Blogs

All

Essential

Insights

Advanced

Sort by:Latest

>

6 min read

25 Apr, 2025

Essential

What Is Cap in Investment?

When you hear the term cap in investment, think of a ceiling. Just like a physical cap keeps something from going too high, in the world of finance, it places a limit on how high the interest rate can rise. This becomes especially useful when you’re dealing with variable-rate instruments like bonds or loans. A

5 min read

09 Apr, 2025

Essential

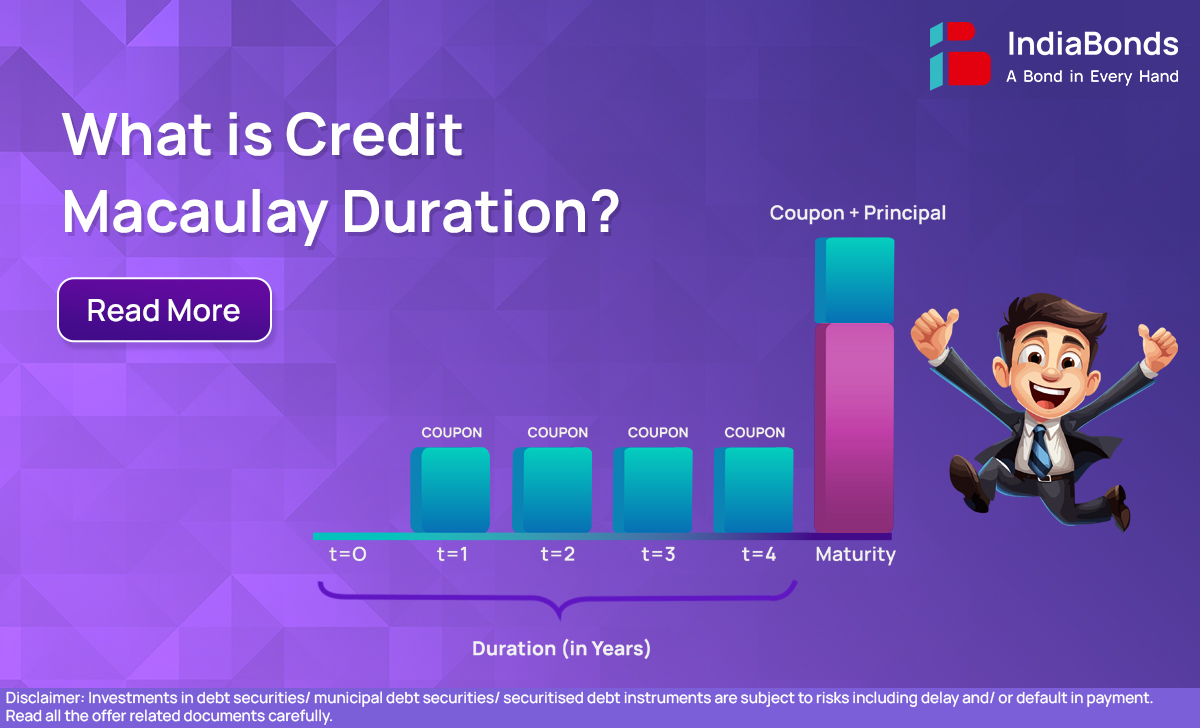

What is Credit Macaulay Duration?

Introduction When you invest in bonds, especially those issued by corporations or lower-rated entities, understanding how long your money is at risk and how sensitive the bond is to interest rate changes becomes critical. One widely used concept in the bond world is Macaulay Duration. It helps investors get a sense of when they’ll recover

6 min read

03 Apr, 2025

Essential

Consumer Price Index (CPI): Your Guide to Understanding Inflation’s Impact

CPI Demystified: More Than Just a Number Introduction: Imagine CPI as the economy’s thermometer. Just as a fever signals health issues, rising CPI indicates inflation heating up your daily expenses. In India, the Consumer Price Index tracks price changes for essentials like food, housing, transport, and healthcare. It’s not just a statistic—it’s a pulse check

7 min read

01 Apr, 2025

Essential

What is Bootstrapping? Building Empires Without Handouts

Picture this: You’re baking a cake, but instead of rushing to the store for fancy ingredients, you work with what’s in your pantry. That’s bootstrapping in a nutshell—crafting a business from scratch using grit, creativity, and the resources already at your fingertips. No investor sugar daddies, no loans—just raw hustle. Companies like Zoho and Mailchimp

5 min read

26 Mar, 2025

Essential

What is the Repo Rate?

