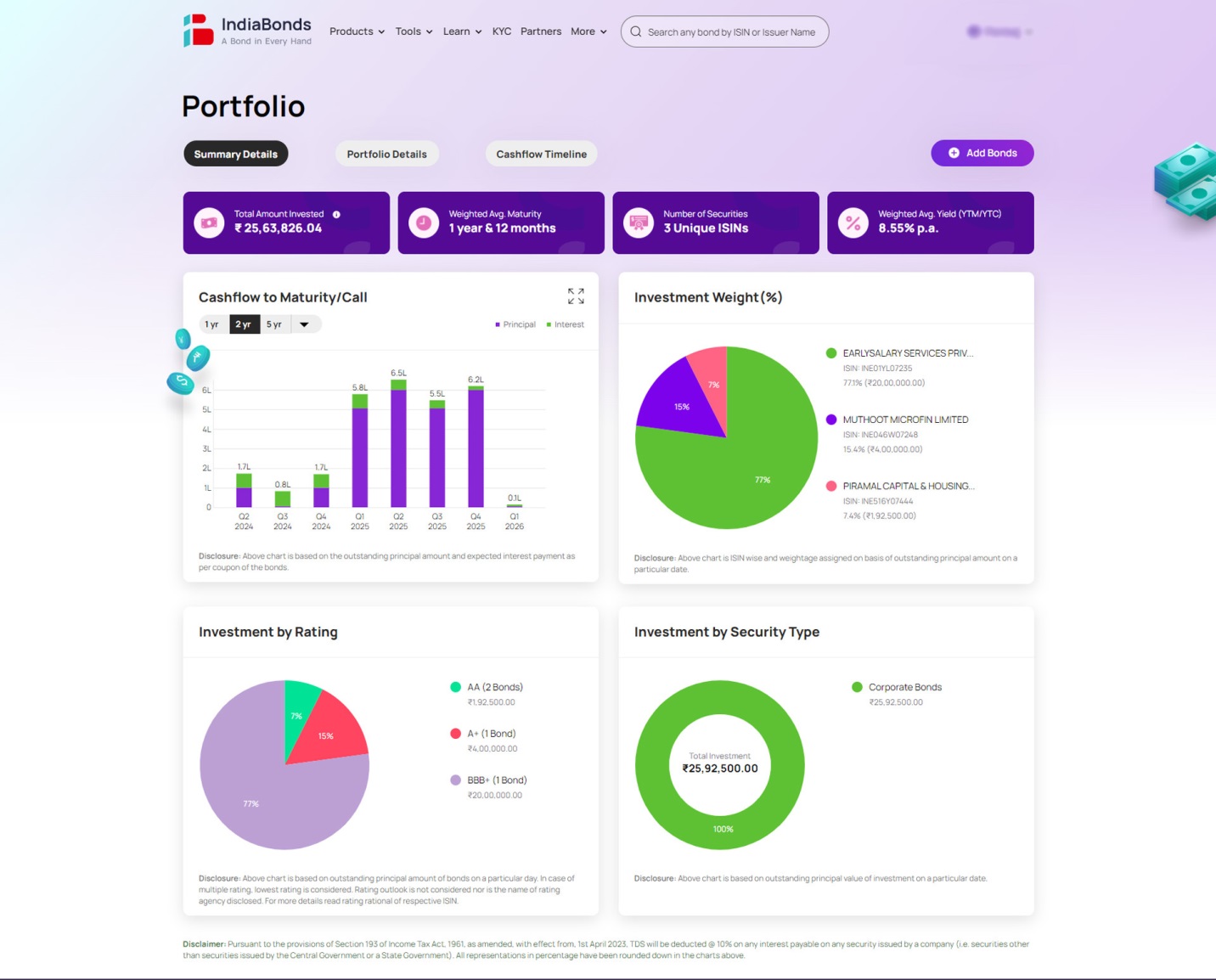

The tool offers a detailed breakdown of your bond portfolio, presenting key metrics such as:

Total Amount Invested: Know exactly how much you have invested in bonds at any given time.

Weighted Average Yield (YTM/YTC): Understand the average yield of your bond holdings, weighted by their respective investment amounts.

Weighted Average Maturity: See the average maturity of your bond portfolio, weighted by the investment amounts in each bond.

Number of ISINs: Track the number of different bonds (identified by their ISINs) in your portfolio.

Concentration Risk and Ratings

One of the standout features of our tool is its ability to analyze concentration risk by credit ratings (AAA, AA, A+, etc) and security type (corporate bonds, g-secs, etc). This feature helps you assess the diversification of your bond investments and identify potential risks associated with over-concentration in specific credit ratings or issuers.

Cashflow Management

Effective cash flow management is critical for bond investors. Our tool plots the entire combined cash flow of your bond holdings until maturity, helping you visualize your future income streams. Additionally, it sends cash flow reminders, ensuring you reinvest your cash promptly to maximize returns.

User-Friendly and Open Architecture

We believe in the power of open information architecture. The IndiaBonds Portfolio Analysis Tool allows you to upload bonds purchased from any source, not just those transacted on the IndiaBonds platform. This feature enables a comprehensive analysis of your entire bond portfolio, offering insights and analytics previously inaccessible to retail investors.

Why Choose IndiaBonds’ Bonds Portfolio Analysis Tool?

Professional-Grade Analytics: Previously available only to institutions, now accessible to retail investors.

Holistic View: Provides a complete picture of your bond holdings, allowing you to upload your past holdings, including those bought outside the IndiaBonds platform, to give you a comprehensive view of your portfolio.

Enhanced Decision Making: Empowers you with key metrics and insights to make informed investment decisions.

Time-Saving: Automates portfolio tracking and cash flow management, saving you time and effort.

Conclusion

The IndiaBonds Portfolio Analysis Tool is a revolutionary step in democratizing access to professional-grade portfolio analytics for bond investors. It empowers you with the insights needed to manage your bond investments effectively, optimize returns and manage risks. Whether you are a seasoned investor or just starting, this tool is designed to simplify your bond investment journey and help you achieve your financial goals. You can view the Portfolio Tool (enabled post registration) at this link:

https://www.indiabonds.com/portfolio/dashboard

FAQs

Q. Can I use the tool if I have bonds from other platforms?

A. Yes, the tool allows you to upload bonds purchased from any source, providing a comprehensive view of your entire portfolio.

Q. What kind of metrics does the tool provide?

A. The tool offers metrics such as total amount invested, weighted average yield, weighted average maturity, concentration risk by ratings and more.

Q. How does the tool help in managing cash flows?

A. The tool plots the combined cash flow of your bond holdings until maturity and sends reminders of cash flows promptly.

Q. Is this tool available for free?

A. The Portfolio Analysis Tool is available for all registered users of IndiaBonds. You can access it by signing up on our platform.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.