In financial news, you must’ve heard the term “repo rate”, but what exactly does it mean for you and how does the repo rate affect a common man? Let’s understand. Imagine banks occasionally need quick cash—just like we do. Instead of a friend or relative, they turn to the Reserve Bank of India (RBI). But

4 min read

21 Mar, 2025

Essential

What is Compound Interest?

Picture this: you’ve got a little money pot, right? You put some rupees in there. Now, the bank, or wherever you keep it, gives you a little extra, like a bonus, for keeping your money with them. That’s called interest. Now, here’s the cool part: with compound interest, that bonus money? It starts earning its

5 min read

05 Mar, 2025

Essential

What Are Credit Rating Agencies?

Introduction Investing in bonds or debt instruments involves evaluating the creditworthiness of issuers—a task that can feel daunting without the right guidance. This is where credit rating agencies step in, offering a trustworthy way to assess the financial trustworthiness of entities issuing debt. In India, these agencies are vital to the financial ecosystem, empowering investors

5 min read

04 Mar, 2025

Essential

What are Non-Convertible Debentures (NCDs)?

Looking for stable returns beyond traditional options? Let’s decode Non-Convertible Debentures (NCDs). These are debt instruments companies use to raise funds, offering fixed interest payouts without the option to convert into equity. Unlike convertible debentures, NCDs are repaid in full at maturity, making them a go-to for investors craving predictable income. With interest rates often

5 min read

17 Feb, 2025

Essential

Understanding Capital Markets: Your Guide to How They Power the Economy

Capital markets are the backbone of economic growth, acting as bridges between those who need funds and those looking to invest. Whether you’re a business expanding operations, a government funding infrastructure projects, or an individual planning for retirement, these markets keep money flowing where it’s needed most. Let’s break down how they operate, their different

6 min read

01 Feb, 2025

Everything You Need to Know About Taxation on Bonds in India: A Story of Smart Investing

Introduction: Two Friends, One Bond Conversation Imagine two friends, Rohan and Priya, sipping chai at a Mumbai café. Rohan, a seasoned investor, boasts about earning steady returns from bonds. Priya, intrigued, asks, “But how does taxation on bonds work? Will I lose half my profits to taxes?” Rohan smiles, “Ah, that’s where strategy comes in!” Like Priya,

5 min read

27 Dec, 2024

Insights

Bond Market Outlook 2025 by IndiaBonds

The global financial ecosystem in 2024 was riddled with turbulence, yet the fixed-income landscape, particularly in India, emerged as a beacon of stability. With markets reeling from geopolitical unrest and economic volatility, Indian bonds delivered calm, steady returns. By the end of September 2024, the Indian bond market had grown to an impressive $2.69 trillion

5 min read

25 Nov, 2024

Essential

What is RFQ or Request for Quote Platform?

RFQ stands for Request for Quote, a platform that allows investors to buy and sell bonds by requesting quotes from multiple dealers and choosing the best one. Consider this: You’re in a busy marketplace filled with sellers offering nearly identical goods or services. Instead of haggling with each seller, you ask a select few for

Bonds you may like...

SATYA MICROCAPITAL LIMITED

Coupon

14.2000%

Maturity

Apr 2029

Rating

Type of Bond

Subordinate Debt

Yield

14.2500%

Price

₹ 1,02,377.09

VARTHANA FINANCE PRIVATE LIMITED

Coupon

11.5000%

Maturity

Sep 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.3700%

Price

₹ 75,564.54

KRAZYBEE SERVICES PRIVATE LIMITED

Coupon

10.9500%

Maturity

Jul 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.2500%

Price

₹ 99,536.80

VARTHANA FINANCE PRIVATE LIMITED

Coupon

11.3500%

Maturity

Sep 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.1300%

Price

₹ 1,00,679.67

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.9000%

Maturity

Dec 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

12.0500%

Price

₹ 99,105.55

MANBA FINANCE LIMITED

Coupon

11.3500%

Maturity

Oct 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.9592%

Price

₹ 10,003.11

NAMRA FINANCE LIMITED

Coupon

11.0000%

Maturity

May 2026

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4519%

Price

₹ 1,01,898.63

NAVI FINSERV LIMITED

Coupon

10.7500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.4500%

Price

₹ 10,011.47

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).